Company is now exclusively Eagle Ford, Delaware operator

Carrizo Oil & Gas (ticker: CRZO) continues to focus on its core activities, announcing the sale of its DJ Basin assets today.

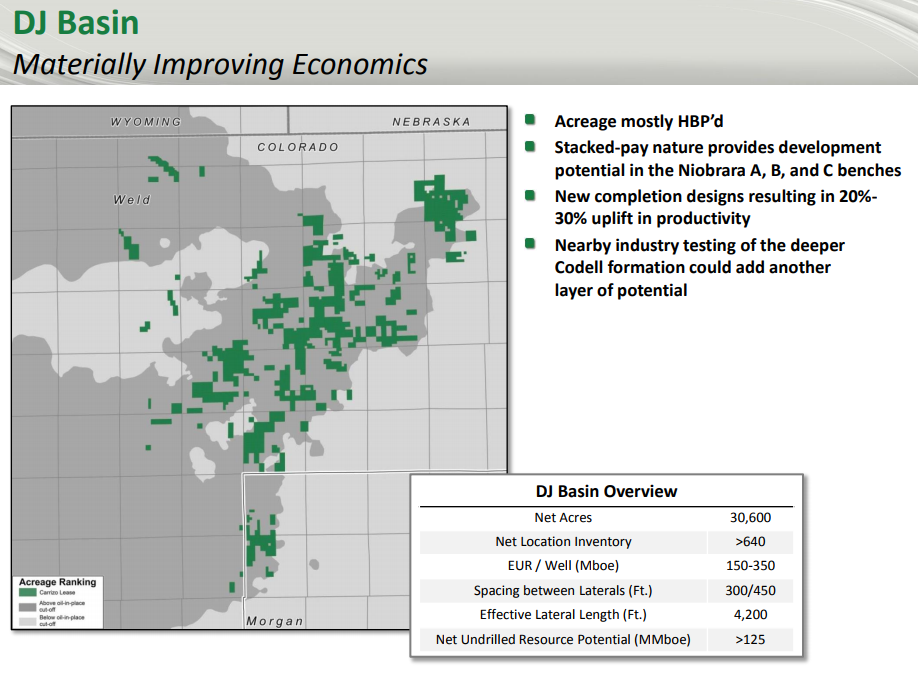

Carrizo will sell its Niobrara assets for $140 million in cash, with an additional $15 million in contingent payments. The company currently owns about 30,600 net acres in the DJ, mostly in Weld County. In Q3, these assets produced a net 2,427 BOEPD, 69% of which was oil. Carrizo declined to announce the buyer. Expected closing is in January.

Based on an acquisition price of $140 million, Carrizo received an unadjusted $4,575 per acre, lower than most recent DJ Basin transactions. If production is valued at the standard $35,000 per BOEPD, Carrizo received just under $1,800 per acre. This is below the next-most recent DJ transaction, when SandRidge announced the acquisition of Bonanza Creek for an adjusted $2,500 per acre. On the other hand, SandRidge paid a premium of 17.4% above Bonanza Creek’s valuation.

Marcellus, Utica sales close

Carrizo also provided an update on its previously-announced asset sales. The company has closed on the sale of its Utica and Marcellus acreage, which it announced earlier in the month. Carrizo received $62 million for its Utica properties, and $84 million for its Marcellus holdings. The two properties produced a combined 40.7 MMcfe/d in Q3.

These transactions represent a notable shift in strategy for the company. The company has long been diversified across multiple basins. As recently as September the company held acreage in the Eagle Ford, Permian, DJ, Marcellus and Utica. If the transaction announced today is completed, the company will be left with only its core areas, the Eagle Ford and the Delaware Basin.

Carrizo President and CEO S.P. “Chip” Johnson, IV commented, “With the announced sale of our DJ Basin assets, we have now executed on the non-core divestiture program that we announced to the market earlier this year. The sale of the DJ Basin assets is another step towards achieving our leverage reduction goals and positioning Carrizo to be able to deliver strong, high-return production growth within cash flow.”