Canada’s curtailments, Cardium’s surprise: Tamarack Valley drills a record lateral for Western Canada

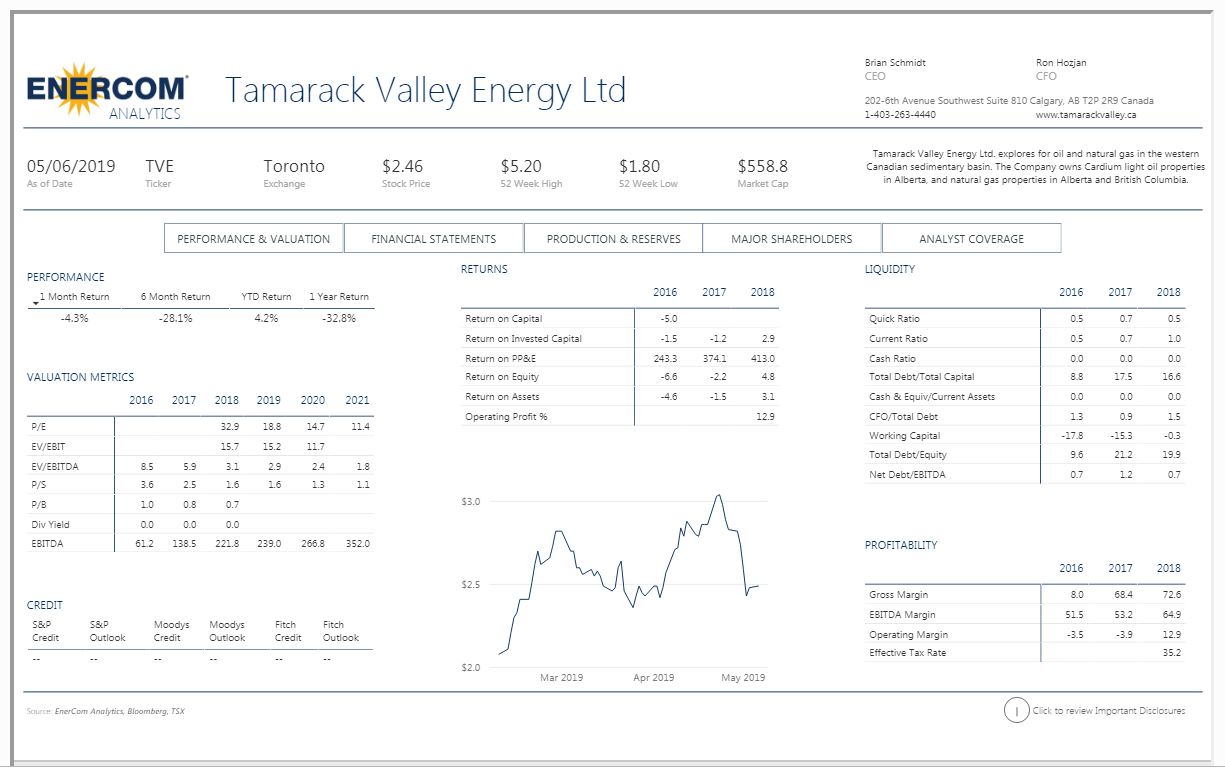

Tamarack Valley Energy (stock ticker: TVE, $TVE) is a Canadian exploration and production company with strong economics and a few nice surprises in Q1 2019. The company’s operating netbacks for the quarter were 58% higher than Q4 2018.

[contextly_sidebar id=”1oXmlMpRVV7TOjDQ15pHfTOc2Vyfhw1J”]

Oil & Gas 360® had the opportunity this week to speak with Tamarack Valley President and CEO Brian Schmidt about the direction he’s taking the company.

The Q&A from our May 13, 2019 interview is published below the Q1 summary.

Q1 2019 Financial and Operating Highlights

- Production averaged 23,149 boe/d (64% oil and NGL weighting), reflecting the Company’s compliance with the production curtailment order imposed by the Government of Alberta that came into effect on January 1, 2019 (“Curtailment Order”). Tamarack adjusted the timing of its capital investment and activity in order to comply with the Curtailment Order and as a result, five wells were brought on production late in the period and had minimal contribution to average volumes in the quarter. The Company also exited Q1/19 with 18 Viking oil wells and two Cardium oil wells that were drilled awaiting completion. Based on field estimates, current production is 24,000 boe/d in line with estimated annual average production between 23,500 boe/d and 24,500 boe/d.

- Total adjusted operating field netback (see “Non-IFRS Measures”) of $57.5 million ($0.25/share basic and diluted) in Q1/19 was 50% higher than the $38.3 million generated in Q4/18 ($0.17/share basic and diluted).

- Operating netback (see “Non-IFRS Measures”) of $30.11/boe in Q1/19 was 58% higher than the Q4/18 netback of $19.03/boe and was equal to Q1/18 primarily due to the continuation of strong realized pricing supported by the Company’s 64% oil and NGL weighting and a reduction of operating and transportation expenses.

