The inevitability of coal’s decline–that perception will probably change: Pipes

To set the stage for a coal comeback, one factor is already in place

Within minutes after his inauguration, President Trump posted a memo on the White House website entitled “An America First Energy Plan.” The memo said: “President Trump is committed to eliminating harmful and unnecessary policies such as the Climate Action Plan and the Waters of the U.S. rule. Lifting these restrictions will greatly help American workers, increasing wages by more than $30 billion over the next 7 years. … The Trump Administration is also committed to clean coal technology, and to reviving America’s coal industry, which has been hurting for too long.”

It’s nearly impossible to imagine. Coal—a legacy American industry that looked as though it had been pushed into an early and permanent grave by federal government policies and the emergence of cheap natural gas—may, by some miracle, begin to enjoy a fresh breath of life.

If a coal rebirth does happen, it won’t be a booming resurgence that restores coal to its prior dominance, but if the stars align just right, the coal industry could start to see an increase in demand from the U.S. power sector, and it could be fueled by foreign demand for U.S. natural gas. That’s what some industry analysts are starting to consider.

Is it too late for coal to benefit from a 180-degree shift in U.S. energy policy?

Eight years of a strongly outspoken anti-coal administration and regulatory actions to back it up were just replaced by three weeks of a new pro-business, pro-fossil fuel administration. With the change of personnel came a shift in energy policy direction that seems to be in serious play. On the order of 180 degrees.

But will the post-election changes taking place inside the U.S. government be enough to pull coal at least partially out of its grave, or is it too late?

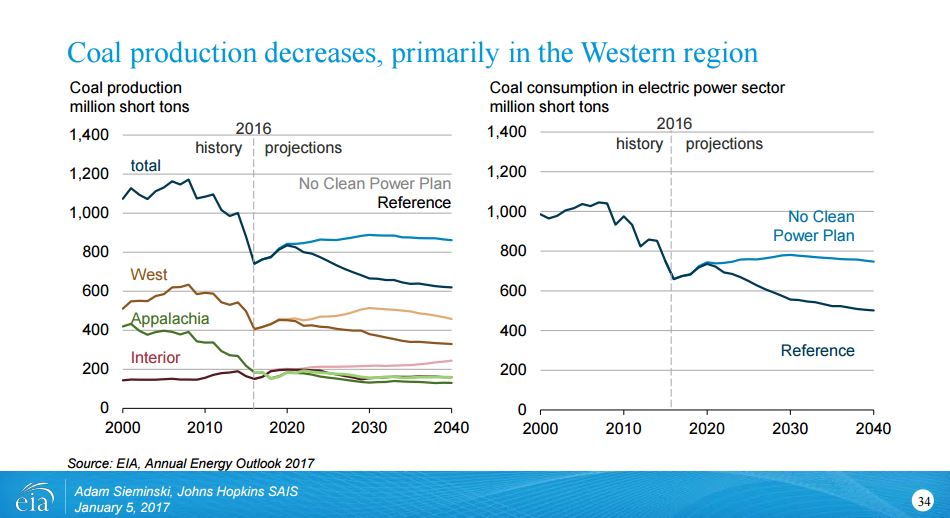

The U.S. Energy Information Administration (EIA) said U.S. coal production in the United States totaled 739 million short tons (MMst) in 2016, an 18% decline from 2015 and the lowest level of coal production since 1978.

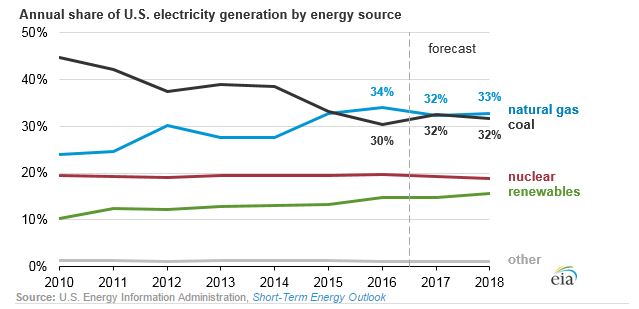

In 2016, the electric power sector accounted for an estimated 92% of total U.S. coal consumption, according to the EIA’s data. From 2008 to 2016, coal’s share of electricity generation decreased, and in 2016, natural gas-fired generation exceeded coal’s share of the U.S. electricity mix on an annual basis for the first time, the agency reported.

However, the agency said that largely because of an expected increase in the price of natural gas, the use of natural gas-fired generators is expected to decline slightly in 2017 and it expects growth in coal-fired electricity generation to contribute to a 3% increase in coal production in 2017. The agency forecasts coal production to increase by 1% in 2018.

