Chaparral Energy, Inc. (ticker: CHPE) closed the sale of its North Burbank and Texas Panhandle enhanced oil recovery (EOR) assets. The properties sold to Perdure Petroleum LLC represented approximately 5,700 BOEPD of the company’s 24,500 BOEPD of total production.

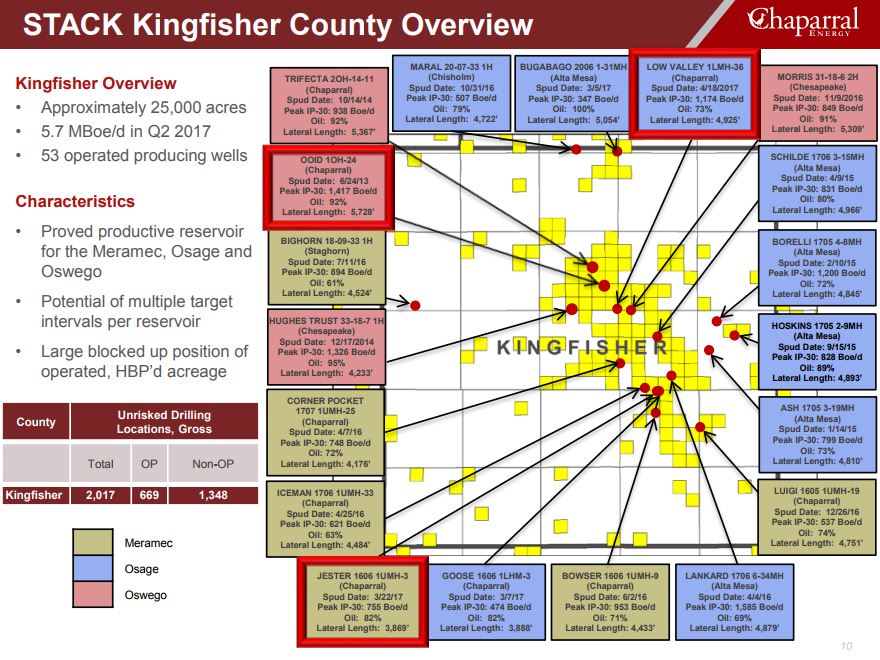

“We are pleased to announce that the close of this sale effectively completes Chaparral’s transition to a pure-play STACK operator,” said Chaparral CEO Earl Reynolds. “Our transition away from EOR operations will allow us to focus our capital and operational activity almost exclusively on accelerating the development of our more than 3,500 STACK drilling locations across our 110,000 net acre position in Kingfisher, Garfield and Canadian counties.”

Proceeds from the sale are going towards repaying the outstanding $149.2 million balance on the company’s term loan and will also repay a portion of the company’s credit facility. Chaparral said that focus remains on maintaining a strong balance sheet by spending within cash flow and potentially selling off non-core assets in the future.

CEO Reynolds said, “By fully repaying our term loan and a portion of our credit facility balance, we are able to secure the financial flexibility necessary to position us well for future growth and ensure our ability to thrive even in a $40 to $60 oil environment.”

EnerCom Analytics looks at the deal

According to a September 2017 investor presentation (pictured above), Chaparral estimated 2016 EOR net reserves to be 72.2 MMBOE. The presentation also estimated a 2017 net production of 5,800 BOEPD. The sale equates to $2.35 per BOE of reserves and $29,310 per flowing BOEPD. Acreage numbers for the EOR assets have not been provided since Q1 2015 and Chaparral’s November 20, 2017 press release did not specify acreage numbers. The reserves are estimated to be 100% oil and only 15% of the acreage has been developed, according to Bloomberg’s data.

By way of comparison, on November 6, 2017, Resolute Energy Corporation (ticker: REN) closed the sale of Aneth Field to an affiliate of Elk Petroleum Limited (ticker: ELK) for $160 million. Aneth Field is located in Utah and utilizes CO2-EOR. Aneth Field has 31.2 MMBOE of proved reserves, production of 5,900 BOEPD, and is 95% oil. The Aneth Field sale equates to $5.13 per BOE of reserves and $27,119 per flowing BOEPD.