Calgary’s Canacol Energy Ltd. (ticker: CNE) recorded a net loss of USD$148 million for the year ended December 31, 2017, or $(0.48) per share – this compares to a net income of $23.6 million for the same period in 2016. For Q4 2017, the company had a net loss of $150.3 million, or $(0.85) per share – this compares to a net income of $20.3 million in Q4 2016.

According to the company, the net losses in the three months and year ended December 31, 2017 were mainly driven by non-cash impairment charges related to the corporation’s assets held for sale, non-cash impairment charges recorded as a result of relinquishment or planned relinquishment of certain exploration blocks, non-cash depletion and depreciation charges, non-cash stock based compensation expenses and non-cash deferred income tax expenses.

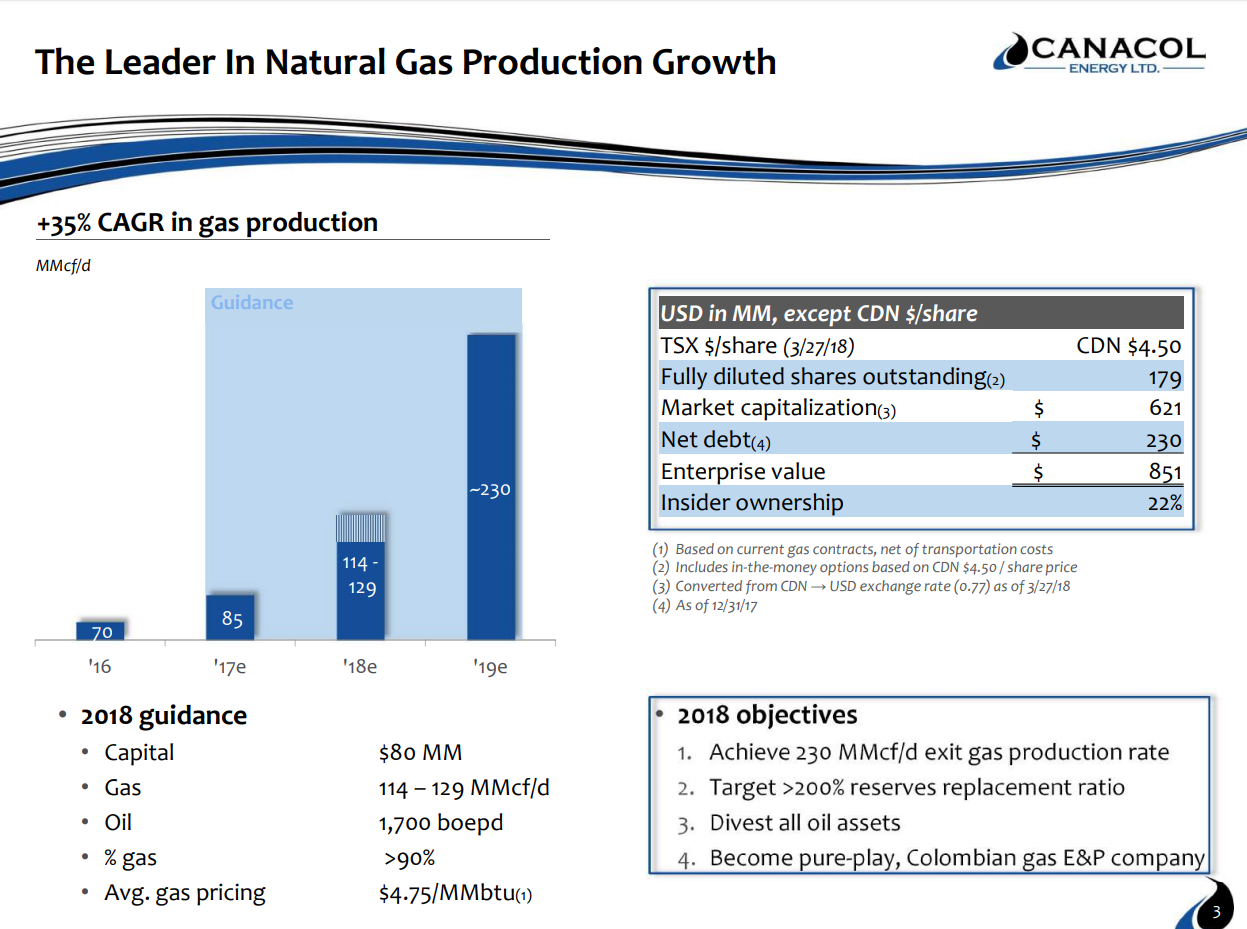

Net capital expenditures, including acquisitions for Q4 and 2017, were $41.7 million and $121.2 million, respectively. In 2017, Canacol increased average production volumes 7% to 17,080 BOEPD.