Last week U.S. House of Representatives Energy and Commerce Committee Chairman Greg Walden (R-OR) talked about why things will be different this Congress when it comes to enacting meaningful energy and environment reforms.

“For the first time since 2007, Republicans maintain majorities in both the House and Senate and now control the White House. This rare opportunity increases the prospects for enacting reforms that build on our nation’s energy abundance, modernize our energy infrastructure, and promote domestic manufacturing and job growth – reforms that truly make a difference at the local level,” Walden said in an op-ed published this week in the The Hill.

“Under President Obama’s tenure, we saw a barrage of red-tape regulations by the Environmental Protection Agency and Department of Energy. These regulations impeded energy development, prematurely shuttered coal plants, delayed or blocked job-creating new projects, crippled innovation and stifled economic growth. Businesses and American ingenuity took a back seat to the Obama administration’s regulatory onslaught … . It’s time we bring greater transparency, accountability and predictability to our energy and environmental laws to meet the needs of consumers in the 21st century. This Congress, things will be different,” Walden said.

But in another story, The Hill took the opposite view, saying in the early days of the new administration it has been difficult for the White House to get legislation to move ahead: “Republicans have unified control of government for the first time in a decade, giving them a rare opportunity to enact the kinds of sweeping policy changes they have long dreamed about. But intraparty divisions, mixed messaging from Trump and Democratic obstruction of cabinet nominees are already slowing the pace of work on legislation.”

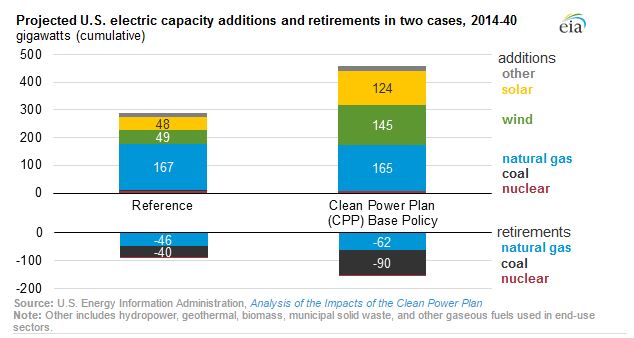

As far as coal’s future, no one expects a sweeping rollback of regulations that would bring the oldest, highest emitting coal-burning plants back from the dead. Those plants are gone, and much of that generating capacity has already been replaced by brand new, natural gas-fired generation in the past eight years. And gas power plants emit about half the carbon dioxide of coal-burning plants.

And there are a lot more natural gas-fired plants in the proposal/design/build/permitting pipeline.

