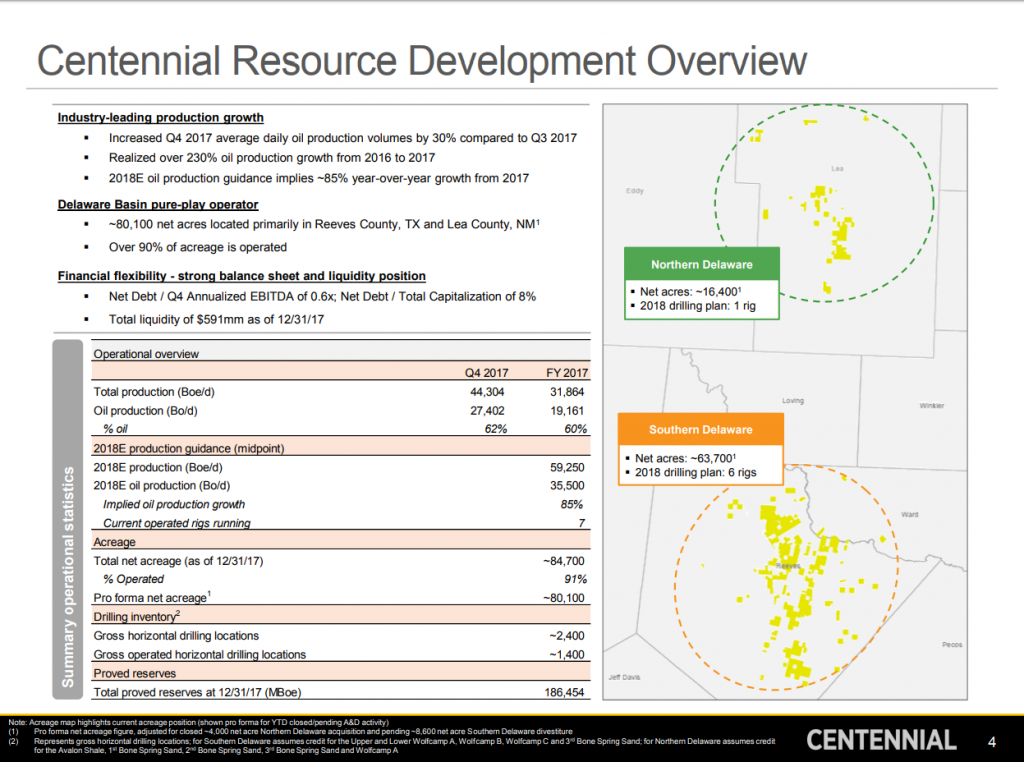

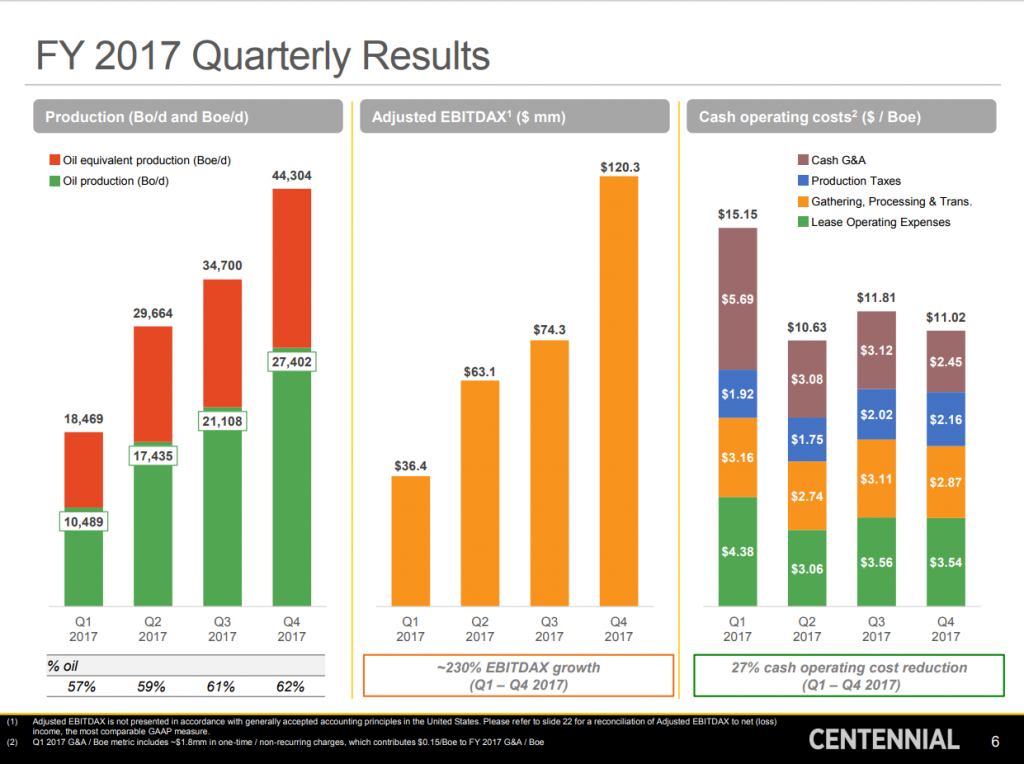

Delaware Basin producer Centennial Resource Development, Inc. (ticker: CDEV) had average daily oil and total equivalent production volumes of 19,161 Bbls/d and 31,864 BOEPD, respectively. Centennial said that these production volumes represent an increase of 233% for daily oil and an increase of 278% for equivalents year-over-year.