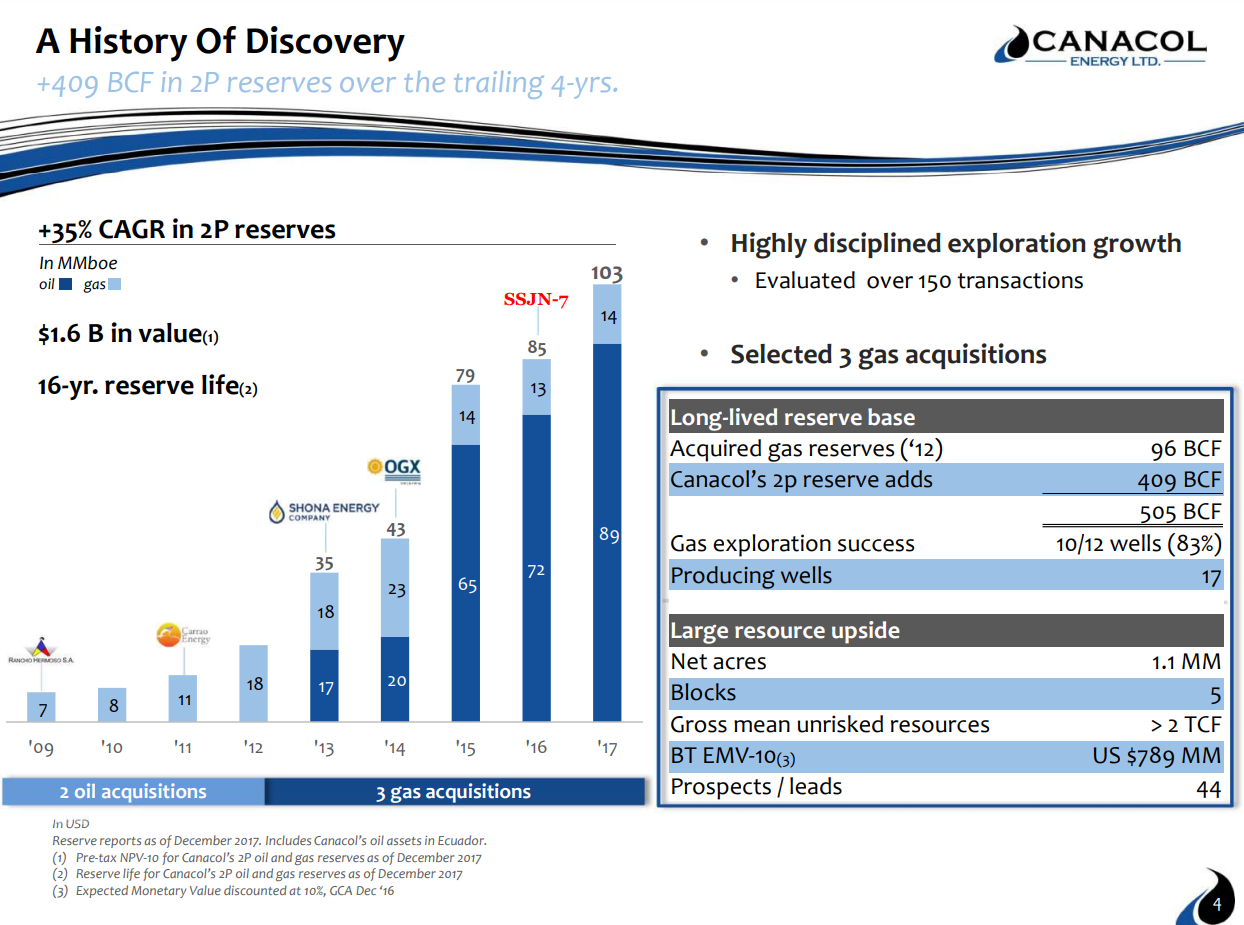

President and CEO Charle Gamba commented, “In 2017, the corporation executed the construction of the Sabanas gas flowline which has increased gas sales to current levels of approximately 120 million standard cubic feet per day (MMscfpd), executed a successful exploration drilling program which increased 2P reserves by 21%, refinanced our debt which lowered our average interest rate and extended the first amortization payment of the new loan into 2019, divested our non-core oil producing assets in Ecuador for $36.4 million and sold all of our shares in Interoil as of March 23, 2018, resulting in an overall realized cash gain of $3.8 million on our original $3.2 million investment.”

