Consolidation continues in the Permian, with Callon Petroleum (ticker: CPE) purchasing $570 million in assets Thursday.

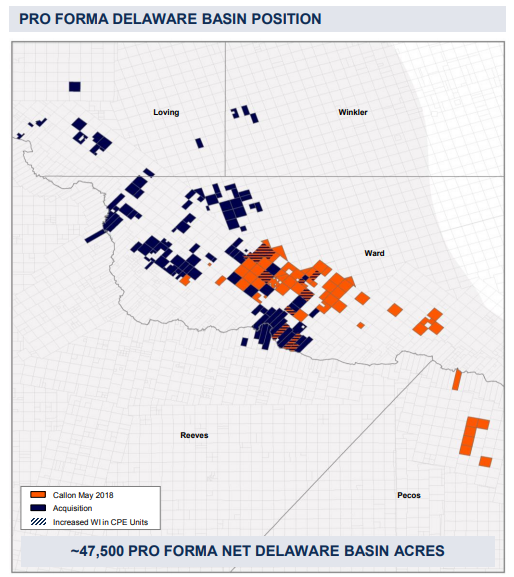

Callon intends to acquire 28,657 net acres in the Delaware, primarily in Ward and Loving Counties, from Cimarex Energy (ticker: XEC). This acreage is partially contiguous with Callon’s assets in the Delaware, and is all at least nearby. Over 90% of the new acreage is held by production, so Callon will be able to develop it as it sees fit.

The assets are currently producing 6,381 BOEPD, 73% of which is oil. Callon estimates the acreage contains 212 delineated horizontal locations, with additional potential from adding benches. Callon has specifically targeted the Second Bone Spring and Wolfcamp C as potential upside, as offset operators are testing the benches with nearby wells.

With a purchase price of $570 million, Callon paid just under $19,900 per acre. After adjusting for production, the acreage is valued at $11,550. This is well below prices paid for Permian acreage in early 2017, and also falls well below the $65,650 per acre Concho paid when it acquired RSP Permian earlier this year. Callon said it intends to fund the cash purchase price with an equity offering, cash on hand and/or by incurring long-term indebtedness.

Overall, Callon’s aggregate Permian Basin position will include approximately 86,000 net acres concentrated in four core operating areas within the Midland and Delaware Basins.

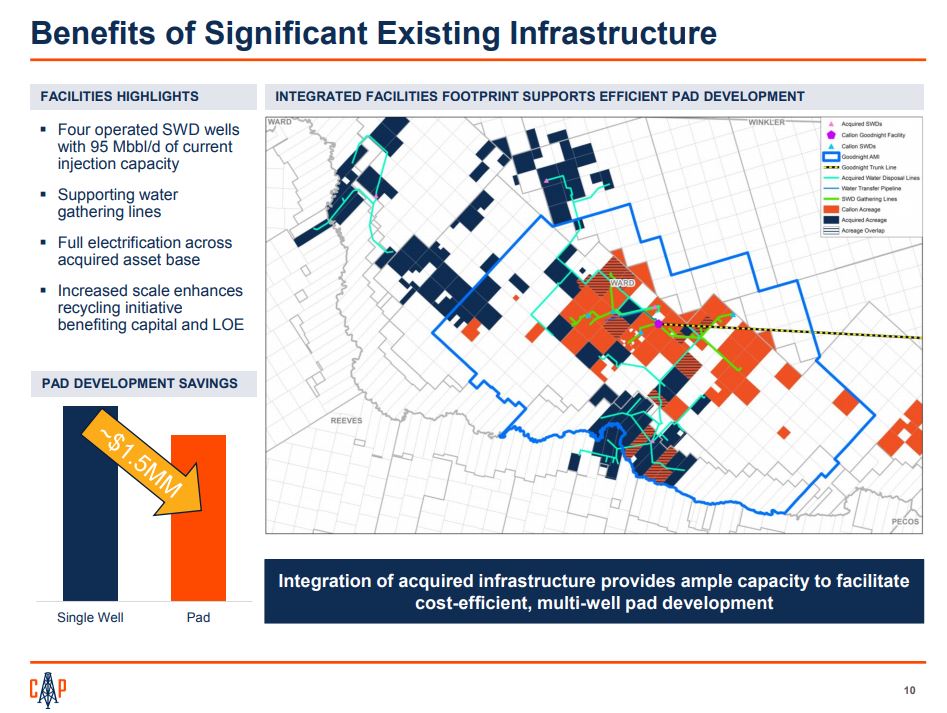

Callon President and CEO Joe Gatto said, “Given the location of the acquired position and associated established infrastructure, we are positioned to benefit from increased lateral lengths on the combined position as well as scale benefits from larger pad development concepts.”

With the acquisition, Callon expects to end Q4 2018 with an exit rate of over 40 MBOEPD and the acquisition is expected to close on or before September 10, 2018.

Cimarex is not selling its entire Permian position, and is retaining its core focus areas in Culberson and Reeves Counites. The company reports that the sold acreage was not expected to receive significant capital.