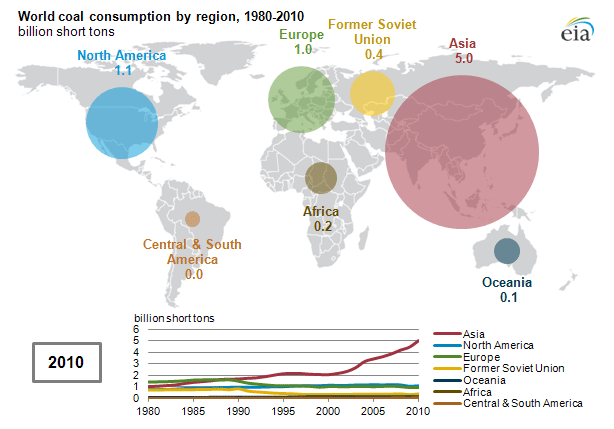

China is the world’s largest consumer of coal. According to the EIA, almost 70% of the energy China used in 2011 came from coal.

However, China announced last year that it plans to cut back on coal in favor of cleaner forms of energy. Chinese Premier Li Kequiang said, “China will wage war against smog weather,” CCTV, a Chinese news organization, reported.

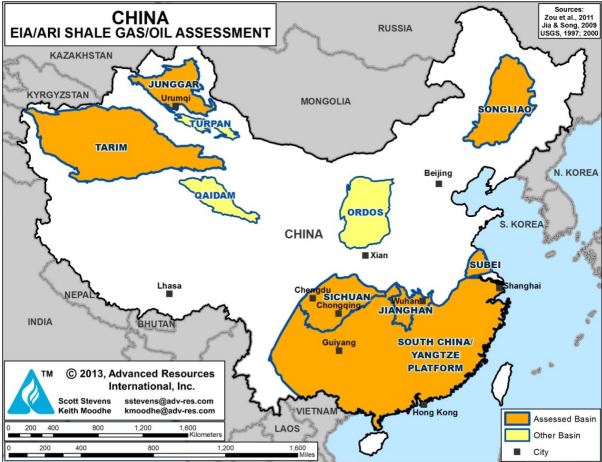

One obvious alternative to coal as fuel for electrical generation, is natural gas. China has approved a $400 billion natural gas pipeline from Russia to China. The country has also been looking into how to develop its own unconventional shale plays. According to an EIA report in June 2013, China is No.3 on its list of top ten countries holding technically recoverable shale oil, estimated by the EIA to be 32 billion barrels, topped only by the U.S. (58 billion barrels) and Russia (75 billion barrels). China ranked No.1 for technically recoverable shale gas with 1,115 Tcf.

China opened blocks of its shale to joint ventures with foreign exploration companies in 2012. A Schlumberger Reservoir Laboratory opened on July 3, 2013 in Chengdu.

In February of 2014, the EIA compiled a list of refinery projects in China:

| Company owner | Location | Capacity | Start date | Notes |

| Sinopec | Yangzi | 160,000 | 2014 Q2 | Construction; Net refining addition of 90,000 bbl/d after removing 70,000 bbl/d from service |

| Sinopec | Caofeidian/Tianjin | 240,000 | 2015 | Construction; Plans to process crude oil from Saudi Arabia |

| Sinopec | Guangdong/Zhanjiang | 300,000 | 2015 Q4 | Construction; Developing with Kuwait Petroleum (30%) and TOTAL (20%) |

| Sinopec | Zhenhai/Zhejiang | 350,000 | 2016 | Expansion; Construction |

| Sinopec | Hainan | 100,000 | 2015 | Environmental approval received February 2013 |

| Sinopec | Luoyang | 160,000 | 2016 | Expansion |

| CNPC | Pengzhou | 200,000 | 2013 Q4 | Trial operations |

| CNPC | Urumqi | 120,000 | 2014 Q1 | Construction; Doubles the existing capacity to 240,000 bbl/d |

| CNPC | Huabei | 100,000 | 2015 | Expansion; Construction |

| CNPC | Anning/Yunnan | 200,000 | 2016 | Construction; Plans to process oil from Saudi Arabia and Kuwait via the crude oil pipeline from Myanmar; JV with Saudi Aramco (39%) and local company (10%) |

| CNPC | Guangdong/Jieyang | 400,000 | 2017 | Construction; JV with PDVSA (40%) |

| CNPC | Karamay | 100,000 | 2017 | Expansion; Processes bitumen |

| CNPC | Chongqing | 200,000 | 2017 | Receive oil from China-Myanmar pipeline |

| CNPC | Jiangsu/ Taizhou | 400,000 | 2017 | NDRC approval; Environmental approval pending; JV with Qatar and Shell |

| CNPC | Lanzhou Lianhua | 200,000 | 2017 | N/A |

| CNPC | Tianjin | 320,000 | 2020 | Planning; FID expected in 2017; JV with Rosneft (49%) |

| CNPC | Shangqiu/Henan | 200,000 | 2020 | N/A |

| CNOOC | Ningbo Daxie/Zhejiang | 140,000 | 2014 Q4 | Construction |

| CNOOC | Huizhou | 200,000 | 2015 Q4 | Expansion; Construction |

| Sinochem | Quanzhou | 241,000 | 2013 Q4 | Trial operations |

| Sinochem | Ningbo | 240,000 | 2020 | Pending approval |

| Sources: U.S. Energy Information Administration based on FACTS Global Energy, PFC Energy, Reuters, Company information. | ||||

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.