Chesapeake Energy Corporation (ticker: CHK) produced approximately 593,200 BOEPD in Q4 2017. Chesapeake’s average daily production for the 2017 full year was approximately 547,800 BOE, compared to approximately 635,400 BOE in the 2016 full year.

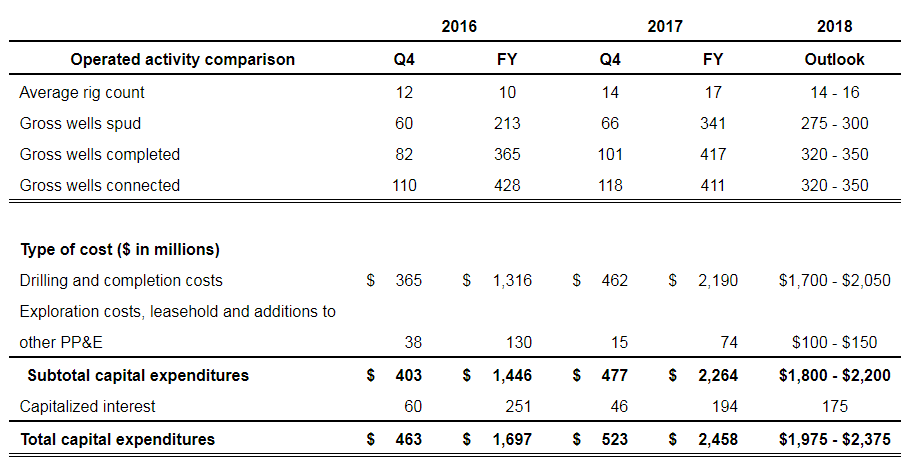

The company’s total capital investments were approximately $2.458 billion during the 2017 full year, compared to approximately $1.697 billion in the 2016 full year. Chesapeake plans to spend about $1.975-$2.375 billion in 2018, which is down 12% compared to 2017 levels.

For the 2017 fourth quarter, Chesapeake reported net income of $334 million and net income available to common stockholders of $309 million, or $0.33 per diluted share. For the 2017 full year, Chesapeake reported net income of $953 million and net income available to common stockholders of $813 million, or $0.90 per diluted share.

Wells completed, rig count

- The company completed 101 wells in Q4 2017. For the 2017 full year, Chesapeake completed 417 wells. As for 2018, the company estimates completing 320-350 wells

- In the Eagle Ford Shale in south Texas, Chesapeake is currently utilizing five drilling rigs and expects to place on production up to 140 wells in 2018, compared to 166 wells in 2017

- In the Marcellus Shale in northeast Pennsylvania, Chesapeake is currently utilizing one drilling rig and expects to place on production up to 55 wells in 2018, compared to 43 wells in 2017

- In the Haynesville Shale in Louisiana, Chesapeake is currently utilizing three drilling rigs and expects to place on production up to 25 wells in 2018, compared to 36 wells in 2017

CEO Lawler

Doug Lawler, Chesapeake’s CEO, commented, “I am very pleased with our fourth quarter and full year 2017 performance, as we made significant progress toward our goals of reducing our debt, increasing cash flow generation and margin enhancement. Fiscal year 2017 was a pivotal year for Chesapeake, as we restored our production and increased net cash provided by operations, increased our oil production, adjusted for asset sales, and significantly improved our cost structure by reducing our combined production, general and administrative and gathering, processing and transportation expenses by approximately $510 million.

“We further demonstrated the depth of our portfolio by closing on approximately $1.3 billion in asset and property sales and signed additional asset sales for approximately $575 million that we expect to close by the end of the 2018 second quarter. We reduced our outstanding secured term debt by approximately $1.3 billion, or 32%, continued to remove legal obligations and recorded the best environmental and safety performance in our company’s history.

“We expect to deliver production growth, adjusted for asset sales, of 1% to 5% on reduced capital expenditures. The expected improvements in our cost structure, as well as improved basis pricing differentials and higher NYMEX pricing, result in higher forecasted year-over-year cash flows.

“Over the last four years, we have fundamentally transformed our business, removing financial and operational complexity, significantly improving our balance sheet and addressing numerous legacy issues that have affected past performance,” Lawler said.