Current production of 54,000 BOEPD – SLB, Torxen plan 1,600 well program starting in 2018

Cenovus Energy Inc. (ticker: CVE) said it will sell its Palliser crude oil and natural gas assets in southeastern Alberta to privately held Torxen Energy and Schlumberger (ticker: SLB) for cash proceeds of CAD$1.3 billion.

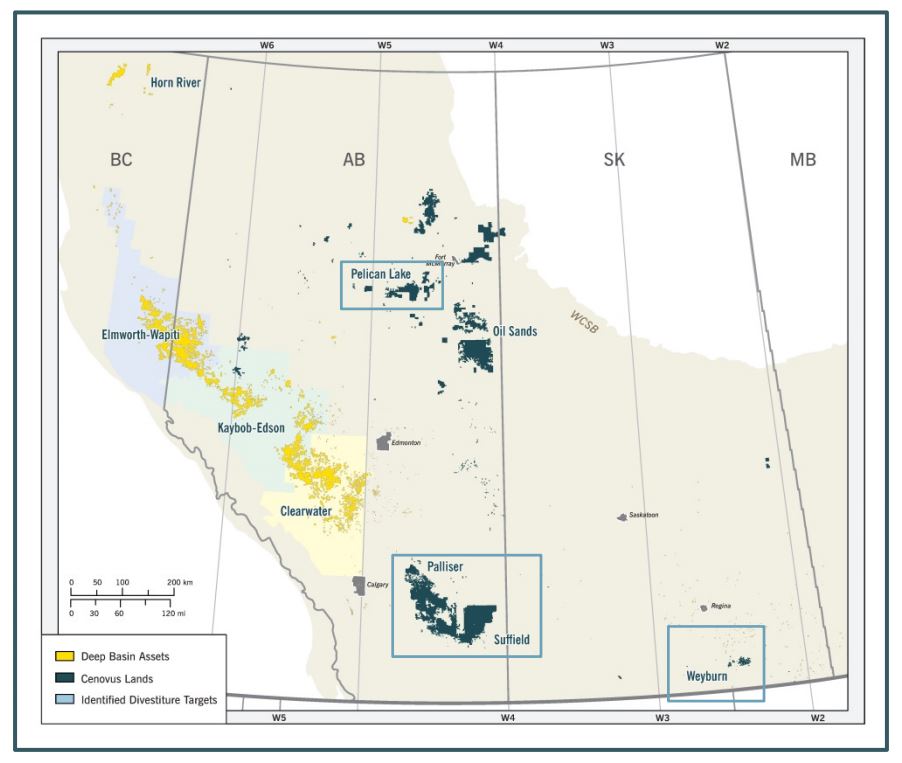

The Palliser Block consists of oil and gas wells, surface facilities, a pipeline network, and approximately 800,000 acres of oil and gas development rights, according to a press release issued today by Schlumberger . The asset has current production of approximately 54,000 BOEPD. The Palliser Block borders the acreage awarded to the Schlumberger Production Management (SPM) and Torxen joint venture established earlier this year. Cenovus characterized Palliser as a target for conventional short-cycle, tight oil opportunities.

Under the agreement, Schlumberger will be the majority non-operating owner, with the rights to exclusive service provision and Torxen will be the operator. The oil-focused development strategy includes a multiyear drilling program of more than 1,600 oil wells starting in 2018, Schlumberger said.

Patrick Schorn, Executive Vice President New Ventures, Schlumberger, commented, “Schlumberger is very pleased to partner with Torxen in the Palliser Block. By leveraging our reservoir knowledge, oilfield services technology and project management expertise, we expect to lower development costs and maximize the value of this asset—in a market where our traditional business model is challenged to deliver the required financial returns.”

Use of proceeds

Cenovus said the proceeds from the Palliser sale will be used to deleverage the company’s balance sheet. Net proceeds from the sale of Cenovus’s Pelican Lake assets, which closed on September 29, 2017, have been used to retire the first tranche of the company’s $3.6 billion asset-sale bridge facility and to pay down a portion of the second tranche. Net proceeds from the Palliser sale and the recently announced Suffield asset sale, both of which are expected to close in the fourth quarter of 2017, will be applied against the outstanding balance of the bridge facility.

“Our strategy to optimize our portfolio by selling non-core assets and using the proceeds to pay down debt is firmly on track,” said Cenovus President & CEO Brian Ferguson.

“We continue to target between $4 billion and $5 billion in announced asset sale agreements by the end of the year, and we remain committed to returning to our long-term debt ratio target,” Ferguson said.

Cenovus said it will use cash flow from its operations and asset sale proceeds to achieve its target of being below two times net debt to adjusted earnings before interest, taxes, depreciation and amortization (EBITDA).

The sale process for Cenovus’s Weyburn carbon-dioxide enhanced oil recovery operation in Saskatchewan is proceeding as expected, the company said. Cenovus said it anticipates reaching a sale agreement for the Weyburn asset in the fourth quarter of 2017.

Credit Suisse and Scotiabank acted as financial advisors to Cenovus for the Palliser transaction. The Palliser sale is expected to close in the fourth quarter of this year.