By Andrew Nichols: EnerCom

ESG reports are a great way for companies to disclose data on how they impact the environment, social culture, and corporate governance. This practice helps to reinforce a company’s social license to operate and signals to markets that the firm is implementing best practices.

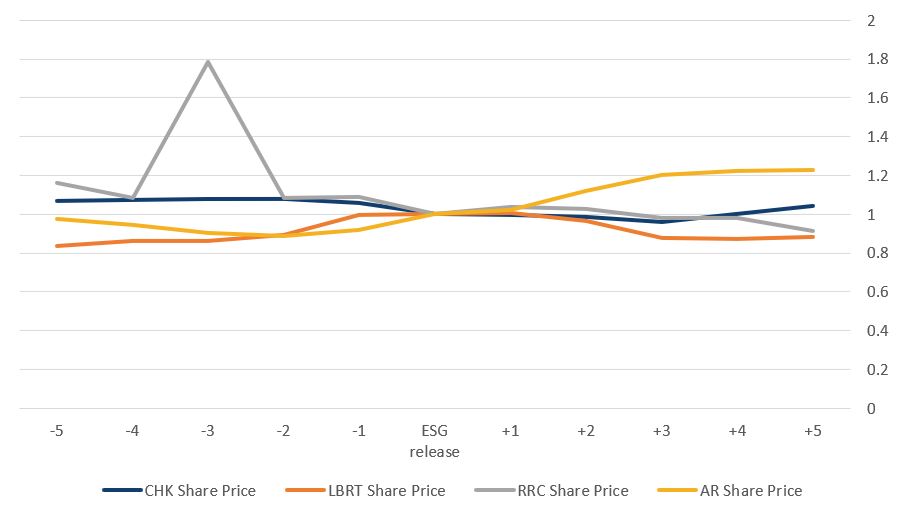

We pulled data for Chesapeake Energy (CHK), Liberty Oilfield Services (LBRT), Range Resources (RRC), and Antero Resources (AR) following announcements regarding their ESG reports and looked at how their stock price performed for the five days before and after. In the graph below the prices are indexed to one and there is not a clear answer on if an ESG report will raise stock price, but there are also many factors that go into stock price.

Comparing these stock prices to an index for their respective sector shows if they are doing better or worse than their peers and we found that CHK and AR both outperformed their respective indices all five days after the release whereas LBRT and RRC only outperformed for a day or two after and then went back down. This shows that releasing an ESG report is not a guarenteed way to boost the share price of a company right away, but that does not mean that it cannot help in the long run. ESG reports provide a company with a way to be more clear and open about their operations which brings many benefits such as an increase in credibility and shareholder loyalty.

While there does not appear to be a clear connection between an ESG report and an immediate improvement in stock price, we believe that these reports will continue to be import for companies. Stakeholders in the market and the communities where companies work are increasingly asking for proof that the work performed there is in-line with expectations of environmental and societal impact. We anticipate that ESG performance will increasingly be tied to the cost of capital for companies by members of capital markets, and companies that are unable to show their performance will be at a disadvantage.