Cimarex Energy (ticker: XEC) announced net income of $97.3 million during its second quarter conference call today—a significant turnaround from its Q2, 2016 loss of $214.4 million. The company produced near the high end of its expected Q2 guidance, with an average of 1.156 Bcfe per day—or approximately 192.7 MBOE per day.

The company’s production climbed nine percent over its Q1, 2017 production and 19% over its Q2, 2016 production. Oil production alone averaged 57,871 BOPD, an increase of 11% from its Q1, 2017 production.

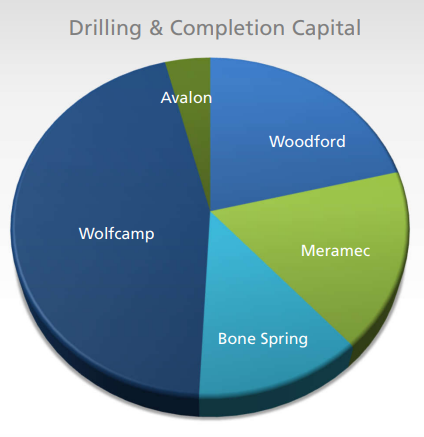

Over the course of 2017, Cimarex has spent $602 million in exploration and development. During Q2, the company invested $296 million in exploration and development—with approximately $219 million of that directed to drilling and completion activities. Of that capital, 53% was directed to the Permian basin and 45% was directed to the Mid-Continent. The company funded its investments during the second quarter from its cash flow and cash on hand.

Looking forward

Cimarex has maintained its 2017 exploration and development capital allocation of $1.1 to $1.2 billion. The company expects that it will direct 62% of its capital investment to its Permian assets, with the remainder redirected to its Mid-Continent operations.

Cimarex anticipates that its average daily production for 2017 will be between 1.120 and 1.140 Bcfe per day, or between approximately 186.7 and 190.0 MBOEPD. Much of its production growth will stem from expected growth in the late third quarter and early fourth quarter of 2017. Its oil production is expected to grow by approximately between 30% and 35% in Q4, 2017 over Q4, 2016.

Q2 operations

Over the course of its second quarter, Cimarex completed 51 gross (18 net) wells. Of those 51 gross wells, 11 gross (10 net) were brought to production in the Permian and 40 gross (8 net) in the Mid-Continent.

The company’s Permian production climbed 12% over its Q1 production to 644.7 Mmcfe per day. Cimarex conducted its Pagoda State four well downspacing project with 16 wells per section producing out of the Upper Wolfcamp. The four wells had lateral lengths of 10,000 feet and averaged a 30-day initial production of 1,922 BOEPD, 956 BPD of which was oil production. As of the Q2 update, the company was operating eight rigs in the Permian.

The company’s Mid-Continent acreage produced an average of 509 MMcfe per day, ten percent higher than its Q2, 2016 production. The company is in the process of delineation efforts in the Meramec play and is undergoing the completion of an increased density pilot in the Woodford formation. The density pilo consists of eight wells, testing 16 and 20 Woodford wells per section. The company believes that the test will show results in the second half of 2017. At the time of its Q2, 2017 update, Cimarex was operating six rigs in the Mid-Continent.

Cimarex Q2, 2017 Earnings Call Q&A

Q: Can you talk about the oil yield rates in the context of Culberson County, and what gave you confidence that rates will not be an issue over time?

XEC: Well, let me just take a stab at and then John or Joe may want to jump in here. Our lens is rate of return. I mean this issue was interesting but we properly modeled our response I think many of you that have followed us know we do a very exhaustive annual look back. We go back 15 years and we update the production on every well we’ve ever drilled. We update the costs, we update the commodity price file that produced into, and we update our returns. And that’s a really important exercise for us, because it levels and grounds our future decisions. And we’ve got a very confident analysis of our production history including Culberson county. Culberson county does go from oil in the reservoir to gas in the reservoir. So there are varying issues around that play, but as long as we’re properly modeling that stream, that hydrocarbon stream, rate of return is that lens and mean some into us and these are very solid outstanding rates of return. But specific to the reservoir issues, I’m going to let John or Jo either kind of…

XEC: Well, I’ll just say real quick is as Tom alluded we have a large acreage position and a multi-variable hydrocarbon system there that any one well or project we looked at has its own design GOR or yield profile. We don’t try to slap the same the yield profile or life of the well across all that acreage. We would never do that. It’s variable across acreage depending upon both the pressure, we know that the reservoir to be and the initial yield and then from there with our expectation of what that yield will do over time. And I’m very proud to say because of, like Tom said, the look backs we do, the checks we do I feel very confident and the economics presented to me is a true representation of what that well and how that well will perform both on its gas and its oil.

XEC: This is Joe. I guess how I would answer that is the phase behavior is different for all different types of hydrocarbon compositions as you know. Alluding to what Tom said is that phase behavior its characteristics will ultimately show up and how wells produce. And so for using older wells and they produce, it’s given us a DNA print of that phase behavior. Those old wells and those forecasts are what we are using to predict our new wells.

So, in our minds, we’re truly modeling the phase behavior of the reservoir, the type curves that we put together our oil, the in place calculations that we make when we perform volumetrics our oil. The recovery calculations that we come up with are based on oil. We’re forecasting an oil curve. The gas relationships to that curve, the gas becomes a secondary hydrocarbon byproduct. To the extent the GOR goes up, the well makes more gas, that the same barrels of oil that we’re forecasting. And so that is how we’re looking at it.

And the bottom line is what is those forecast for oil and gas, ultimately yield from a rate of return on our capital investment.

Cimarex Energy is presenting at EnerCom’s The Oil & Gas Conference® 22

Cimarex will be a presenting company at the upcoming EnerCom conference in Denver, Colorado—The Oil & Gas Conference® 22.

The conference is EnerCom’s 22nd Denver-based oil and gas focused investor conference, bringing together publicly traded E&Ps and oilfield service and technology companies with institutional investors. The conference will be at the Denver Downtown Westin Hotel, August 13-17, 2017. To register for The Oil & Gas Conference® 22 please visit the conference website.