Cabot bumps Marcellus EURs 16%

Cabot Oil & Gas (ticker: COG) reported its fourth quarter and year-end numbers Friday, posting higher than expected production for the three months ended December 31, 2016. The company produced 1.79 Bcfe/d, about 2% above guidance. Full-year production reached 627.1 Bcfe, consisting of 600.4 Bcf of natural gas, 4,013.1 MBO of crude oil and condensate, and 441.2 MBO of natural gas liquids (NGLs), according to the company’s press release.

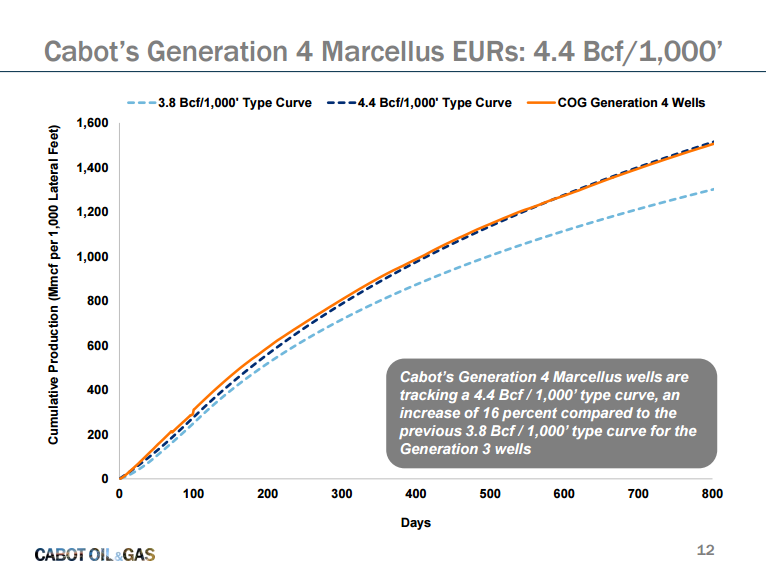

The company reported increased Estimated Ultimate Recoveries (EURs) in its Marcellus acreage, helping to drive production higher. Based on Cabot’s year-end reserve bookings for 21 producing Lower Marcellus wells that were completed with the company’s fourth generation completion design, Cabot has increased its guidance for Lower Marcellus EUR per 1,000 feet of lateral from 3.8 Bcf to 4.4 Bcf, or 16%.

“The EURs for our fourth generation wells further highlight the peer-leading productivity from our Marcellus assets in the core of the dry gas window in Northeast Pennsylvania,” said Cabot Oil & Gas President and CEO Dan Dinges. “Based on our current well design and current commodity prices, we believe our project-level economics in the Marcellus are unrivaled across North American resource plays; however, we continue to test new initiatives to further enhance our economics.

“Based on our current outlook for 2017, we anticipate another year of production and reserves growth while generating positive free cash flow,” he added.

Cash flow from operations in the fourth quarter of 2016 was $139.7 million, compared to $155.8 million in the fourth quarter of 2015, according to Cabot. This equated to a net loss for the quarter of $292.8 million, or $0.63 per share, compared to a net loss of $111.1 million, or $0.27 per share, in the fourth quarter of 2015.

Cabot locks in the majority of its well costs for 2017

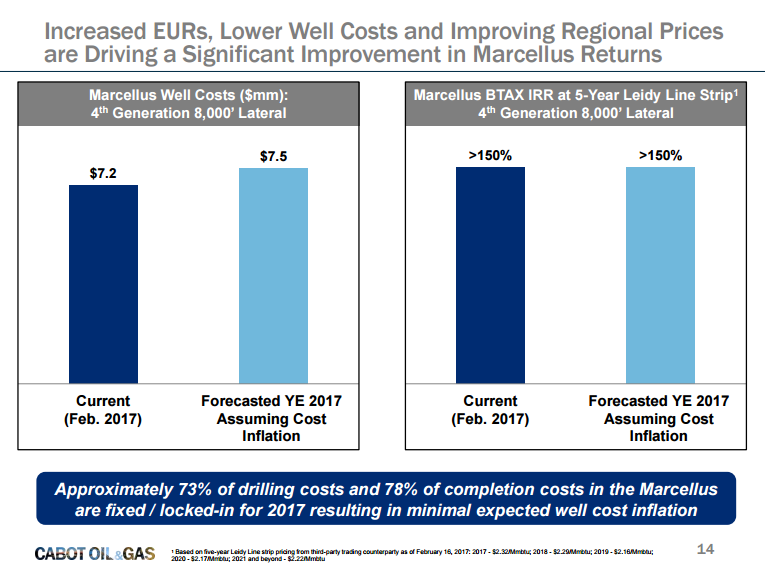

Cabot also announced as part of its quarterly earnings that the company has locked in 73%-78% of its drilling and completion costs in the Marcellus for 2017. Many E&P companies are concerned about rising oil service costs, but Cabot has worked out contracts in the Marcellus to limit well cost inflation, the company said.

Cabot increases 2017 capex budget

Cabot Oil & Gas reiterated its 2017 production growth guidance range of 5%-10% and initiated crude oil production growth guidance of 15%, which represents a substantial increase from the 0% oil growth contained in the preliminary 2017 budget issued in October 2016.

Based on the expectation for higher operating cash flow due to an improvement in the commodity price outlook, the company is increasing its exploration and production capital budget from $575 million to $650 million, or 13%. This incremental capital will fund additional drilling and completion activity, primarily in the Eagle Ford, the company said in its release.

“Cabot has seen a significant improvement in project-level returns in our Eagle Ford asset due to increased productivity from enhanced completions, continued cost reductions, and higher crude oil prices,” said Dinges. “Accordingly, we plan to allocate additional capital to this asset to grow exit-to-exit crude oil volumes by 50% in 2017.” Dinges added, “Even with this modest increase in capital for 2017, we are forecasting approximately $250 million of positive free cash flow for the year based on recent strip prices.”