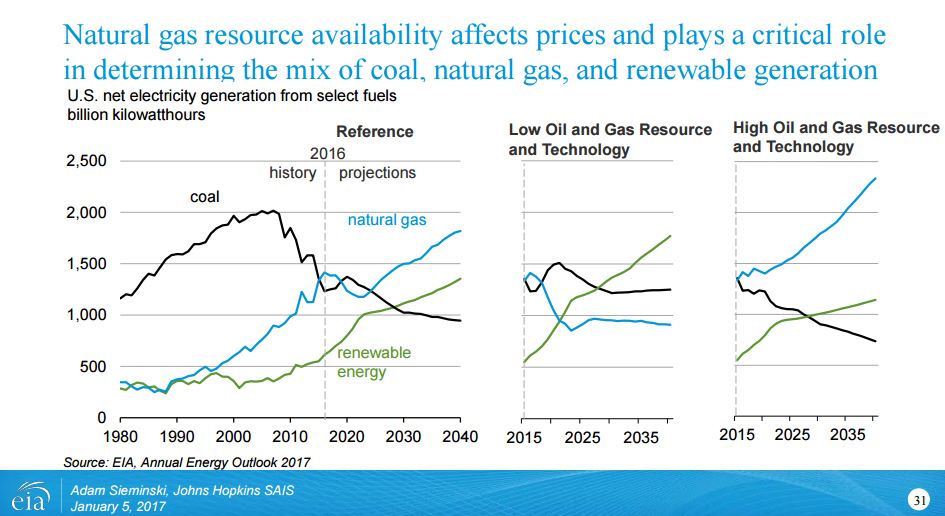

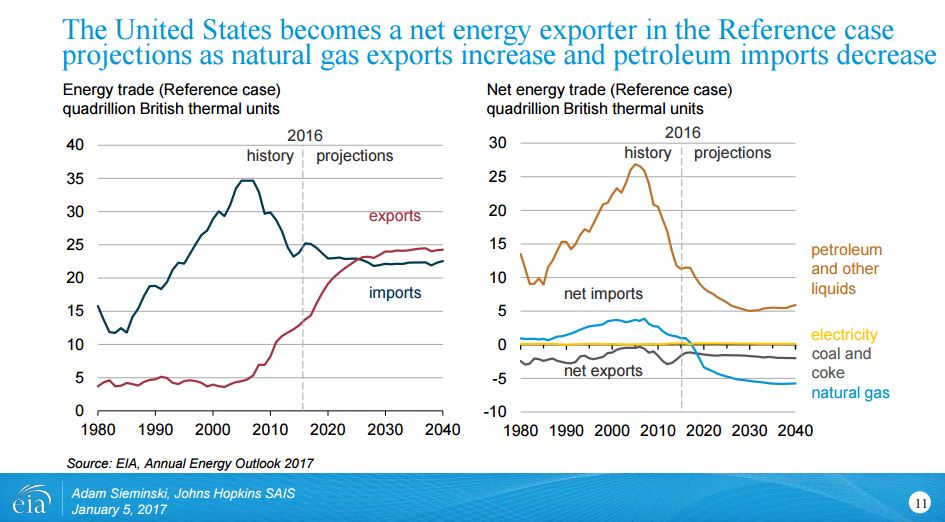

Even if more gas-fired electricity capacity is in the works, if global LNG demand and U.S. manufacturing growth happen to converge, they could result in an increase in U.S. coal-fired generation, according to FBR Capital Markets’ coal analyst Lucas Pipes.

Oil & Gas 360® spoke to FBR & Company Senior Analyst Lucas Pipes last week to get his view as to the degree to which the new administration’s policies could have a meaningful effect on the coal industry.

OAG360: How exactly will the new administration support coal?

It’s a question of electricity demand, Pipes said.

LUCAS PIPES: The coal-fired power plant fleet, even after all the retirements, is still underutilized. The ones that are left are not running as hard as they could be running.

Electricity demand since 2008, has been anemic at best. If you can make the case that [U.S.] manufacturing comes back, then you can make the case that electricity demand is going to grow, and arguably coal is the greatest beneficiary, because it is the source in the generating mix that has the greatest spare capacity.

I think that could be a way to bolster coal without throwing other sources of fuel or power generation under the bus, so to speak.

The rule of thumb I use every day in my conversations with investors very frequently is 1 Bcf per day of natural gas consumption in the power sector is equal to about 25-30 million tons of coal demand annually. So if you can push out 10 Bcfe/day through LNG or through pipes, that makes a big difference for coal.

Those are ways in which coal can be supported, maybe not directly, but it sure would help coal if more gas were to leave the nation. That would be very welcomed by the coal industry—greater exports of LNG.

I think what is perceived as a risk—more so from investors than the corporates—is the uncertainty of trade relations with Mexico. Right now we are exporting via pipe about 4 Bcfe/day [of natural gas] to Mexico. That’s almost the equivalent of 100 million tons of coal burn if [that natural gas] were to stay here in the country. That’s one area that [coal investors] feel a little bit uneasy.

The two things I’ve mentioned thus far have been really on the demand side of things. Where the administration can also make a difference is on the supply side—[if they get] moving pretty quickly there. For example, the Stream Protection Rule I think is in the process of being reversed. Compliance costs and permitting costs have increased under the Obama administration, according to the industry. I believe investors and the industry expect that to change under the Trump administration.

OAG360: What are coal company executives telling you anecdotally—what change do they see on the horizon from the White House?

PIPES: I would say across the executive ranks in the industry, the hope is that with the very challenging regulatory environment in the previous administration, I think the expectation is that not everything is going to be easy—we still have to compete with natural gas. There is still a very major cultural divide as it relates to environmental regulations in the place of coal—the Sierra Club is not going to go away; they still have a ‘Beyond Coal’ campaign. So there will continue to be major disagreements between the industry and certain parts of the federal government. But I think the view among executives is there is someone who understands what the industry is going through who will keep an open ear to what the industry needs in order to stay competitive.

The Clean Power Plan = ‘life or death’ for coal

Another point that is very important to the coal industry is the future of the Clean Power Plan, Pipes emphasized.

The Clean Power Plan is tied to the U.S. commitments that were made by the prior administration under the Paris climate agreement. The CPP requires that by 2030 power plants will cut their carbon emissions by 32%. President Trump said before the inauguration that he planned to ignore the Paris agreement.

