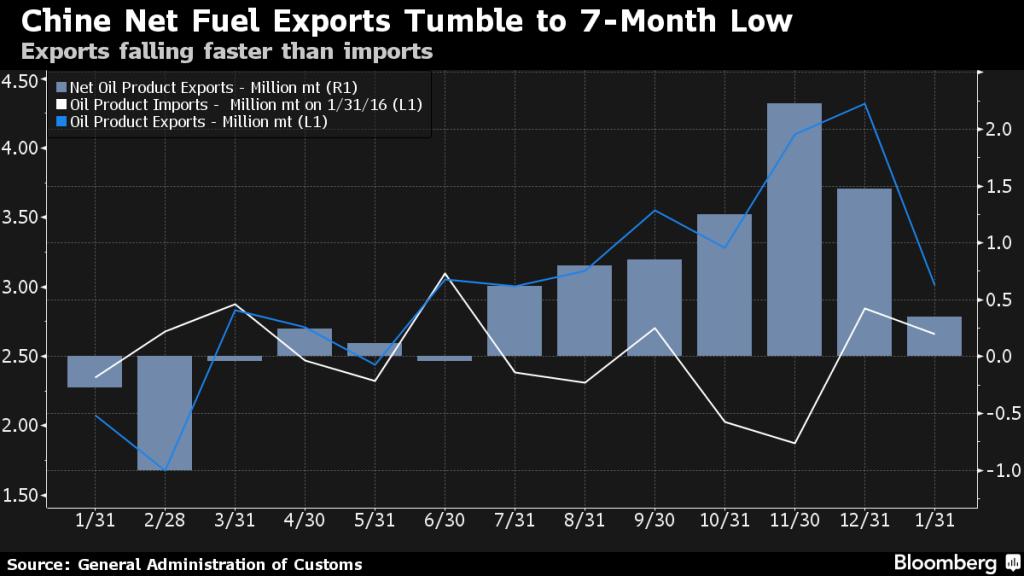

China net fuel exports down 76% month-over-month

China’s net fuel product exports fell 76% in January from the final month of 2015 to 350,000 metric tons, the lowest level since June, according to Bloomberg. China’s net exports reached the seven-month low as refiners chose to sell more fuel at home after the government stopped cutting domestic prices.

The government had previously been lowering fuel prices when crude traded below $40 per barrel, supporting gasoline and diesel above levels typically seen in international trading. The decision may help increase refining margins for refineries in Asia after they exported a record amount of diesel kerosene and gasoline abroad last year.

“The price spread between exports and domestic retail sales fell to zero in December and have been negative since the government stopped adjusting fuel prices lower,” Lin Jiaxin, a Guangzhou-based analyst with ICIS-China, said. “As long as crude oil prices are subdued, refiners lack the economic incentive to export.”

Cold weather last month also boosted domestic demand last month.

In U.S. dollar terms, total exports declined 11.2% from a year earlier.

Crude oil imports fall to three-month low

In addition to slumping exports, China also reported record low crude oil imports as refineries slowed operations. Refining rates could slow further as China Petroleum & Chemical Corp. plans to lower its oil-processing target by 1.2% this year due to weak demand and competition from independent refiners.

In January, China cut imports by 4.6% compared to the same time last year to 26.69 million metric tons, or about 6.3 MMBOPD, according to Bloomberg. The level of imports also represents a 20% drop from record levels in December. In U.S. dollar terms, January imports fell 18.8% from a year earlier.

Exports could continue to fall as the country returns from last week’s Lunar New Year holiday, when it essentially shuts down for a week.

“Inbound shipment won’t likely pick up its pace until fuel demand recovers after the Chinese New Year holiday,” said Amy Sun, an analyst with ICIS China. “China’s crude imports are expected to ease following the very high level in December as commercial oil stockpiles are quite full now.”