Marcellus acquisitions increase IRRs from 9% to 37% at $2.50 MMBtu gas prices

EQT Corporation (ticker: EQT) released its third quarter earnings results today, reporting a loss of $0.05 per diluted share compared to a net income of $0.27 per share for the same period last year as the oil and gas industry continues to face an oversupplied market. EQT realized fewer gains from derivatives not designated as hedges, the company said in its press release. While the company reported a loss today, during its conference call management stayed focused on the company’s continued growth despite current market conditions.

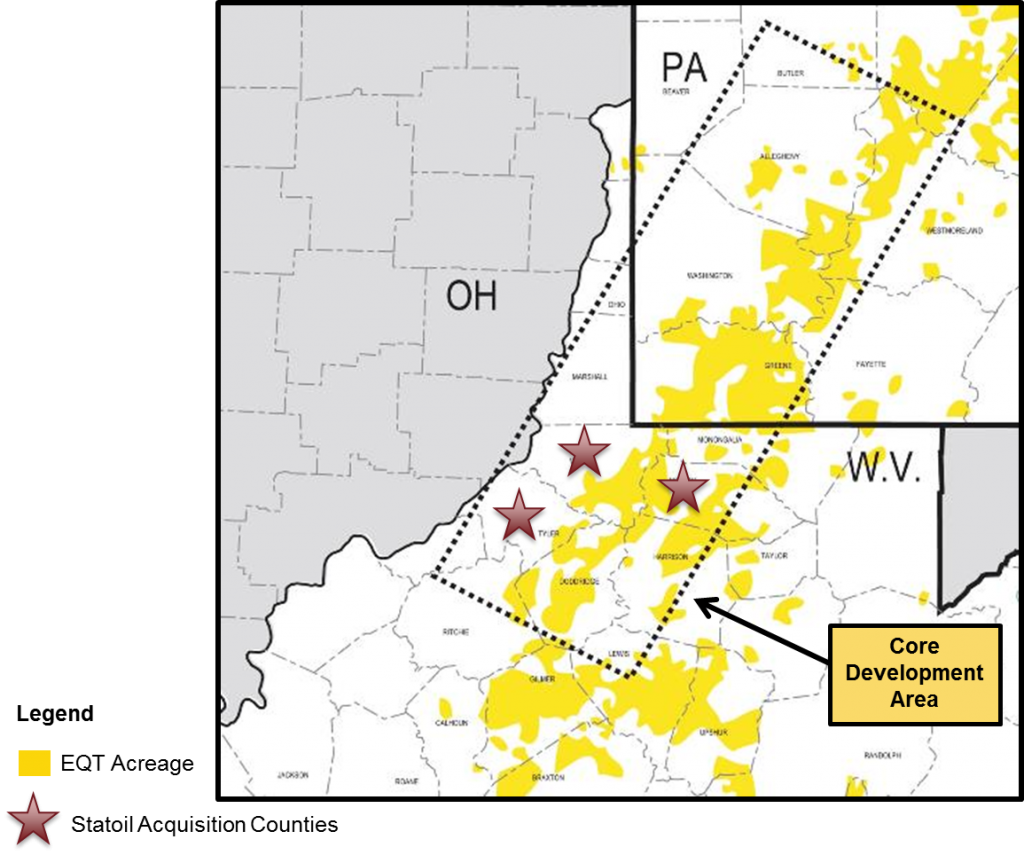

The company completed a number of deals this year that have expanded its core acreage in the Marcellus by 55% to 400,000 acres. That’s 19 acres of newly acquired land for every acre the company developed this year, said EQT CFO Robert McNally, and the company’s expanding acreage presents economic upside for the company, even at today’s prices.

“Our core Marcellus acreage has increased by 143,000 net acres or 55%. And our undeveloped location inventory has increased to almost 3,700 locations,” McNally said during prepared remarks on the conference call. “Much of this acreage is contiguous with EQT’s existing development area. Therefore the lateral links of 190 existing EQT locations can now be extended from approximately 3000 feet to 6000 feet on average. At a flat $2.50 realized gas price, the IRR’s on these wells increased from approximately 9% to 37%.”

EQT has spent roughly $1 billion in the last six months expanding its core acreage

Two of the major acquisitions that helped EQT realize such substantial growth in the first nine months of the year were a $407 million purchase from Statoil (ticker: STO) in May, and a $683 million bolt-on acquisition from Trans Energy, Inc. and entities affiliated with Republic Energy, announced earlier this week.

EQT raised approximately $800 million in a common stock offering May 6, which, in conjunction with a $275 million dropdown to EQT’s MLP EQT Midstream Partners (ticker: EQM), financed the two large acquisitions.

As EQT continues to grow its core position in the Marcellus, the company continues to increase its production as well. During the third quarter, EQT reported 196 Bcfe in Q3 sales volumes, a 26% increase over the third quarter of last year.

“The operational story for the third quarter was strong volume growth in a low commodity price environment,” said McNally. “We had another very solid operational quarter, including record produced natural gas sales and record volumes at Midstream.”

David Porges retires as CEO after six years at the post and 19 years with EQT

Along with today’s operational updates, EQT CEO David Porges announced that he will be retiring at the end of the year. Porges has served as the company’s CEO since early 2010, and has been with EQT for 19 years. Succeeding Porges as CEO is Steve Schlotterbeck, EQT’s current president. Porges will transition to the role of executive chairman, he said during the company’s conference call.