2018 goals

- Sell an average of 114 to 129 MMscfpd of gas and 1,700 BOPD

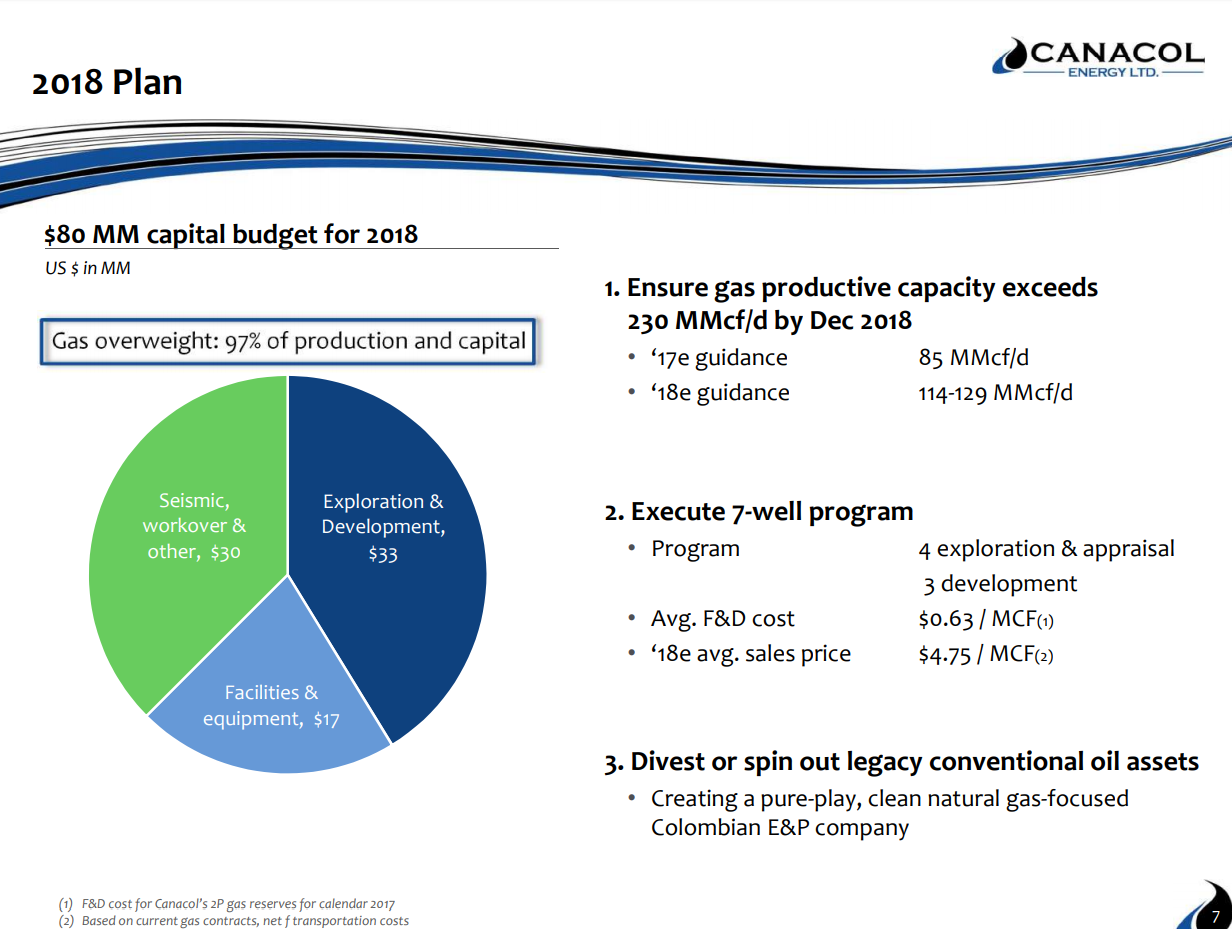

- Execute the necessary investments in drilling, facilities and flowlines to ensure that the productive capacity of the corporation is greater than 230 MMscfpd by December 1, 2018

- Execute a four well exploration and appraisal drilling program to build reserves

- Divest non-core Colombian conventional oil assets to focus on the exploration and commercialization of significant Colombian gas reserves and resource base

Approximately 97% of the $80 million budget for 2018 is dedicated to spending on the corporation’s gas assets, with the remainder on its oil assets. The capital program will be fully funded from existing cash and cash flows. One of the planned appraisal wells, Pandereta-3, was spud on January 12, 2018.

