Oil & Gas killing amendment could very well be in the hands of voters in November: Wells Fargo

On a conference call hosted by Wells Fargo today regarding the possible battle over the future of fracing in Colorado, the crystal ball looks murky, but it’s pretty clear that the oil and gas industry may have a fight on its hands.

The bank hosted Josh Penry, who has served as a State Senator and Senate Minority leader, State Representative, and a number of other high-profile political positions, to get his take on Colorado ballot initiative 78’s chances at making it in front of voters.

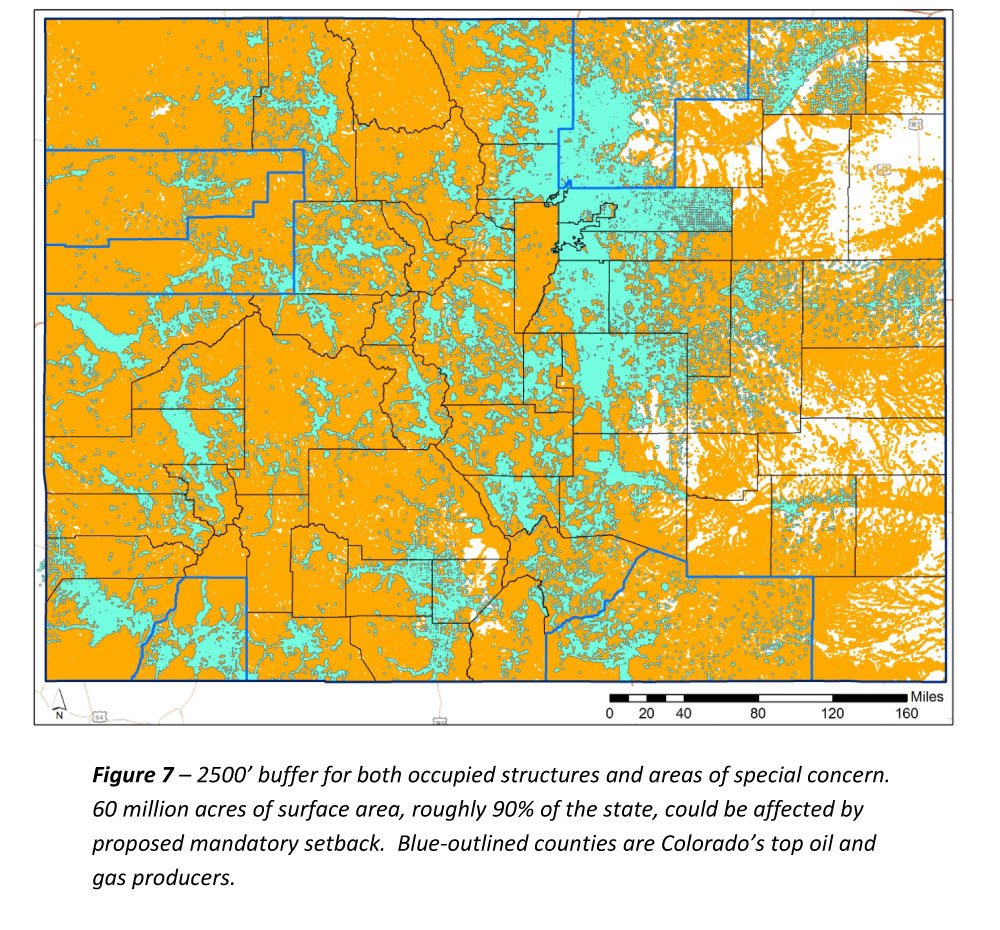

Colorado ballot initiative #78 proposes an amendment to the state’s constitution that would require a 2500-foot mandatory setback between an oil and gas development facility (including oil and gas wells, injection wells, production and processing equipment, and pits) and any “occupied structure(s)” and “area(s) of special concern.” This regulatory change would be applied to all new oil and gas development facilities in Colorado, and any operation that used hydraulic fracturing.

If the proposal makes it to the ballot and is passed, it may effectively shut down hydraulic fracturing in the state.

A new report from the Colorado Oil and Gas Conservation Commission (COGCC) reported that if the bill passes:

- ~90% of surface acreage in Colorado would be unavailable for future oil and gas development or hydraulic fracturing under the proposed mandatory setback requirement.

- 85% of surface acreage in Weld County, the state’s largest oil and gas producing county, would be unavailable for new oil and gas development facilities or hydraulic fracturing operations.

- In the state’s top five producing oil and gas counties (Weld, Garfield, La Plata, Rio Blanco, and Las Animas), 95% of the total surface area would be unavailable for new oil and gas development facilities or hydraulic fracturing operations.

Gathering signatures now

Politics and ballot measures can be unpredictable, and Penry was unsure if the initiative would receive the 140,000-150,000 signatures required before August 8th to make it in front of voters. While noting that he does work for the industry, he indicated he did not believe it would pass in November if on the ballot.

In their summary following the call, Wells Fargo said, “we believe there is a better than 50/50 possibility that enough signatures are secured” by the deadline. After that, it becomes even more difficult to tell what may happen.

Wells notes that the industry is in a better position to reach people and have a “more mature dialogue” with the voter base than it was the last time the issue came up in 2014, but many obstacles remain.

“When the average person reads an amendment that says push back drilling 1,500’ further from schools, they will tend to believe it’s a good idea. Just significant risk in our opinion,” the bank said in its summary.

Many oil and gas industry people in Colorado have learned to be vocal about how much the oil and gas industry positively impacts the state and local communities where these resources are extracted. According to a study by the University of Colorado Leeds School of Business, “The economic contributions of the upstream and midstream oil and gas industry totaled $126.5 billion in output in Colorado between 2008 and 2012. In total, the industry supported more than 93,500 jobs in Colorado.”

“When you look at the tax dollars that are going out to these districts, the counties, the schools,” Lynn Peterson, CEO of Synergy Resources (ticker: SYRG), told Oil & Gas 360® in an interview in February, “the oil and gas industry is an invaluable part of Colorado’s economy. … We’re trying to train our staff that when people go to a soccer game, a church function or whatever it might be, they can talk to the constituents about what we’re doing, how we’re doing it, how we’re siting [wells]. That’s a big push that we’re trying to do internally here.”

Synergy is a significant operator in Weld County, in the Wattenberg field, one of the most prolific shale development areas in the state. Other operators include Anadarko Petroleum, Noble Energy, Bill Barrett Corporation, PDC Energy, Bonanza Creek Energy, Carrizo Oil & Gas, Encana and others.

“A lot of us are Colorado natives,” Peterson said. “The people we’ve hired, a lot of them are Colorado natives. Being able to work with municipalities, being able to work with residents—we take a lot of pride in that. When you talk about setbacks, a lot of that we’re already doing. If we have a location that is close to a school or some type of facility like that, we’re glad to move around; we’re more than willing to do that. You can’t really have a 2,500 foot setback. It would shut down the whole industry.”