Did Cheniere Squeeze through a Closing Door?

Carl Icahn has followed up his August purchase of 19.4 million Cheniere Energy (ticker: LNG) shares by purchasing another 3.3 million shares, increasing his stake in the company to about 9.59%. Icahn’s group was awarded two seats on the board upon its purchase last month and has now invested approximately $1.2 billion in the company who is pioneering the liquefied natural gas (LNG) market.

In the filing confirming the first purchase, Icahn’s firm reasoned that Cheniere’s stock is undervalued and critics believe his influence could more closely align Cheniere’s management with its shareholders. Public chatter about Cheniere has escalated in recent months as the company nears the milestone of generating its initial production of LNG from Sabine Pass, which is still on track to commence late this year.

Can Profitable LNG Actually Work?

The patience, staggering investments and long-term uncertainty of LNG projects have been a staple of its critics for years. “There is always so much talk about these big LNG projects around the world, but only a small fraction of them will get built,” said Matthias Bichsel, Director of Projects and Technology for Royal Dutch Shell (ticker: RDS.B). “Costs in the oil and gas sector are still on the rise and outpacing inflation, and gas projects are extremely price-sensitive because the margins are so thin.”

Take note that Bichsel’s comment was made in June 2014 – five months before oil’s nosedive. Click here for a list of LNG and regasification projects that have been suspended or even cancelled in the new commodity market, courtesy of Global LNG Info.

Additional factors have surfaced as of late, including questions about China’s market stability and Japan slowly restarting its nuclear program. The headwinds prompted Jim Chanos, another hedge fund manager, to short his Cheniere stock and even label the industry a “looming disaster” in an interview with CNBC. “LNG was seen as a savior for a lot of natural gas plays,” he explained in the interview last week. “The problem is, everybody figured this out at the same time… LNG demand isn’t growing any more. We already have excess capacity and we’re about to double it in the next four years.”

How Cheniere is Different from the LNG Pack

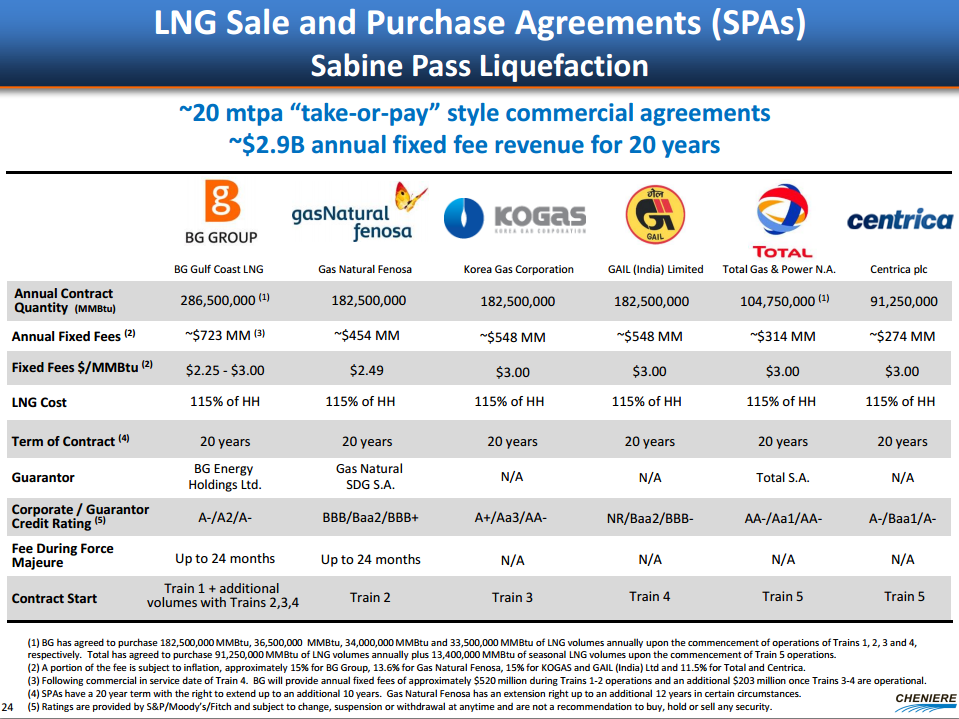

Icahn has yet to comment on his decision that directly opposes Chanos’ view, but analysts like Will Frohnhoefer of BTIG, LLC, believe Cheniere has some differentiators in its back pocket. The company has established several long term contracts (most consisting of 20 years) with its consumers for the rights to its terminal, which creates a much different scenario than overseas competitors that leave their customers vulnerable to commodity swings. Consumers with ties to Cheniere can take or leave the LNG prices, depending on the market environment.

“What Cheniere is offering is not really LNG per se, it’s an option to take LNG,” Frohnhoefer said in an interview with Bloomberg, adding that the structure can help Cheniere avoid renegotiating contracts like its peers. “So they’re selling a hedging instrument allowing companies to buy it or not, depending on the price.”

Frohnhoefer explains that, with an average blended price of $2.75/MMBtu and about 20 million tons per annum of utilization, Cheniere will still generate $1.8 billion of income annually on the low end of expectations. “I believe Cheniere will be able to get that price, that capacity fee, year-in and year-out for the next 20 years regardless of where the commodity price moves,” he added.

Headwinds Are Good – Souki

Charif Souki, President and Chief Executive Officer of Cheniere Energy, has heard it all since his venture first began in 2012

“Headwinds are good – if it were easy, everybody would do it,” he said in an exclusive interview with Oil & Gas 360®. Souki credited the United States shale boom with the approaching LNG market, even though his own company and its investors have invested billions in the massive endeavor.

“It has nothing to do with us, it has to do with the wonderful capacity of producers in this country,” he said, adding the extensive infrastructure in place increases its efficiency and gives Cheniere a competitive advantage. “Our costs are $600 to $700 per ton compared to other places that are $2,500 to $3,000 per ton, so we have a very significant advantage.”

In the breakout session, Souki did not address a question about the day Cheniere reaches free cash flow, but did mention its near-term revenues, saying: “With our 31 million ton per annum platform, we have secured our cash flow come hell or high water. Now that we have that platform, we can start to diversify.”