“I don’t want to sound like I’m exaggerating, and I’m paraphrasing some of the comments I’ve heard from [coal industry] executives: the Clean Power Plan [represents] ‘life or death’ for coal. I think that’s how it is often viewed, and I think the expectation in the industry is that the Trump administration will take this rule very seriously and do what it can to reverse it,” the analyst said.

A CNN-Money story last week said, “President Trump’s “America First” Energy Plan makes clear that the White House is committed to ‘reviving’ the country’s long-suffering coal industry. It’s part of Trump’s effort to live up to his campaign pledge to coal miners, whom he has told: “Get ready, because you’re going to be working your asses off.”

Trump’s America First Energy Plan also embraces shale development—i.e., oil and gas. “The Trump Administration will embrace the shale oil and gas revolution to bring jobs and prosperity to millions of Americans,” the White House “An America First Energy Plan” memo says. “We must take advantage of the estimated $50 trillion in untapped shale, oil, and natural gas reserves, especially those on federal lands that the American people own.”

“Despite Trump’s best intentions and regulation-busting actions, experts don’t believe they will be enough to save coal,” CNN said. “That’s because coal has a fierce competitor in the form of natural gas. It’s cheap, it’s clean and there’s a ton of it in the U.S. Plus, Trump himself supports expanded drilling of U.S. shale, the chief source of the boom in natural gas.”

But if global LNG pricing works (i.e., if oil prices go higher), there is a global market, chiefly Asia and Europe, that’s ready to take U.S. excess natural gas production

The coal industry would love nothing better than the development of a thriving natural gas LNG (liquefied natural gas) export market to take as much natural gas as the U.S. gas producers can muster and send it to Asia and Europe in the form of liquefied natural gas.

Robert Murray, CEO of Ohio’s privately held Murray Energy Corporation, made recent comments to media saying he met with Trump and asked for speedier LNG export permitting.

LNG export plants in various stages

A number of U.S.-based LNG export projects are in the permitting and design/development stage. The first lower-48 LNG export plant to begin shipping cargoes was Cheniere Energy’s (ticker: LNG) Sabine Pass plant in Louisiana. But with the exception of ConocoPhillips’ Nikiski Kenai facility in Alaska, which shipped no cargoes in 2016, no other plants are ready to ship natural gas as LNG from the U.S.

Other countries have been building LNG export facilities and they are are watching the new administration’s U.S. pro-energy developments with caution. Last month, the Australia Financial Review published a story entitled “Trump’s America-First Energy Policy Looms as LNG Threat,” citing the fact that increased U.S. LNG exports could pose a risk for Australian producers.

“The prospect of the most petroleum-friendly policy settings for decades has revived worries about a potential flood of natural gas exports posing a competitive threat to Australian producers in Asia, the biggest market,” the AFR reported.

“If Trump implements policies reducing taxes and regulation, reducing US gas prices, then U.S. LNG cash costs will come down having a flow-on downward effect on Asian spot LNG prices,” Wood Mackenzie’s Saul Kavonic told AFR, citing Wood Mac’s prediction that U.S. LNG exports will virtually triple this year to 11 million tonnes, up from four million in 2016.

“Mr. Kavonic said the competition between Australia and the U.S. for LNG exports is ‘real’, for short-term spot sales as well as longer-term, and was being strained by increasingly ‘anti-gas’ policies being implemented by state governments which contrast starkly with the Trump administration’s pro-drilling platform.”

A coal company’s view of the path ahead

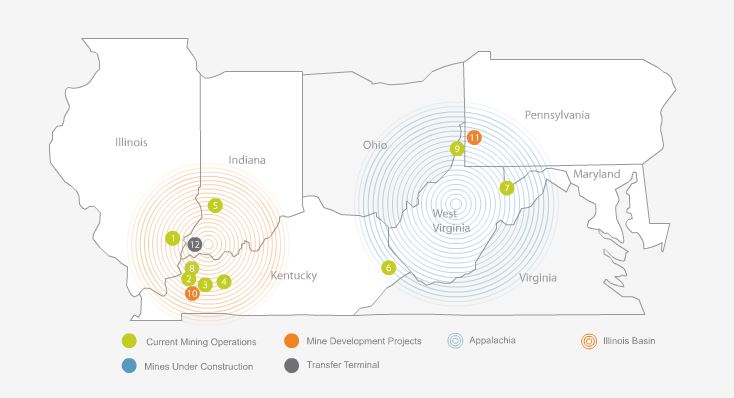

Alliance Resource Partners (ticker: ARLP), a coal producer in the Illinois and Appalachian basins, held its Q4 conference call a week ago, and in the call Alliance CEO Joseph Craft III summed up how he saw the prospects for thermal coal for 2017 compared to this time in 2016:

“Conditions in the U.S. thermal markets had deteriorated sharply coming into 2016 and continued to weaken during the first third of the year. The warm winter and low natural gas prices led to anemic coal demand, prompting utilities to defer deliveries, build inventories, and delay contracting decisions.”

