PDC: Ready to Integrate and Develop Permian Assets in 2017

PDC (ticker: PDCE) CEO Bart Brookman summarized Q3 as a “terrific” quarter for PDC on its 3Q earnings call today.

Brookman called for increased production and activity going forward in both the company’s core Wattenberg and Delaware acreage.

Third quarter production increased 39% year-over-year to 65,000 BOEPD, despite a 10% year-over-year decline in CapEx, which was $118.0 million. Per Boe lease operating expenses declined 27% year-over-year to $2.33.

Forty gross operated wells were turned online, including the company’s first two-mile lateral wells in the Core Wattenberg in Colorado.

The company spudded 16 extended reach lateral wells in the Wattenberg, continuing trends seen throughout the basin. Brookman noted that “these projects are becoming increasingly prevalent in our Wattenberg operating plan and will be a key part of our 2017 capital budget when blended with the recent acreage swap.”

PDC’s $1.5 Billion Core Delaware Acres are Transformative

The main transformative event for PDC this quarter was its acquisition of 57,000 net Core Delaware acres in Reeves and Culberson counties for $1.5 billion, to be closed by the end of the year. Roughly $1.2 billion was financed through a mix of public equity, senior notes, and convertible notes.

PDC Expects “Top Tier Growth” in 2017

While the 2017 budget has not been approved yet, the company plans to achieve 30% production growth. In the next year, one rig is planned to be added in the Wattenberg Field along with one in the Delaware, resulting in four rigs in the Wattenberg and three in the Delaware at the end of 2017.

Wattenberg

The Wattenberg is expected to provide “reliable production growth,” supported by technical enhancements in completions and drilling, efficiency gains supported by the company’s recently completed acreage swap with Noble, and a larger focus on extended reach drilling.

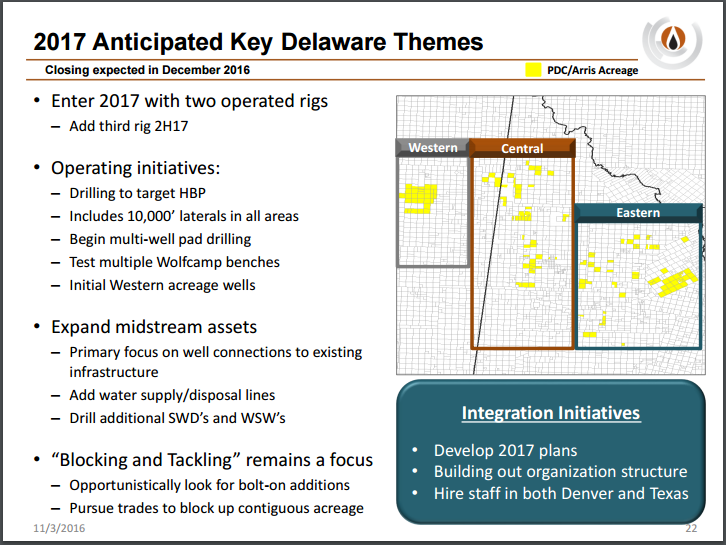

Delaware

In the Delaware, the company will be running Wolfcamp A and B horizontal drilling programs to hold acreage and better understand benches outside the Wolfcamp. Midstream asset strategy for the Delaware is expected to be fully defined by mid-year 2017 and multi-well pads are expected to become a larger part of the company’s operating model.

Analyst Q&A

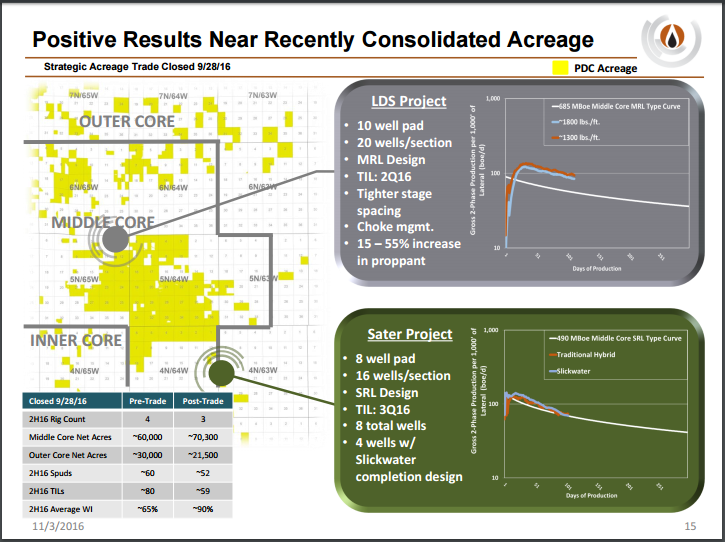

Q: You talked about the performance, how you’ve been varying the sand concentration in a lot of the Wattenberg wells. It sounded like you’re not seeing any difference in terms of the performance right now?