“In our first full year of operation, Centennial delivered on the 2017 goals we articulated last March. After raising production targets three times during the year, the company delivered oil production that ultimately exceeded the high-end of our 2017 guidance range. Within a short period of time, we assembled one of the highest quality technical teams in the industry,” said Mark G. Papa, chairman and CEO. “Based on the company’s strong operational outperformance in 2017 and the continued confidence in our technical capability, we are increasing our 2020 oil production target to 65,000 barrels per day, which is likely one of the highest four-year oil growth rates in the E&P industry.”

Centennial reported 2017 net income of $75.6 million, or $0.32 per diluted share. For the fourth quarter, net income increased 111% to $30.5 million, or $0.12 per diluted share, compared to $14.4 million, or $0.06 per diluted share, in the third quarter 2017.

Production

Reeves County, Texas

- Blackstone West 1H and 2H, Upper Wolfcamp A (100% WI)

- 880 foot spacing, ~4,115-foot laterals

- 1H – 1,745 BOEPD (81% oil, IP-30)

- 2H – 1,316 BOEPD (82% oil, IP-30)

- Big House A 4 57-60 1H and 2H, Upper Wolfcamp A (100% WI)

- Eight wells per section, ~7,040-foot laterals

- 1H – 2,705 BOEPD (52% oil, IP-30)

- 2H – 2,731 BOEPD (53% oil, IP-30)

“The Big House A 4 57-60 was a positive 660-foot test. To date, our development program and drilling inventory has been based on 880-foot spacing. With continued successful down-spacing tests, there is the potential to meaningfully increase our drilling inventory in this area. We plan additional spacing and delineation tests throughout the year,” Papa said. “We drilled these wells with extended laterals reflecting our shift to more efficient, higher return drilling operations. During the fourth quarter, we completed more extended lateral wells than in the first three quarters of the year combined.”

Lea County, New Mexico

- Pirate State 101H, Avalon Shale (100% WI)

- ~4,190-foot lateral, 1,112 BOEPD (79% oil, IP-30)

- Tour Bus 23 State 503H and 504H, 2nd Bone Spring (100% WI)

- Average lateral length of ~4,040 feet

- Average production of 1,016 BOEPD (83% oil, IP-30)

“We continue to see higher well productivity from our enhanced completion techniques. Centennial’s current completion design represents a 30% increase in pounds of proppant per foot and an 80% increase in clusters per stage, compared to 2016,” Papa said. “We expect to combine these new completion techniques with longer laterals to improve the overall drilling returns of our capital program in 2018.”

Centennial reported total 2017 D&C capital expenditures incurred of approximately $624 million. D&C capital expenditures incurred for the fourth quarter were approximately $226 million, compared to $163 million in the third quarter 2017.

2018 CapEx, plans and targets

The company is targeting total production growth of 86% during 2018. Centennial added a seventh drilling rig in February and plans to continue operating a seven-rig program throughout the year. The company expects the majority of its wells drilled during the year to be extended laterals on multi-well pads.

During 2018, Centennial expects to operate six of its seven rigs in Reeves County, where it will spend approximately 85% of the total operated D&C capital budget. Centennial will focus its Reeves County activity in the Upper Wolfcamp A zone following successful results from its 2017 capital program, with plans to develop additional zones throughout the year. According to Centennial, the remaining operated rig and associated D&C capital will be allocated to a newly expanded Lea County position.

“We remain focused on generating corporate returns for our shareholders and estimate our 2018 total capital program could generate GAAP return on equity and return on capital employed of approximately seven to ten percent, assuming $60 oil,” Papa said.

The estimated 2018 total capital budget is approximately $885-$1,050 million, including D&C capital, facilities, infrastructure, seismic, land and other expenditures. Centennial’s production profile is predicated on a D&C budget of $710-$820 million, of which approximately 90% is associated with operated activity.

To support future production growth, Centennial has allocated approximately $125-$160 million for facilities and infrastructure, which includes production facilities, saltwater disposal wells, water pipeline infrastructure and seismic, among other capitalized items.

Acreage

On February 8, 2018, Centennial acquired approximately 4,000 net acres in Lea County, New Mexico from OneEnergy Partners, LLC for a total purchase price of $95 million. The operated acreage position contains an average 95% working interest and is largely contiguous to Centennial’s existing position. Centennial has identified approximately 100 gross horizontal locations on the acreage, which are additive to its existing inventory in Lea County.

Centennial also entered into a definitive agreement with an undisclosed third-party for the sale of approximately 8,600 net acres in Reeves County for a purchase price of $141 million. The divested acreage represents a largely non-operated position (average 32% WI) on the western portion of Centennial’s position in Reeves County. 2017 average net production on the divested acreage was less than 250 BOEPD, or less than 1% of total company production. The transaction is expected to close on March 1, 2018.

“The acquisition increases our Northern Delaware position by approximately thirty percent to over 16,000 net acres and adds operated locations to our inventory in Lea County,” Papa said.

YE 2017 proved reserves

Centennial reported a 125% increase in year-end 2017 total proved reserves to 186,454 MBOE, consisting of 54% oil, 29% natural gas and 17% natural gas liquids. Proved developed reserves increased by 197% to 74,929 MBOE (40% of total proved reserves) as of December 31, 2017.

During 2017, Centennial’s organic reserves replacement ratio was 954%. The company’s 2017 proved developed finding and development cost totaled $10.62 per BOE. Centennial’s drill-bit finding and development cost was $5.47 per BOE for 2017.

Using SEC prices and discounting the present value at 10% (PV-10), the value of Centennial’s total proved reserves at December 31, 2017 increased 309% to $1,748 million. Netherland Sewell & Associates, Inc., an independent reserve engineering firm, prepared Centennial’s year-end reserves estimates.