“As we enter 2017, supply/demand fundamentals have improved meaningfully compared to this time last year, and are pointing to a cyclical recovery in the domestic thermal market; the extent of which will be dependent upon electricity demand and natural gas prices staying at or above current levels.”

2017 coal demand

Craft said ARLP is expecting year-over-year coal production to increase approximately three million tons, or 9%, in 2017. “There’s a possibility that market demand could improve further as the year progresses. Should the market signal a sustained need for additional tons, ARLP is positioned to increase coal production above current planned volumes with minimal incremental capital and attractive per-ton cost by deploying additional units at any of our Illinois Basin operations.

“Longer term, we are hopeful that the Trump administration will work to reduce the over-reaching regulatory burden that has plagued the coal industry for the last eight years and protect the existing fleet of coal-fired generating power plants. A return to more rational environmental and energy policies should provide clarity and stability to coal markets and potentially set the stage for growing coal demand in the future.”

Alliance Resource Partners Q4 Q&A

Q: You mentioned your hopes for the new administration. You also talked about demand for coal going up. I can see stability. I’m just wondering what might lead to a recovery in coal production, if your expectations for shale gas, shale oil are delivered on and there’s no foreign gas that’s touching around in the system.

JOSEPH CRAFT III: I think on the gas side, we still believe that to make a prudent return on investment as you deploy capital on the oil and gas side and drilling, that the producers need $3.25-$3.50 gas to make attractive returns. We think a lot of drilling activity is more focused on oil than it is natural gas. And if you look at the Trump policies, I think we will start seeing more emphasis on allowing for the oil and gas producers to export their product, and it will allow gas to receive more at a global price instead of just a U.S. price.

So, when you look at the export potential to Mexico and overseas with LNG, as well as some industrial increases in demand for natural gas, we think that there can be a potential to see gas in the $3.25-plus area on a sustainable basis. And if we have gas in that range, we think that there’s a potential for increased demand. So, we’re not talking about going back to 2008 levels, but we are looking at 2017 as, sort of, a floor on demand – or really 2016 as a floor on demand for gas and that for the next four to five years, we have the opportunity to see more stability, as well as more upside for growth than downside as we try to evaluate where the gas price is going to be.

Getting existing coal fleets to expand their capacity

Another factor that I think will be an emphasis by the Trump administration is to try to allow for existing fleets to expand their capacity, and that’s something that I know we’ll be working hard to see if we can make that happen.

Q: I think you mentioned 18.9 million tons priced in 2018. But just directionally, what kind of prices you guys have been getting? So, for people who are thinking about the distribution beyond 2017 and 2018 and trying to figure out what the cash flows could look like, anything you could maybe help us with regard to 2018?

CRAFT: I think that when you look at our drop in average sales price from 2016 to 2017, one of the factors in that is we had some higher-priced contracts that expired at the end of 2016. So, we’re replacing legacy contracts with sales that were made during the last half of 2016. The markets have definitely improved, most recently in the November, December, January timeframe compared to six months ago.

As we project supply and demand, because there will be some supply that will be depleting and some higher priced contracts that some of our competitors have that will expire in 2017 that are supporting some production that is high cost, we think there will be opportunity for uplift in pricing continuing beyond where we are today going into 2018.

That’s coal-on-coal competitive analysis; we’ll get into what will be the buying strategy of our utilities. Will they continue to be short and go month-to-month, quarter-to-quarter, and in some cases, not all of them are doing that, but enough are doing it that it has made our book shorter. And then also, of course, the price of natural gas, I gave my view on that earlier.

So, if you combine our view with natural gas prices staying in the $3.25-plus range, as well as what we see on supply and demand for utilities, we are – again, we are assuming in our plan that the prices will, in fact, be higher into 2018 and really the five-year plan that we look at.

I think it’s a little bit too early to talk about at what level that will be, but we do anticipate growth in both the tonnage and price as we look forward to 2018, assuming the assumptions that I laid out come to play.

Effect of new coal demand on labor—putting coal miners back to work

Q: looking at your planned production increase for 2017, I wonder if you could comment a little bit on the labor markets and whether there’s any sort of – after years of not really think about increases, any sort of scarcity or any positions that you’re having a harder time feeling that you would have had a very easy time feeling a year or two ago?

