Status Bump: China’s renminbi joins the dollar, euro, pound and yen as an IMF reserve currency

The International Monetary Fund (IMF) announced Monday that the international lender will include the Chinese renminbi, or yuan, in its basket of currencies that make up the Special Drawing Right (SDR), it said in a release. The IMF’s decision will be effective as of October 1, 2016, providing lead time for the IMF and users of the SDR basket time to adjust.

The SDR is neither a currency, nor a claim on the IMF, but rather a potential claim on the freely usable currencies of IMF members.

How It Works

The value of the SDR is based on the various currency included in the basket, meaning the inclusion of the renminbi makes China’s currency more influential internationally. Holders of SDRs can obtain any of the basket currencies either through voluntary exchanges between IMF members, or by the IMF designating members with strong external positions to purchase SDRs from members with weaker positions.

The weighted average of the basket currencies also determines the SDR interest rate, which provides the basis for calculating the interest charged to borrowing members of the IMF, and the interest paid to members for the use of their resources for regular (non-concessional) IMF loans.

According to the IMF’s release today, “the inclusion of the [renminbi] will enhance the attractiveness of the SDR by diversifying the basket and making more representative of the world’s major currencies.”

China will have to make market reforms

To be included in the IMF SDR basket, a currency must meet two major requirements: first, it must be the currency of a major exporting country, a requirement China had no trouble meeting, and second, it must be “freely usable.”

Meeting the second requirement has required market reform in China, with the People’s Bank of China (PBOC) making moves to turn the renminbi into a more market-oriented currency. On August 11, 2015, the PBOC surprised financial markets by devaluing the renminbi by 2%, as the bank tried to bring the value of the currency more in-line with market fundamentals. The decision triggered the biggest one-day drop the currency had seen in more than 20 years.

In October, EnerCom Analytics postulated that the move was likely made in order to increase the liquidity of the renminbi in the hopes of inclusion in the IMF SDR basket. The move gives China more political power, according to EnerCom’s analysts and others.

“Reserve currency status gives governments more policy options, and political clout. Reserve currency nations can more easily sell debt, have more liquid and vibrant capital markets and have the ability to set interest rates and employ non-traditional monetary policy tools, such as quantitative easing.”

“This inclusion is clearly an important milestone in a journey…that will include certainly more reforms,” IMF Managing Director Christine Lagarde said after the board approved the renminbi’s inclusion in the SDR basket, signaling the importance of earlier reforms on the currency’s path to inclusion in the IMF’s basket.

Being next in line for G20 presidency, China’s economy faces increased exposure

Inclusion in the SDR basket was an important goal for China as the country prepares to take on the rotating presidency of the Group of 20 major economies next year, and it acknowledges the country’s economic importance, with China now accounting for more than 15% of global gross economic output, but it also leaves China’s economy more exposed.

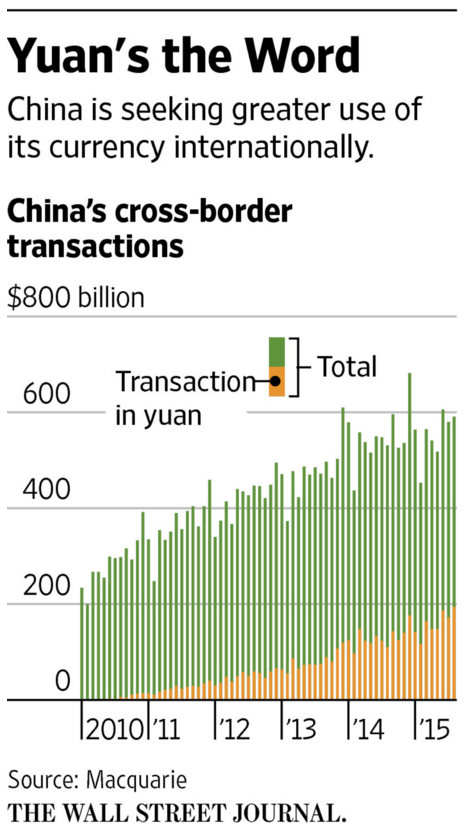

Allowing its currency to trade more freely also opens the door to greater capital outflows. Cooling growth prospects could influence some investors to take their money elsewhere, a growing trend in emerging markets, reports The Wall Street Journal.

Eswar Prasad, a Cornell University economist and former top China hand at the IMF, also indicated that further challenges remain to continued economic reform.

“Domestic opposition to further financial-sector reforms and market-oriented liberalization measures remains fierce, and this decision by itself is unlikely to shift the balance substantially,” he said.

Mixed reaction in the U.S.

While the U.S. Treasury issued a short two-line statement saying it supported the IMF staff recommendation to include China’s currency in the SDR basket, the reaction from some U.S. Senators has been less positive.

“This decision does nothing but validate China’s history of cheating on its currency,” said Sen. Bob Casey (D-Pa). Sen. Charles Schumer, (D-N.Y.), said “the IMF is choosing to reward China’s currency manipulation instead of combating it.”