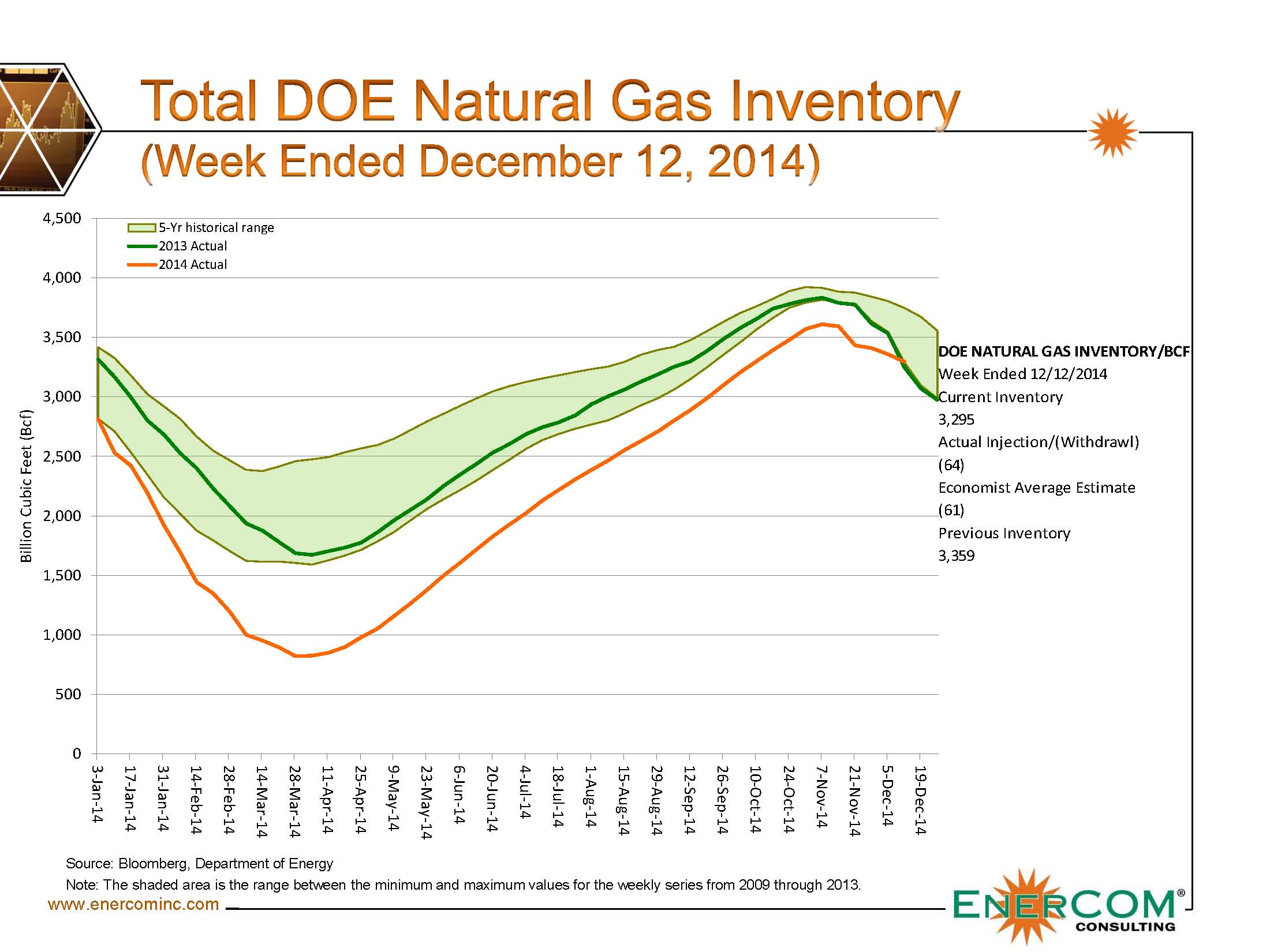

As indicated by EnerCom’s Natural Gas Roundup inventory report, gas levels fell in line with five year averages for the first time in nearly a full calendar year in the report issued on December 12, 2014. Storage levels were as much as 33% below the five year average in March, but a cooler summer, record injections and forecasts for a warmer than usual December all contributed to natural gas recovering to fall within the five year range.

As indicated by EnerCom’s Natural Gas Roundup inventory report, gas levels fell in line with five year averages for the first time in nearly a full calendar year in the report issued on December 12, 2014. Storage levels were as much as 33% below the five year average in March, but a cooler summer, record injections and forecasts for a warmer than usual December all contributed to natural gas recovering to fall within the five year range.

After nearly 12 months of catch-up, natural gas inventory had a bearish effect in prices, which dropped to its lowest level since January 2013.

The Wall Street Journal reports: “This December is on pace to be the ninth-warmest winter since 1950, according to MDA Information Systems LLC. The warm-up has both limited demand and allowed producers to work unimpeded. Drillers are producing about 8 billion cubic feet a day more than this time a year ago, Macquarie Research said last week as the losing streak started.”

The Wall Street Journal reports: “This December is on pace to be the ninth-warmest winter since 1950, according to MDA Information Systems LLC. The warm-up has both limited demand and allowed producers to work unimpeded. Drillers are producing about 8 billion cubic feet a day more than this time a year ago, Macquarie Research said last week as the losing streak started.”

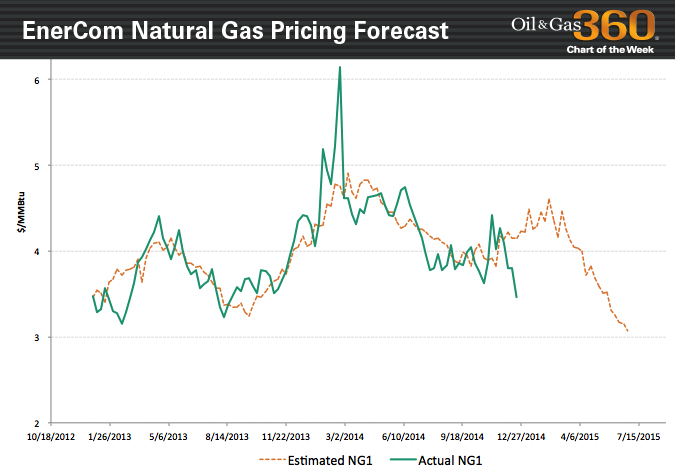

EnerCom’s Natural Gas Pricing Forecast is the focus in our Chart of the Week. Our model shows prices dropping near the $3/MMBtu range in July 2015 after staying above the $4/MMBtu threshold through April. Our current model indicates natural gas is currently being oversold, a notion shared by Bruce Baruch, senior marketing trader for iiTrader. “This is panic selling right here,” he said in an interview with CNBC.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.