PrairieSky to purchase Canadian Natural assets for C$1.8 billion

Canadian oil major Canadian Natural Resources (ticker: CNQ) announced today that PrairieSky Royalty (ticker: PSK) will purchase assets from CNR to for the largest fee simple mineral title and royalty positions in Western Canada. PrairieSky will acquire a portion of Canadian Natural’s royalty assets for total consideration of C$1.8 billion (USD$1.36 billion), consisting of C$680 million in cash and the issuance of approximately 44.4 million PSK common shares at an ascribed price of $25.20 per common share, according to a company press release.

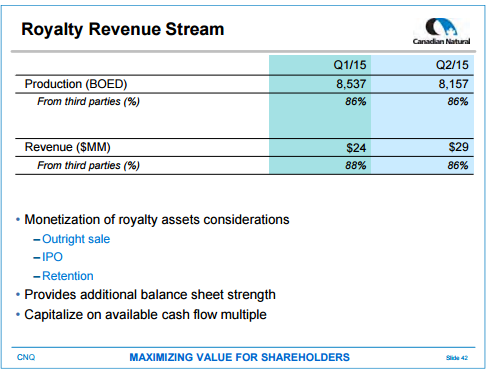

PrairieSky, the royalty business spun off by Encana Corp. (ticker: ECA) last year, will acquire approximately 81% of Canadian Natural’s royalty volumes (approximately 6,700 BOEPD) for its C$1.8 billion consideration. The assets consist of approximately 5.4 million acres of royalty lands throughout Western Canada, including 2.2 million acres of fee simple mineral title land. In an investor presentation released earlier this month, CNR said its royalties generated about C$29 million in revenue for the company during the second quarter of 2015.

Last week, CNQ reported a quarterly loss in its Q3’15 release, and said the company was looking for a way to monetize its royalty business by either selling or spinning it off sometime this year.

Under the terms of the agreement, Canadian Natural has agreed with PrairieSky to distribute the PSK shares to its shareholders, by no later than December 31, 2016, by way of a dividend or return of capital sufficient PrairieSky common shares so that Canadian Natural owns less than 10% of the issued and outstanding shares of PrairieSky. Canadian Natural said it plans to distribute the PSK shares at or near its next Annual and Special Meeting of Shareholders in May 2016.

Canadian Natural will allocate $680 million from the purchase price to the balance sheet through the application of the proceeds to the reduction of bank credit facilities increasing its undrawn bank lines of credit from $3.4 billion to $4.1 billion and decreasing its debt to book capitalization from approximately 38% to approximately 36% (all figures pro forma September 30, 2015).

PrairieSky plans to finance the $680 million cash portion of the purchase through a non-brokered private placement of 27.0 million subscription receipts at a price of $25.20 per receipt, according to the company’s press release. The funds raised from the private placement will be held in escrow until the completion of the deal between CNQ and PSK. In the event the deal to combine the two companies’ royalty bases is unsuccessful, the money will be returned to the investors.

Canada’s largest oil and natural gas royalty position

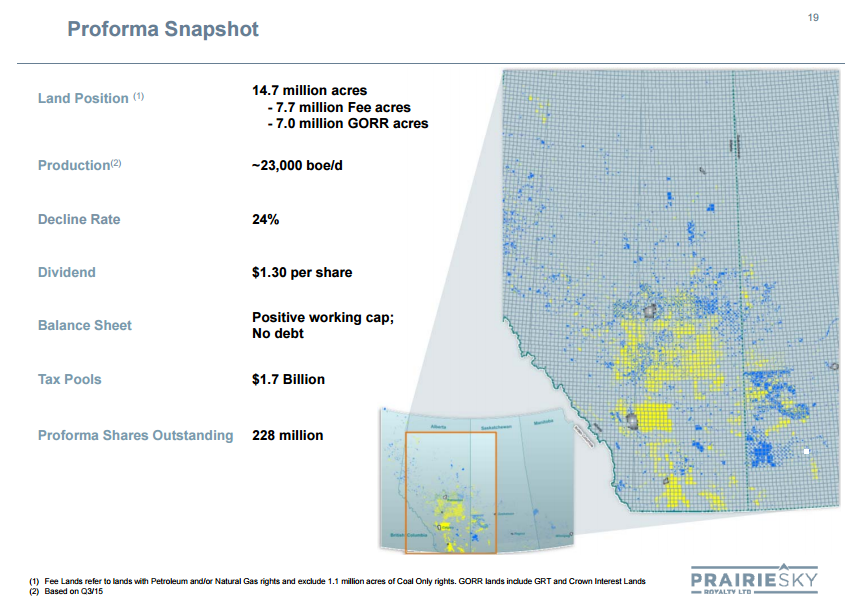

Upon the completion of the deal, the combined royalty position will be the largest oil and natural gas enterprise in Canada, according to the companies. The combined assets will have positions in Saskatchewan, where it has exposure to the Viking light oil fairway and the Bakken. In Manitoba, it encompasses the Spearfish light oil paly, and the combined entity will be the largest royalty land position in the Deep Basin fairway of Alberta and British Columbia, with multi-zone exposure to world class resource plays such as the Montney, Spirit River, Mannville, Cardium and Charlie Lake.

The Western Saskatchewan portion of Canadian Natural’s assets included 800,000 acres of fee simple mineral title lands, while the company holds approximately 3.2 million acres of royalty lands in Alberta and British Columbia, and an additional 670,000 acres of fee simple mineral title lands in Central and Eastern Alberta, approximately 60% of which is currently unleased.

The deal will also form a multi-year, multi-well drilling commitment in an area representing approximately 104,000 acres of the acquired fee simple mineral title lands in Western Saskatchewan directly offsetting a recent heavy oil discovery, which provides for near term activity and future development potential on currently unleased lands.

According to the company’s press release, PrairieSky will add $1.2 billion of COGPE tax pools, bringing the total to $1.7 billion, and reducing PSK’s 2015 cash taxes to zero while also reducing future cash taxes.

Currently there are approximately 2,000 Viking wells producing from the fee simple mineral title lands held by Canadian Natural Resources, which pay a median royalty of 17.5%, with over 2,500 risked Viking locations excluding further downspacing and secondary recovery potential.

An average royalty of 5% (average oil royalty of 9%, average natural gas royalty of 3%) is paid on over 10,000 non-unit producing wells and further diversifies PrairieSky’s production base and royalty payers.

As part of the agreement between the two companies, CNQ will shoot seismic over the 104,000 acres offsetting the recent heavy oil discovery in Wester Saskatchewan and drill up to 10 wells in the first two years of the agreement with royalty payments of 17.5%. Following the completion of that commitment, Canadian Natural Resources will have a rolling two-year rolling option to drill an additional 10 wells per option period, as long as the previous 10 well drilling commitment was completed.

Commenting on the Transaction, Andrew Phillips, President and CEO of PrairieSky said, “With this Transaction, Canadian Natural and PrairieSky have cooperated to form a true Canadian champion with a royalty land position that cannot be duplicated. With over 14.7 million acres of royalty lands, including over 7.7 million acres of fee simple mineral title (excluding coal), the combined asset base represents the largest independent oil and natural gas royalty position in Canada.”