CRAFT: If you look at our increase in production, it’s largely driven by our production at Hamilton. And so, we did have a temporary reduction enforced last summer that we’ve called people back to allow us to put ourselves in more of a full production mode. A lot of our increase in the fourth quarter and reduction in costs related to the improvement in productivity at Hamilton.

So, you look at fourth quarter at Hamilton, we produced right at 1.3 million tons compared to 500,000 tons in the third quarter, as an example. We really didn’t start that ramp until November at Hamilton. So, relative to finding people, that has not been a problem. We do not anticipate that being a problem. We also, as you recall, the impact, we closed the Pattiki mine. So, we were able to transfer employees from our Pattiki operation. It helps at both the Hamilton as well as Gibson County, which is our other operation where we’re going to increase production in 2017.

So, as we look at how many people that we, in fact, had to lay off because of the reduction in 2016 in production compared to 2015, we find that our ability to hire quality folks, that they’re still available and once we announced, for example, just recently adding back the unit at Gibson County, a lot of the folks that had really taken jobs at other industries were quick to come back. And so, they wanted to get back in the coal business because of the outlook and the expectation.

And I give credit to the election for this. I believe that the Trump administration does appreciate the value that coal-fired electricity brings to the nation, and that our men and women can expect careers in this industry, that before, with the prior administration, they were concerned they not exist. So, from our perspective, we’re always looking for the best and the brightest, but we don’t anticipate a challenge to be able to complete our roster, with the quality of folks that we need to be able to get the results that we’ve historically gotten.

I think so much of it really depends on our customers’ commitment to take tonnage at a level that we feel comfortable hiring people and giving them sustainable jobs. And a lot of the swing does get back to natural gas prices. So, I gave my view on that earlier.

Now, we will see what the industry does, what the oil and gas industry does to see if they do, in fact, bring on more supply and bring those prices down. So we’re going to be cautious. I think I mentioned on the last call and we’ve mentioned it again in this release and/or in our prepared comments that we would like to see a commitment from our customers. And it doesn’t have to be a legal commitment, but we would really like to hear that as they look at their planning cycles that they can give us more clarity as to what their expected coal burn is going to be to where we know it’s sustainable.

And absent that, part of the challenge is most of our customers want to have diversity of supply also. So that’s another factor that weighs in it, but we constantly are asking ‘what’s the right level?’ And we would rather take that market through growth in the market as opposed to trying to just bring on tonnage and drop the overall price. It doesn’t seem to – the math doesn’t seem to work if you try to get into that situation, given the size of our market right now.

Coal supply and demand is in balance

On the question of inventory, I’m of the view, and this may be a minority view, but I’m of the view that the inventories are at the level they are right now because of the utilities’ buying strategies have gone short. In other words, I believe they’re increasing their inventory level to complement their strategy of trying to be short in the contract commitments.

So, when you look historically, I don’t think that’s a good measurement to determine where we are from a supply/demand perspective. And I base that on the fact that there were quite a few increase into the marketplace in the fourth quarter, that these utilities had what would appear to be sufficient stockpile capacity, but yet they were still buying tons in the fourth quarter to replace the burn that they had in the summer that was a little higher than what they had expected.

So, I may be wrong, but I’m of the view that supply/demand is in balance and I think the export increase and export demand in the last quarter is actually, combined with the natural gas prices, it’s the responsibility as to why the prices have been a little bit better in the year, the November, December, January time period, compared to six months ago.

So, personally, I think the inventories are going to be at these levels. Now, each utility, there may be some outliers, but as a general statement, I think you’re going to see inventories hang around the levels they are today as long as utilities continue to want to continue their buying practices of being short as opposed to committing longer term. If they want to commit longer term, then they can pull their inventories down. With the cost of money, they haven’t really needed to do that.

Will a return of U.S.-based manufacturing that drives electricity demand from coal be fueled by a booming middle class located outside of America?

Business media around the country are reporting that the entrepreneurial community is optimistic about the possibility of peeling away federal red tape, clearing the way for quicker expansion and reducing the high expense imposed on business by an overburden of federal regulations.

Will President Trump and Congress be able to set regulatory, tax and pro-growth policies in place that will deliver a manufacturing rebirth?

Some big U.S. manufacturers have reported some recent significant orders and made strategic moves in order to better capture global markets. Big U.S.-based corporations are looking at every kind of logistical option to get ahead of their domestic and global competition.

