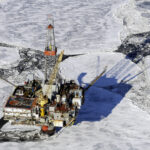

Canadian opposition, oil CEOs call for scrapping federal carbon price system

(Investing) – CALGARY – The future of Canada’s six-year-old carbon pricing system is on shaky ground after 14 oil and gas CEOs and the political opposition leader this week called for its repeal. Scrapping the system, which aims to reduce pollution by giving heavy industry a financial incentive to cut carbon emissions, however, puts the viability of a high-profile carbon capture