3% production growth despite no new wells

Cabot Oil & Gas (ticker: COG) announced first quarter results today, showing net earnings of $117.2 million, or $0.26 per share. After adjusting for hedging and other non-recurring items, Cabot earned $128.5 million, or $0.28 per share. Both of these earnings are the highest recorded by the company since before the downturn, and further growth is expected.

Cabot reported only modest production growth this quarter, with output of 1.84 Bcfe/d. Virtually all of this production came from the company’s Marcellus acreage, which produced 1.82 Bcfe/d, representing 3% sequential growth. This minor growth is actually remarkable, as Cabot did not place any wells on production in the quarter.

The company reports the lack of new wells is due to larger pad sizes in Q1, additionally Cabot’s second completion crew did not come online until February. New wells are on the way though, and Cabot expects to bring 20 net wells online in Q2 and 60 in the second half of 2018. This activity is expected to generate about 20% production growth this year after adjusting for divestitures.

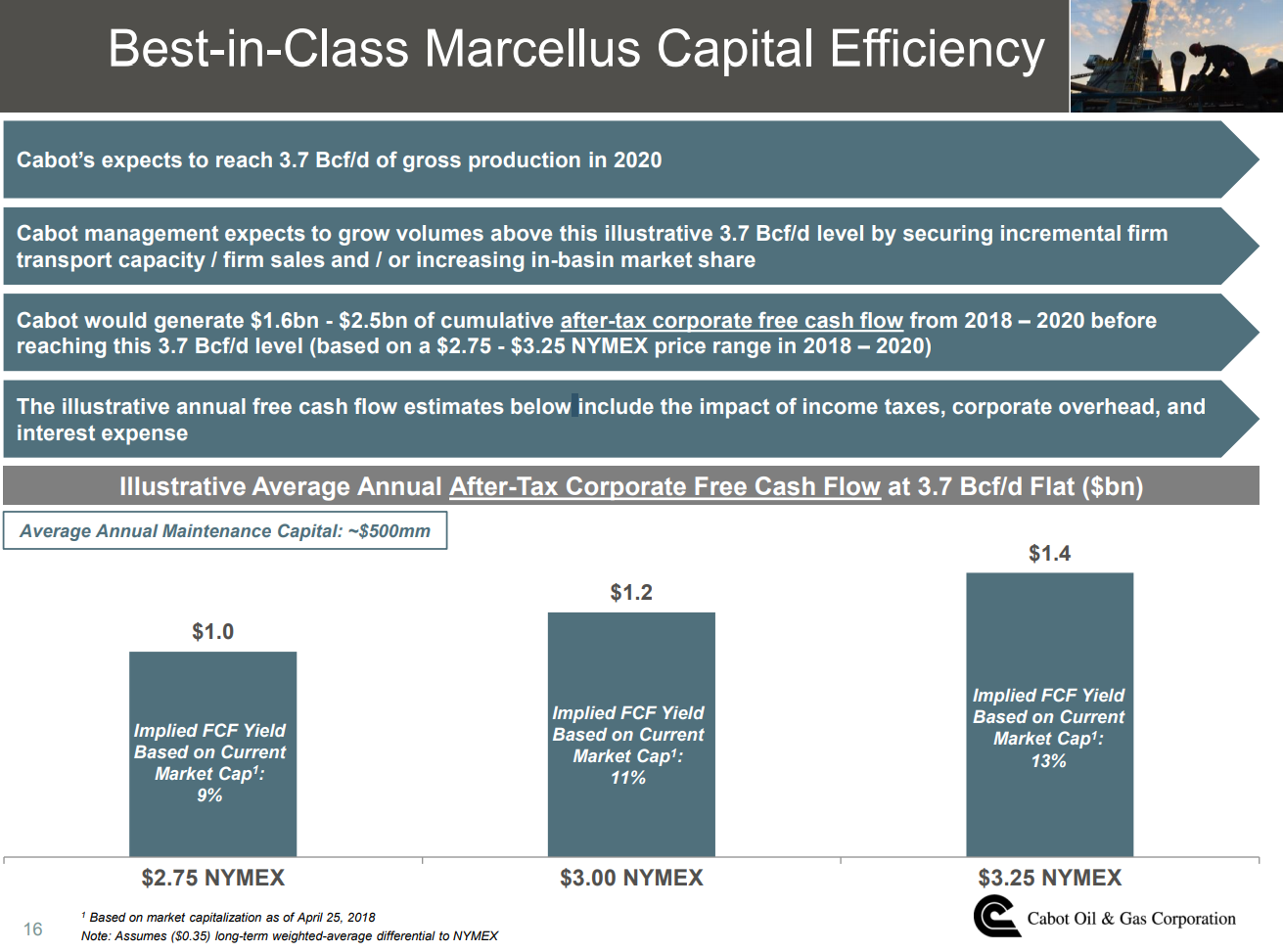

Cabot has ambitious longer-term plans, and intends to reach 3.7 Bcf/d of production in 2020. This implies approximately doubling production in the next three years, and would give the company a strong foundation to generate free cash. Cabot estimates that it will generate about $2 billion in after-tax free cash flow from 2018-2020, and would be in a position to produce even more after reaching its production goal. The company predicts it will generate $1 billion in annual after-tax cash at $2.75 gas when it is producing 3.7 Bcf/d.

COG comparison to all sectors

Cabot also offered an unusual comparison in its conference call slides, showing a peer comparison rarely seen among E&Ps. While independents commonly compare various metrics to other oil and gas producers, this is typically the only style of comparison given. Cabot, by contrast, has compared several metrics to different sectors in the overall S&P 500 index. Cabot’s return on capital employed, estimated earnings per share growth and EV/expected 2019 EBITDA appear very competitive with other sectors of the economy, so making the comparison is understandable.

Cabot Chairman, President and CEO Dan Dinges commented on the results, saying “We continue to believe our combination of growth in discretionary cash flow, free cash flow, production and reserve per debt adjusted share growth, improving returns on capital employed and increasing returns of capital to shareholders is unrivaled in the independent E&P space.”

“Despite recent headwinds in the form of negative sentiment around the outlook of natural gas, we have just as much conviction today in our ability to deliver on our top tier financial metrics from our three-year plan as we did when we rolled the plan out last October.”

“As we mentioned, over the last year, we took numerous steps to high-grade our company’s asset base and further enhance our cost structure. These strategic moves have positioned us as the low-cost natural gas producer in the United States and should allow for continued success throughout all of the natural gas cycles.”