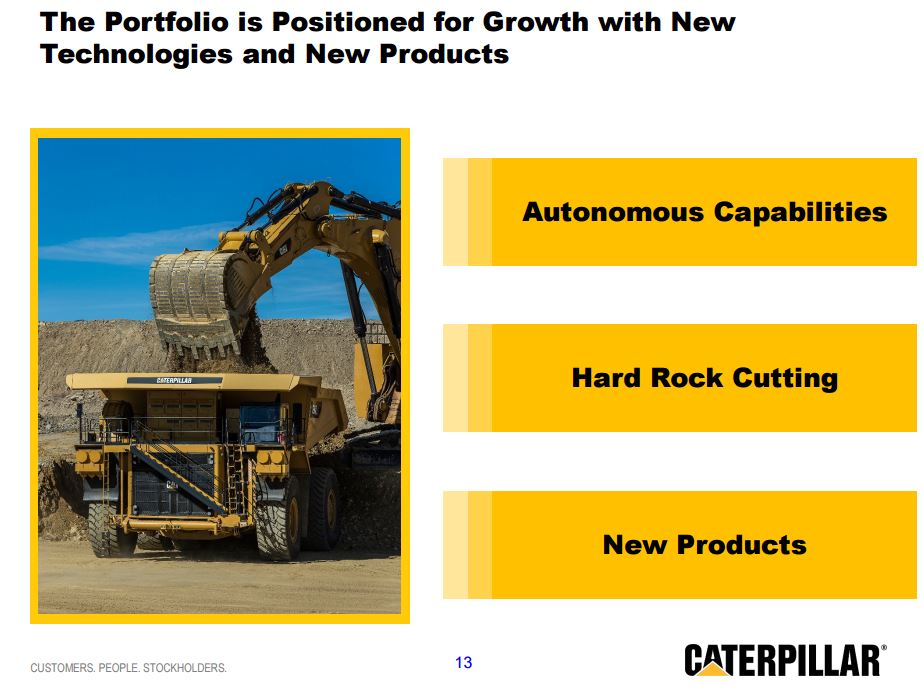

For example, Caterpillar announced this month that it would move its corporate headquarters to Chicago from Peoria, Illinois, simply to take advantage of better global access for its executives to reach customers in other parts of the world from the Chicago global air hub.

Caterpillar Inc. CEO Jim Umpleby spoke with the Peoria Journal-Star regarding the decision:

“[Our sales] peaked out over $66 billion in 2012, and we’re down more than 40 percent. Our outlook for this year is about $37.5 billion, and it’s been a painful process. We have decided to locate a small, lean headquarters team, a team of senior executives, in the Chicago area to have better access to flights. About two-thirds of our business over the last five years has come from outside the United States. We see a lot of growth coming in the international markets, and we believe that speed and agility for our senior leadership team to be able to travel around the globe is very important.

“So over the last two years, our volumes have continued to decline, and many of our customers are really suffering. Our mining customers have struggled to survive over the last few years. Customers are becoming more demanding, there are new competitors that are coming at us every day… .”

Caterpillar believes it can land international deals by working quickly face-to-face to meet the needs of customers outside the U.S.

Another iconic U.S. manufacturer, Boeing, and India’s discount airline SpiceJet, have announced the largest order in the carrier’s history. Boeing and SpiceJet announced an order for 205 new airplanes, a huge order for the fast-growing, low-fare Indian air travel provider.

Flying is for everyone in India: demand for aircraft is red, hot and spicy

SpiceJet is an example of a company serving a fast-growing customer base in one of the world’s most rapidly growing economies: India.

SpiceJet understands the changes coming to its country of operations: “With India’s economic and business growth, the percentage of traveling population is burgeoning. More and more Indians are traveling for both business and pleasure and everyone needs to save both time and money. SpiceJet’s vision is to address that and ensure that flying is for everyone. Management is committed to bring to customers in India all the benefits of the global revolution in the skies. SpiceJet aims to make travel comfortable, affordable and a refreshingly efficient experience for all. India, get ready for the power to fly!” the company website says. The airline’s motto is “Red. Hot. Spicy.”

The [SpiceJet] order, coupled with one from Qatar Airlines valued at USD $18.6 billion a few months ago, puts Boeing at an advantage over its competitor Airbus, Engineering.com reported.

Boeing, Airbus forecast $5 trillion in airplanes will be built, delivered next 20 years

Both aircraft makers are predicting record worldwide demand for aircraft in the next two decades, representing a pool of business in the trillions of dollars. Boeing projects global investments of $5.9 trillion for 39,620 new commercial airplanes to be delivered during the next 20 years. Airbus anticipates that worldwide air traffic will grow at 4.5 per cent annually, requiring some 33,070 new passenger and dedicated freighter aircraft at a value of US$ 5.2 trillion over the next 20 years.

