Another 560 MBOPD production growth in 2017

The Permian has experienced massive production growth this year, adding more than 560 MBOPD with no signs of slowing down.

Companies in the Permian expect to grow even more next year, further cementing the basin as the premier U.S. shale play. This relentless growth has led investors to wonder, what, if anything, can slow the Permian down? Argus examined this very question in a webinar today, looking at the state of the basin now and what concerns are facing it in the near future.

Lower oil prices, well quality, equipment costs can all slow down growth

The most obvious impediment to further Permian expansion is the price of oil. The spread between WTI and Brent is widening, and is currently above $5/bbl. Such a difference is quite meaningful when it represents more than 8.5% of the total price of oil, and discourages expanded U.S. production.

Another major factor for the price of oil remains the OPEC production cuts. While OPEC, Russia and several other producers agreed to cut output through the end of 2018, the production cut end remains a major unknown. OPEC and its allies have taken some 1.7 MMBOPD off the market, but do not intend to stay at reduced production levels forever. Quickly restoring production may amount to another OPEC attempt to force the Permian out, dampening growth in the region.

Concerns about Permian well quality also came to the fore during Q2 conference calls. Permian wells are not behaving as expected, with GORs above projections. This has led some to fear that companies do not quite understand the acreage they own, throwing well productivity forecasts into doubt. If wells fail to deliver over their lifetime, expected Permian growth will not materialize.

The massive surge of M&A activity that characterized the Permian from late 2016 to mid 2017 has died off, as the Permian saw only $1.48 billion in M&A deals in Q3 2017. Most companies that want a position in the Permian already have one, and the high prices charged for acreage currently have deterred more big deals.

The costs of drilling a well in the basin are also increasing, and the availability of quality manpower and equipment is still limited. One major Permian operator, Jagged Peak, discussed this problem in their most recent earnings call. Company Chairman, CEO and President Joe Jaggers noted that less experienced crews and unreliable frac equipment caused delays in completing wells. Jagged Peak could make up the delays by hiring spot crews, but the incremental costs of such fleets are nearly $1 million per well, making such an option very distasteful. Problems like this will likely continue until service companies are able to catch up with the massive growth in drilling.

Over 540,000 BPD of additional pipeline capacity planned/in progress

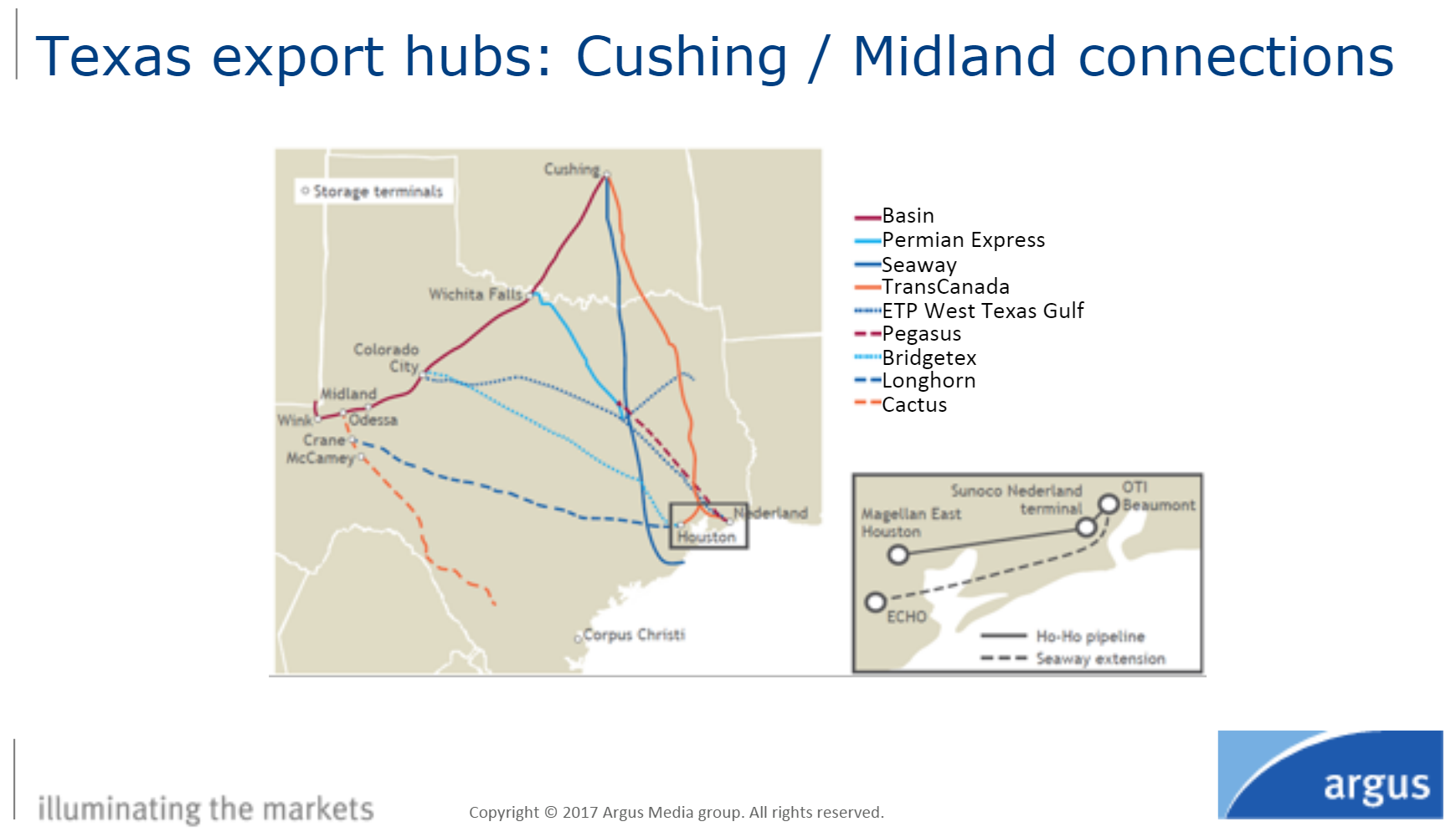

One thing that likely will not be a problem for producers is takeaway capacity. Many companies are planning Permian-to-Houston pipelines, either expanding current lines or constructing new ones. Enterprise Production Partners, for example, has expanded its Midland-to-Sealy pipeline, which can now transport 450,000 BPD. The line began service this month, and is expected to be in full service in Q2 2018. Enterprise also announced today that it will convert one of its NGL lines to carry crude oil instead. This will give the firm an additional 200,000 BPD of crude capacity.

Plains All American and Magellan have expanded their Bridgetex line by 100,000 BPD already this year, and are considering adding another 40,000 BPD of capacity. Energy Transfer Partners is currently expanding its Permian Express pipeline by 100,000 BPD, and is also weighing further expansions. Additional pipelines are planned for Permian-to-Corpus Christi routes, where operations are underway to allow supertankers to load and unload oil. American Midstream Partners, Plains and Phillips 66 are all expanding gathering systems in the Permian itself, so getting oil to markets should not be a problem.