PDC: You are correct. You can see on the graph, we really don’t see a lot of difference between the two sand concentrations that we have on that LDS pad. It doesn’t mean that’s an absolute answer yet, but we’re definitely more focused on the other parts of the testing that we did there because of that, which puts us more pointed toward the shorter stage lengths and dealing with our different flow back method, both of which we think contributed fairly significantly to that uplift.

That’s what we’re really testing through the end of the year on the various projects we have are that variation of stage length and flow back method, but we’re also still running some tests at the 1,300 pounds per foot type range. We’re not planning to go up to those upper numbers the rest of this year but probably will reconsider that. I know some of our peers out there in the Wattenberg and obviously down in the Delaware we’re seeing the same thing, increasing sand concentrations, but we’re looking at the data and right now it’s not encouraging us. It’s also the more expensive part of the additional costs associated with these tests we’re running.

Q: Do you guys have any update on the Raise the Bar initiatives? [EDITOR’S NOTE: “Raise the Bar” is the sponsors’ name for the initiative that is currently before Colorado voters proposing a constitutional amendment that will significantly strengthen the requirements for citizens groups to land future proposed constitutional amendments on the Colorado ballot—also known as Amendment 71. Raise the Bar was proposed after a number of citizen initiatives limiting oil and gas development in Colorado’s recent election cycles, most recently by imposing a 1,500 setback and giving local governments control over oil and gas development, came close to making the ballot. If voters would have approved the two amendments, the State COGCC showed how the oil and gas industry would have been essentially shut down in the state.]

PDC: We’ve been very involved in the campaign around Raise the Bar. The best I can say is things look slightly favorable in that initiative right now.

Q: You guys have everything’s held by production in the Wattenberg. Would that be where you would potentially ramp down if needed, if commodity prices don’t cooperate?

PDC: If oil were to drop into the low 30’s, and that was our outlook long term, we would use the Wattenberg as our flex capital point. Obviously next year are going to have more intense capital into the Wattenberg than the Delaware on a total basis, so the Wattenberg would definitely be where we would slow down if we need to back off on our capital spend, and once you cover what it takes to hold the acreage.

When we look at this overall, we really need to run those two rigs pretty consistently in order to hold the acreage. I feel like we can do that, well into the $30 per barrel range of pricing. At this point we’re still contemplating adding a rig in each area. We probably don’t need to add the third rig to hold the acreage in that area, and we obviously would not add a fourth rig in Wattenberg if prices were projected to be low for a long period of time. But it’s very flexible in Wattenberg. I would say it’s much more of a requirement in Delaware that we run at least the two rigs.

Q: Is there a difference in how those Wolf Camp A completions that you highlighted performing above the type curve were completed versus what was used to develop the million BOE type curve?

PDC: Yes. What we’re dealing with in terms of the type curve is many of the older completions still and these recent completions were conducted by Arris. But what you see there is a 2,000 pounds per foot of sand, 100 feet between stages and we really see that changing the productivity. But also, Arris’ flow back method, soon to be ours, approach to this has been similar to the way we’re approaching things in the Wattenberg.

Q: What’s the estimated cost for a two-mile lateral?

PDC: We’ve got about $9.5 million and that’s on a single well. When you look at the two mile multi-wells we think we will get down around $9 million. And again, that’s really early. I hope everybody recognizes we’ve got a lot to learn on that.

Q: Can you discuss what the cost of the three Wolf Camp A wells were and how that binds up to your expectations? And can you see yourself being able to bring those costs down once you take over operations?

PDC: I would believe they’re probably close to that $6.5 million kind of range that we put out for a one mile lateral. In terms of cost, even within what we’ve shown, we feel like we can drop several hundred thousand dollars off a well just by going to multi-well pads.

There’s room for improvement on getting a rig running consistently and getting the efficiency associated with that as a part of the equation. On the completion side, when you drill a single well you don’t get any efficiency on a completion, particularly when you’re doing a plug-in perf operation. It’s very inefficient on single wells.

Q: How do you expect the oil cut to vary over the life of these wells?

PDC: Thus far, the three-phase basis as we talked about is around 60% crude oil. We are very encouraged by that, and it’s in the range that we outlined as far as the oil mix with the roll-out. In this eastern area, we were anticipating between 50% and 70% crude oil, so it’s right in the range with that. There could be some variances a bit overtime, but where we sit today and thus far with the data that we have after the 120 days we’re right down the fairway with that range.

Q: I’ve heard that the higher sand concentrations may have a more favorable impact where the GOR is a little bit lower. Any thought as to where you are located in the play?

PDC: We’re going to be focusing most of our drilling in that blocked up acreage that we have after the acreage trade. LDS is very significant on how we see things going forward. As we move into the more oily areas we could see this change and need a little more sand concentration that near wellbore propped permeability. That’s a possibility but we really aren’t there and probably won’t be out in that area much if at all this next year. So it may not impact us as much as it might others.

Links to the company’s earnings release, investor presentation, and webcast are provided.