The Pandereta-3 appraisal well encountered 103 feet true vertical depth of net gas pay within the Cienago de Oro (CDO) sandstone reservoir and flow tested at an absolute open flow rate of 168 MMscfpd from the upper part of the CDO in February 2018, confirming a significant new gas discovery on the VIM-5 block, Canacol said.

The company has contracted a single drilling rig which it intends to use to execute its exploration and development drilling program for the remainder of 2018. The remaining gas exploration wells planned for 2018 include the Breva-1 exploration well on the VIM-21 contract, and the Borojo-1 and Canahuate-Este exploration wells on the Esperanza contract.

The remaining development wells are the Chirimia-1 well located on the VIM-5 contract which spud in early March 2018, and one other infill development well yet to be determined to be spud prior to mid-year 2018.

Canacol anticipates that its exploration and development drilling programs will be completed by the third quarter of 2018. The objective of the 2018 drilling program is to lift the productive potential of its existing and new well portfolio beyond the 230 MMscfpd required by December 1, 2018, the company said.

Additionally, Canacol expects to award a contract to build and install a new gas processing module at its Jobo gas facility to process an additional 100 MMscfpd of gas, which will raise the gas treating capability to 300 MMscfpd by December 2018. Canacol said it will purchase and operate the new gas processing module.

Reserves

Conference call Q&A excerpts

Q: I have a question in regards of the impairments you registered this quarter, is it because we have seen this as a trend in the company when big impairments derived in big deficits in the equity that actually when you look at the numbers here with [indiscernible] (00:24:00) you see that the deficit has increased from $385 million to $533 million, and that has put a pressure in the equity from $376 million to $239 million. So what can we suspect in the way the company is managing these kinds of impairments?

My second question is regarding the remaining adjustments we can expect from these divestments. Can we expect further impairments during this year and how can be these accounted in the moment of the investments are materialized. Can we expect maybe a profit from the divestments?

CEO Gamba: So obviously a write-down is driven. Every quarter, every company is forced to or is required to compare their carrying value to the fair value of the assets on their balance sheet. Obviously, this quarter’s impairment includes… the Colombian oil assets as they’re held for sale, conventional oil assets that are held for sale and the Ecuador assets.

So Ecuador, we have sold that, so it’s simply written down to the price that we received. With respect to the Colombian conventional oil assets, we wrote it down to a price that we felt is likely the fair value range in which we expect to receive.

With respect to what could further come in terms of write-downs, at this point in time there’s only roughly $40 million of oil assets left on our books with respect to the conventional oil assets, so obviously we wouldn’t expect anything further to that.

And then, if you turn your attention to our gas assets, our three-year F&D costs are $0.50 in Mcf, which implies obviously a very low capital asset base that was spent with respect to the fair value where we’re selling our gas for $4.75 and netting back 80% of that. So one wouldn’t expect any gas write-downs at any point in time.

The second question I believe was related to equity and potential dilution. The last time we issued shares was in 2015 or 2016 to a large strategic investor, so I think it’s been well over two years since we have issued any equity. And given that the company has abundant cash flow and $70 million cash on the balance sheet, I don’t foresee us issuing any equity…

Q: Can you talk about your drilling program?

Gamba: We just completed the drilling of the Chirimia-1 well. We’re just about to just finish logging, preparing to run casing, and testing that well. And, yeah, we do have two placeholders in Q3 for two infill development wells which we’re contemplating in the Nelson field and the Canahuate field.

And as we go through our exploratory drilling program between now and then, which include two exploratory wells – Breva and Borojo – which we will be completed the drilling of this summer, we will evaluate the results of those wells in the context of whether we do or do not need to drill additional infill wells this year.

I might add however that although the well productivity of these reservoirs is very high, these wells are capable of producing between 20 million and 30 million cubic feet per day from an individual zone. We do prefer to produce the rate of the wells at a lower rate, between 10 million and 14 million cubic feet per day, simply to minimize the amount of pressure drive-down and to extend the reserve capture of these wells.

So although these wells test at very high rates and are capable of producing at very high rates if we choose, we prefer to produce them at a lower rate in order to maximize the reserve recovery from these. But we will, after the completion of the drilling program of Borojo and Breva, we will kind of make a call as to the remainder of the drilling program for this year, especially those two development wells.