Bill gives cabinet and environment minister final power to approve or reject a project regardless of the findings of an environment assessment

In February 2018, Catherine McKenna, the federal Minister of Environment and Climate Change, introduced Bill C-69. The bill may replace the Canadian Environmental Assessment Act of 2012 (CEAA 2012) with the Impact Assessment Act.

McKenna claimed the new act would restore public trust by increasing public participation in project reviews and create more comprehensive impact assessments by evaluating environmental, health, social and economic factors.

Environmental assessments will be required to take climate change into account if the bill passes.

Under the new statute, which is now back in the House of Commons for the third and final reading, the federal cabinet and the environment minister retain the power to approve or reject projects – regardless of an assessment’s findings.

“Environmental assessment has always been an empty shell devoid of substantive rules or standards,” said Bruce Pardy, a law professor at Queen’s University. “At a time when major pipeline projects remain in limbo, the last thing Canada needs is a more arbitrary and politically-driven impact assessment process.”

Bill C-69 would broaden the factors to be considered in environmental impact assessments of proposed natural resource development projects within federal jurisdiction, such as dams and oil and gas pipelines.

Broadening the scope may create regulatory uncertainties and delays, leading to decreased investment in energy projects and infrastructure, as was seen when Kinder Morgan shut down work on the Trans Mountain pipeline.

Lack of pipelines hurt Canada by billions

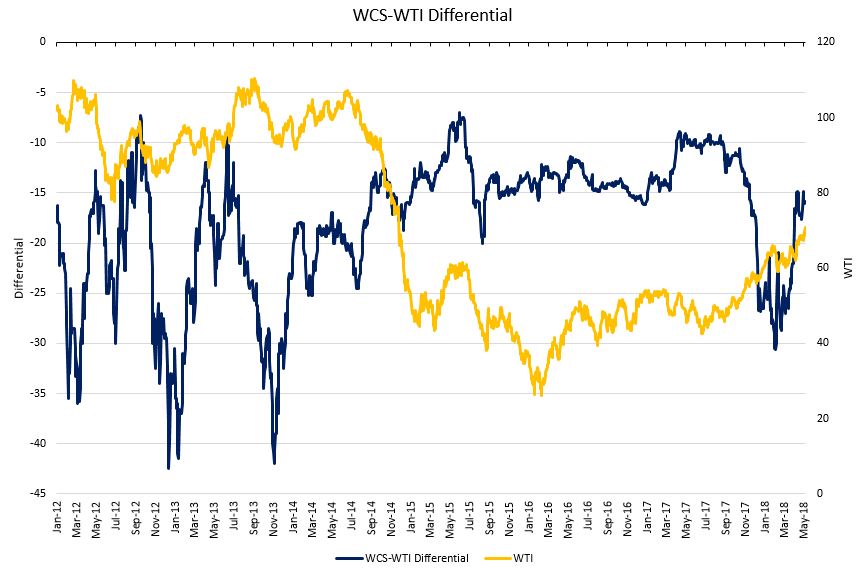

Early in May 2018, the Fraser Institute calculated the WCS/WTI price differential of US$26.30 per barrel, equating to CAD$15.8 billion in lost revenue for Canada’s energy sector.

Between 2012 and 2017, the price difference averaged US$16.54 per barrel, costing Canadian producers an estimated CAD$20.7 billion in foregone revenues.

Filled storage tanks lowers WCS price point

The inadequate transport capacity dilemma is also reflected in rising crude oil inventories in Alberta. Many oil producers have been forced to put excess production into storage tanks until sufficient capacity is available.

Based on data provided by the Alberta Energy Regulator, crude oil inventories increased by 47% between January 2013 and January 2018. Higher inventory leads to lower price points.

Given the steady growth in oil production and lack of adequate takeaway capacity, Canada requires new pipeline infrastructure to transport heavy crude production from western Canada to Gulf Coast refining hubs and overseas markets.

Trans Mountain Pipeline to be bought by the Canadian government

This week the Government of Canada said it would purchase Kinder Morgan’s Trans Mountain Expansion Project and related pipeline and terminal assets for C$4.5 billion.

“This investment represents a fair price for Canadians and for shareholders of the company, and will allow the project to proceed under the ownership of a Crown corporation. The core assets required to build the Trans Mountain Expansion Project have significant commercial value, and this transaction represents a sound investment opportunity,” Canada said in its May 29, 2018 news release.

Canada’s federal government said it does not intend to be a long-term owner of the project and will work with investors in the future to transfer assets to a new owner and/or owners.

The goal is to get the project over a wall of political opposition erected by the government of British Columbia, which opposes the transporting of oil sands production through the province and shipping it to customers abroad—citing local environmental concerns and global climate implications.