New IHS report finds FSB’s climate risk reporting recommendations would undermine capital allocation decisions and could distort markets

In December 2016, the Basel, Switzerland-based Financial Stability Board (FSB) put out the recommendation of its Michael Bloomberg-led task force that concluded that public companies should disclose climate-related risks in their financial filings.

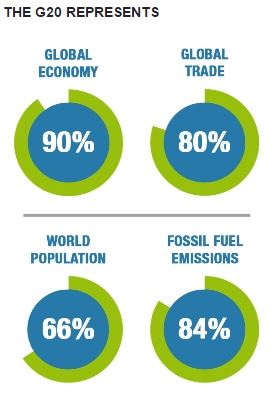

The FSB is the G20’s financial policy-making/recommending body. It is composed of financial regulators, central banks, finance ministries and international financial organizations that report to the G20. G20 is an abbreviation for the Group of Twenty, consisting of the governments of Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Republic of Korea, Mexico, Russia, Saudi Arabia, South Africa, Turkey, the United Kingdom, the United States and the European Union.

“The FSB discharges its accountability, beyond its members, through publication of reports and, in particular, through periodical reporting of progress in its work to the Heads of State and Governments and the Finance Ministers and Central Bank Governors of the Group of Twenty,” is how the FSB describes its organizational reporting responsibility.

It’s all about Paris: facilitating the transition to a low carbon economy

The FSB is heavily into the business of bringing forward climate change financial policy at the request of its boss, the G20. FSB chairman is Mark Carney, governor of the Bank of England. In a September 2016 lecture in Berlin entitled “Resolving the Climate Paradox,” Carney addressed the goals that prompted the task force.

In the Berlin lecture Carney said, “A market in the transition to a two-degree world can be built. It will reveal how the valuations of companies that produce and use fossil fuels might change over time. It will expose the likely future cost of doing business, paying for emissions, changing processes to avoid those charges, and tighter regulation.

“First, static disclosures of current carbon footprints are not sufficient to reveal a company’s climate-related financial risks. Investors and creditors need to know the strategic as well as the static. A mix of forward-looking, and sufficiently granular, qualitative and quantitative information is needed to offer real insight into how climate-related risks and opportunities may impact a firm’s existing and future business lines.

“This could include information on governance and management of such risks, and on a firm’s mitigation strategy and its financial planning, including capital expenditures and R&D.

“Second, the robustness of a firm’s strategy and targets could be further illuminated through scenario analysis. For investors to price financial risks and opportunities correctly, they need to weigh firms’ strategies against plausible public policy developments, technological advances, and evolving physical risks.

“A full exploration of transition risks may require consideration of financial risks and opportunities under several scenarios. An important question is what form these scenarios should take. One option for a global firm operating across multiple markets could be to apply a transition scenario that takes into account the NDCs of the countries in which its businesses are located. This could support analysis of whether a company is under- or over-performing relative to articulated policy frameworks. Another very relevant scenario is, of course, the ultimate two-degree goal agreed in Paris.

“Clear policy frameworks that encourage sustained private investment are thus essential, including those that mobilize private investment to finance the transition to the low-carbon economy.”

Whose interest does the FSB task force serve?

The FSB announced its task force members (50% of whom have the words ‘sustainable’, ‘climate’, ‘impact’ or ‘responsible’ as part of their job titles) in January 2016.

FSB task force Chairman Michael Bloomberg said in a press release, “Managing climate-related risk is increasingly critical to financial stability, but it can’t be done without effective disclosure. The recommendations from the Task Force will increase transparency and help to make markets more efficient, and economies more stable and resilient.”

Not so fast

A report published today by IHS Markit concludes that climate risk disclosure in public financial filings could have the polar opposite effect than what Bloomberg described—IHS concludes it could lead investors to misunderstand opportunities and risks, misprice assets and forego future returns.

“The TCFD proposal represents a radical departure from established financial reporting rules and goes against the basic principles of disclosure,” said Antonia Bullard, IHS Markit vice president for energy-wide perspectives.

“Singling out one type of risk for separate treatment would prevent financial markets from accurately assessing, comparing and pricing all risks and opportunities. That would undermine, not support, the goal of improving capital allocation decisions and market functioning,” Bullard said.

The IHS Markit report, entitled Climate-related Financial Risk and the Oil and Gas Sector, says some elements of the TCFD framework could be helpful to investors in understanding how companies comprehend and manage potential risks related to climate change. However, the analysis concludes that several of the recommendations could obscure material information and create a false sense of certainty around the financial implications of climate-related risks.

The impact of climate-related factors is more complex and multi-dimensional than reporting typical financial drivers like commodity prices, IHS points out in its report.

“Carbon emissions do not correlate with climate-related financial risk in a straightforward manner. For example, operational emissions might decrease due to declining production rather than the result of improved emissions management, which could have a greater financial impact than climate-related risk,” the report finds.

“In addition, the TCFD recommends the disclosure of “climate-related opportunities”—such as investments in low-carbon alternatives—in terms that imply that these opportunities will generate positive financial outcomes. No such guarantee can exist. In fact, some “clean energy” investments have high financial risk and some of the recommended disclosures could lead investors to misprice assets and increase their financial risk,” the report says.

How public company climate disclosure would affect oil and gas companies

The TCFD recommends that oil and gas companies disclose metrics such as “indicative costs of supply for current and future projects.” Disclosures of such confidential information would undermine companies’ competitive positions and harm existing shareholders, the IHS report says.

It warns that “in the oil and gas sector, disclosing information about project plans could reveal a company’s development priorities and impair its position with host governments, project partners and service sector companies. In addition, absolute and relative costs shift constantly in response to market and technology changes. Companies also could face litigation if future costs do not align with the projected costs in the disclosures.”

“The TCFD recommendations extend beyond the scope of investor needs and enter the realm of climate policy,” IHS Markit Chairman Daniel Yergin said in a press release.

Research for the IHS report was supported by BP, Chevron, ConocoPhillips and Total. The FSB is expected to present the final TCFD recommendations to the G20 summit in Hamburg in July 2017.

In advance of the July meeting of the G20 in Hamburg, at which the FSB will present its final recommendations for a requirement for public companies to disclose climate risk, the U.S. Chamber of Commerce’s Institute for 21st Century Energy and Center for Capital Markets Competitiveness will host a breakfast discussion on “Distorting Financial Markets: The Role of Disclosure, Sustainability and the Importance of Materiality,” which includes IHS Markit Chairman Dan Yergin. The event is at the U.S. Chamber of Commerce office in Washington, D.C. on May 16, 2017.