- Net production and transportation expenses in Q1/19 were 5% lower at $10.20/boe compared to $10.76/boe in Q1/18 primarily due to increased production from the lower-cost Veteran area and a reduction in transportation expenses as a result of the recently commissioned pipeline in the Provost area of Alberta (the “Provost Pipeline”).

- Invested $71.2 million in the quarter, with 76% directed to drill, complete and equip 31 (30.2 net) Viking oil wells, 7 (6.1 net) Cardium oil wells and 2.0 net Penny oil wells. In addition, 19 (18.5 net) Viking oil wells that were drilled in late Q4/18 were completed and brought on production. The Company also drilled 18 (17.7 net) Viking oil wells and 2.0 net Cardium oil wells that will be brought on production in Q2/19, resulting in the Company being able to increase production in Q2/19.

- Completed four minor tuck-in acquisitions of assets in Q1/19 totaling $1.1 million and subsequent to quarter end closed a Viking oil acquisition for $4.7 million in the Veteran/Consort area of Alberta, adding 130 boe/d and 9.4 net sections of undeveloped Viking land. These lands are adjacent to existing Tamarack lands.

Exclusive May 13 interview with Brian Schmidt, Tamarack Valley Energy president and CEO

50%+ higher netbacks

OAG360: Brian, could you talk about the significantly higher net backs that you guys achieved in the quarter and kind of go through the factors that made that possible?

TVE CEO Brian Schmidt: There were a couple things that made that possible. Gibson’s Petroleum ran a new sales line into our Veteran Field. And that field, by the way, I want to talk a bit about this. It’s about a billion barrels of oil in place and it’s more of a conventional field than anything else. And that’s the biggest waterflood that’s been done in Alberta in three decades.

So it makes a lot of sense to bring a line down into that field and we were the anchor for it and that started up in December. So, eliminating the trucking cost and taking the crude up to that line, that affected that buy, so you saw our operating costs drop in the first quarter because of that. And that’s despite issues like cold weather. Operating costs changes, and also our G&A was down in the first quarter. So it all adds up.

Effects of the Alberta government’s production curtailments on Tamarack Valley Energy

OAG360: Could you talk about the government curtailments on production. How does the order specifically apply to Tamarack Valley? What limits does the company currently have to work with?

TVE CEO Brian Schmidt: So in the first quarter we had [a curtailment of] about 350 barrels a day of oil production. And then you’ve got to add some solution gas in that, that was curtailed. They look at your total Alberta crude production and the curtailment applies to anything over 10,000 barrels day. Now we don’t really know what the curtailment picture is going to look like for the rest of the year because the current government hasn’t stated its policy.

You may be aware that the previous government of Alberta was going to build railcars. [EDITOR’S NOTE: Alberta’s prior CEO Premier Rachel Notley proposed buying rail cars to transport oil and liquids to market in the absence of politically stalled pipeline capacity additions]. So, my guess is they’re probably trying to find a way to balance curtailment with the differentials that you need to build railcars because those differentials needed to build railcars kind of disappeared.

That’s the one of the reasons your netbacks are improved is we didn’t pay anywhere near the differentials relative to budget. Now we are forecasting differentials to increase, again, not near to where they were last fall, but I think we’re sitting at about $5 a barrel differential now. And I think in the back part of the year we’re [forecasting] more like $10.

OAG360: How effective do you believe that the government’s curtailment program has been in managing the differentials?

TVE CEO Brian Schmidt: I’m not similar to my peers on this. I was never in favor of curtailment. The reason I wasn’t is because the barrels were going to get shut in anyway—the low economic barrels—because some guys were trying to produce oil and getting paid $12. It was costing him $20 to lift it. Well that’s not going to last. And when the government announced curtailment all those guys left those barrels on because they didn’t know, they thought it would be based on existing production. So, the last thing they want to do is get this cut back and then they get cut back again with curtailment. I’m never in favor of more government influence in the market, but I was a minority relative to my peers.

In my view, I think a balance can be struck here. I think the government’s going to have to do something about the contract to build those railcars because they don’t want to go forward with it like the previous government did. I’m sure over the next couple of months there’ll be quite a bit of news coming out on that.

I think on the positive side, I think we are going to hear some news on Trans Mountain Pipeline here at the end of June. And I take that that would be a positive announcement because prior to the election I’m not sure that the government would announce a negative one.

So, I think that’s good. Now if you have Trans Mountain and railcars or [Keystone] XL and railcars or Line 3 and railcars, you’ve probably got enough here for a while.

OAG360: What do you think’s going to happen when the production limits are lifted? Is everybody just going to cut loose?

TVE CEO Brian Schmidt: I don’t think so. I think you’re seeing a lot of companies with share buybacks and things like that. I don’t think that there’s a lot of shareholder motivation to increase production and make the situation worse.