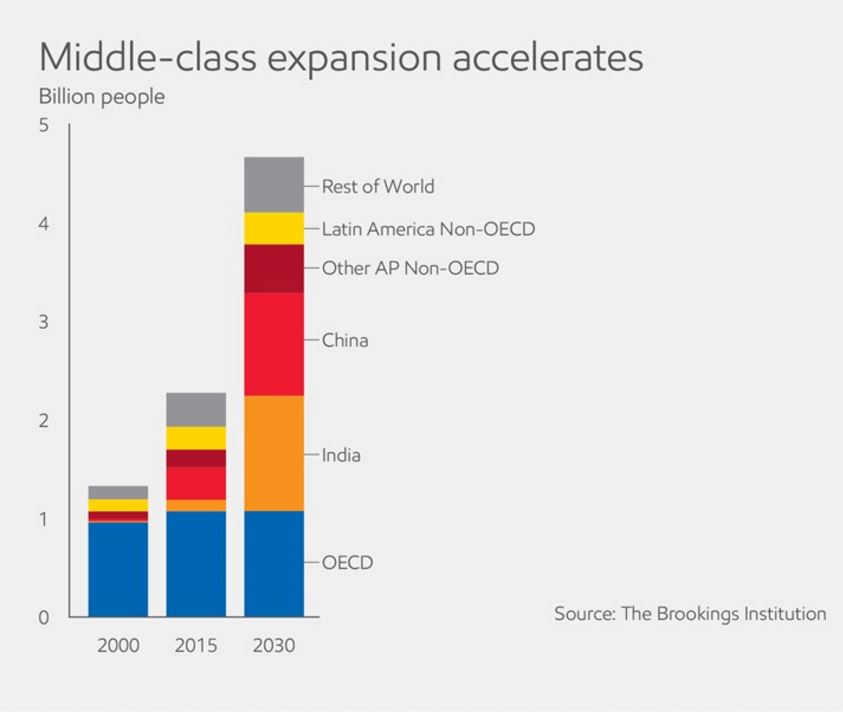

These mega-giant projections, some of which are already beginning to take form as orders, help make the case put forward by Exxon’s VP of corporate strategic planning William Colton, who is predicting a middle-class boom around the world.

Exxon sees global middle class (representing a growing demand for products, services) growing to 5 billion people, more than half the world’s population, by 2030

“At the turn of the century, about 1.3 billion people could have been described as middle class. The global population at the time was about 6 billion, so that was nearly a quarter of the planet’s population, most of whom resided in the advanced economies of Europe and the Americas,” Colton wrote in an Exxon publication, Energy Factor.

“By 2030, however, the world will be a very different place. We anticipate the number of people classified as middle class will near 5 billion – well more than half the expected 2030 global population of about 8.5 billion people. Much of that expansion occurs in the dynamic economies of the Asia Pacific region, with significant growth in Africa and Latin America as well.

“Among the most pressing will be to meet the increase in energy demand this middle-class expansion will both require and drive, as more people expect and gain access to air-conditioned homes, cars, and appliances like refrigerators, dishwashers, and smartphones.”

That kind of growth requires reliable, low cost electrical generating capacity and the coal mining industry is hoping to tap into that new demand alongside its cousin natural gas.

OAG360: If you had to make a guess, what does the U.S. coal mining industry look like at the end of 2020—or in the next four to five years?

PIPES: I think the best story to tell is ‘what would this industry have looked like without the understanding that it was under severe duress and that the very sharp decline in coal consumption is creating a lot of uncertainty in coal country?’ I think you partially saw that in the election outcome, in Pennsylvania in particular. So my sense is that the [Trump] administration will have an open ear to coal.

And when it comes to LNG exports and some of the other factors I mentioned earlier, I think it will try to make the business climate much more friendly for coal than it has been under the previous administration. And I think that, coupled with the broader timing [Pipes referenced Bush era proposals on emission control], and on top of that, just the fact that the coal fleet is aging—most coal-fired power plants were built in response to the oil shock in the 1970s, so they are reaching their end of life, with or without emission targets. And so we went through a bulge of retirements, especially in the last four years, and that pace of retirements is most likely going to slow down dramatically.

And so in four years, if we assume strong economic growth—who knows if we’re going to see that or not—but if the economy holds and if in fact more manufacturing does come back to the United States, if LNG exports start to grow, then I think you can make a case that coal is maintaining its place in the U.S. generating mix.

After years of declines, many folks were expecting that sharp erosion of market share would continue, to the point that in 20 years there’s no more coal—I think that view is likely going to change. I think about coal—what is left now is going to be stickier, it’s going to be much more stable, and so I think the perception surrounding the inevitability of coal’s decline—I think that will probably change.