Q&A from COG conference call

Q: I know you guys didn’t bring on any incremental wells during the quarter, but do you just have a general update on some of the Gen 5 well performance versus wells that may be brought on in the last couple of quarters?

COG: Leo, there is no concern with any of the production curves that we’ve seen with our Gen 5. We were comfortable with the information we provided so far and our expectations of being met with the flow volumes that we see.

Again, you have to keep in mind that to be too specific way early in a production – in a curve fit is problematic and not as accurate of information as it would be if you’d have a year, year-and-a-half or so of production. We bring our wells on slow up there. And so to be able to look at the curve fit out months and months is the appropriate way of evaluating it. But so far, we see no issues.

Q: All right, that makes sense for sure. And I guess can you maybe talk a little about sort of where the current well costs are there in the Marcellus? And kind of whether or not you’re seeing any cost pressures that might move those around? And obviously there may be some efficiency gain as well. Can you just kind of talk about the cost dynamics you see up there in Appalachia?

COG: We’re completing these wells plus or minus $1,000 a foot, lateral foot. And that’s kind of the ZIP code we’re in right now.

Q: How would that translate into sort of overall well cost?

COG: Say, as an example, our average is around 8,000 foot lateral, a little bit more for our 18 wells. And our well cost is about $8 million.

Q: The exploration program wasn’t really mentioned in the use of proceeds and/or meaning use of excess cash flow. How do you think about that in a success case? Say, how many years or how much funding are you willing to kind of push towards moving an exploration program into the development mode? Like, how does that process look in your eyes? And how quickly do you push it to something that’s sustainable on its own? Just any commentary on that will be helpful.

COG: Yeah, I’ll restate again what I’ve said in the past. Any investment we make has to have a return that we think is somewhat competitive with our Marcellus. We anticipate staying with our current strategy of delivering growth, both on production and reserve growth on debt adjusted share basis.

We are intent on delivering a return, increasing return on our capital employed. We like the idea of our yield model on increasing our yield on our free cash flow. And we’re going to be focused on that also. So any project or allocation of capital is going to have to have a component that within a reasonable period of time – and as I’ve stated in the past, a reasonable period of time would be a couple of years or so, that we would be able to identify assets that would deliver that type of return and also be able to fit within our overall strategy and again, a reasonable period of time of delivering on all of those objectives.