So, I just think you’re going to see some pretty strong, healthy companies. And I know in our case we’ve got rates of return that are quite good right now. And it’s just that if you turn that into increasing production, that doesn’t go over so well. But if you turn it into paying down debt [that’s a positive]. In our case, we don’t have really much debt at all. If you turn it into share buybacks it seems to go well.

Tamarack’s Cardium surprise

OAG360: Brian, could you talk about what Tamarack Valley did in the Cardium?

TVE CEO Brian Schmidt: Here’s the thing. If someone said, “Well, what was your biggest achievement? What was new that you didn’t expect in Q1?” It was probably our achievements in the Cardium:

- We’re down to about 20 to 25% on cost

- We went to drilling techniques that allow us to drill faster

- On the completion side, we’ve done some cost reduction with the service provider and that’s worked out real well. So that’s probably the biggest achievement.

- We moved a whole bunch of inventory that was in around the two year payback past our cutoff into, around one and a half year payback for inventory.

- And we moved that into 1.3 with that cost reduction, so that’s a very significant achievement there on the Cardium.

Tamarack Valley drilled the longest lateral horizontal for any well under 2,000 meters vertical depth in Western Canada

OAG360: Brian, you’d mentioned in the Q1 press release moving to three-mile laterals in the Cardium. What’s the background on those and what do you think the timing is for drilling some of these “superlaterals.”

TVE CEO Brian Schmidt: With the longer laterals you’re going to be restricted somewhat on geometry. And so we can do those in some areas and not in others. It just, in this particular case we are going under a lake and so we needed the reach and we’ll do those where we can, we’ll see. We’ll see what happens with the production on these. They are slower to clean up, you know, because the heel of the well starts producing the oil and the toe of the well isn’t even cleaned out yet. So, there’s some learnings going on there with that kind of well. And so, we’ll see how that turns out at the end of the day. But from an execution standpoint, that was a real achievement, being able to do that.

[NOTE: Tamarack Valley Energy will present updated operational and financial data on these topics at the upcoming 24th EnerCom The Oil & Gas Conference in Denver – Aug. 11-14, 2019]

That is the longest lateral horizontal for any well under 2000 meters vertical depth in western Canada. It’s a tremendous feat.

We had to do some real tricks, things like getting casing to bottom. How do you do that? You don’t have enough weight on top to push it around the bend, right.

And then how do you frac it with coil tubing, you know, it’s incredible. It’s pretty neat how they did it. For example, you know, making your casing buoyant, you know, pumping the inside of the casing with air so you can get at the bottom. It’s incredible.

Veteran waterflood – tapping into 100 million barrels from a billion-barrel oilfield

OAG360: Did you have anything further on the Veteran waterflood?

TVE CEO Brian Schmidt: In terms of scope, let me give you some perspective on the scope this projects brings to Tamarack Valley Energy.

That’s a billion-barrel oilfield. And we’re expecting about 10.5% recovery. So, round numbers, that’s a hundred million barrels of oil.

My whole company reserves are 105 million barrels BOE, to give you some perspective.

And then I get asked the question, “Well, how does that affect your inventory? Because you’re going to slow declines.” Well, if I just said, well, a hundred million barrels, how many wells would that be if it was 50,000 a well, that’s the same as having 2,000 wells and that’s coming in at $5 to $6 Canadian per barrel on reserve costs.

You’re kind of back to conventional. It is a conventional field because it’s about 200 millidarcies permeability versus about a half to 2.5 millidarcies in the upper. And in terms of decline rates just based on the $30 million we spent last year, we will slow corporate decline 4%.

On tap for the rest of 2019

OAG360: How would you summarize Tamarack Valley’s objectives for the balance of 2019?

TVE CEO Brian Schmidt: I’m so excited about our business right now, because we decided in the first half, we drilled about a third of our wells for the year in the first half and we have two thirds [scheduled] in the back half.

And we decided to put a fair bit of money into waterflood. We spent $30 million last year and then $20 million this year. And I would say the planning on that is going very well. We ramped up injection in February, from 2000 barrels a day up to 12,000 barrels a day injection. And on the injection side, we’re getting the rates we wanted to get.

In fact, the wells are actually taking water a little better than we thought.

So, I think based on that, what we’ve been telling the market is that, “Listen, I put no waterflood upside in my production forecast. And yet I’ve anchored the capital and I’ve got a great capital efficiency even with waterflood capital. So, it’s a free option and there really is no risk. There is uncertainty, but there’s no risk. And this waterflood we’ve got is in a proven area, so everything there is going according to plan.

Go ahead and look under the hood: TVE economics speak for themselves

And so then you look at capital efficiency, it’s getting much better, our netbacks are getting better. For the last four or five years operationally, if you look at the company’s performance, people that take the time to look under the hood are going to be real pleased with how this company is performing right now.