Liquefied natural gas (LNG) is being touted as the next major movement in the energy industry. Supermajors like Chevron (ticker: CVX), ExxonMobil (ticker: XOM) and Shell (ticker: RDS.B) are investing billions to build up LNG networks while scaling back on more conventional opportunities. The catalyst for such a movement lies overseas in the energy-starved markets of Asia and Europe. In the short-term, Japan and South Korea are in immediate need of resources due to a revised energy outlook that includes eliminating nuclear power. The ongoing issue with Russia and its importing European customers can also reshape the industry. In the long-term, countries like China and India are prime targets for LNG imports as the respective nations aim to move to a cleaner burning fuel.

British Columbia Pushing for LNG Investment

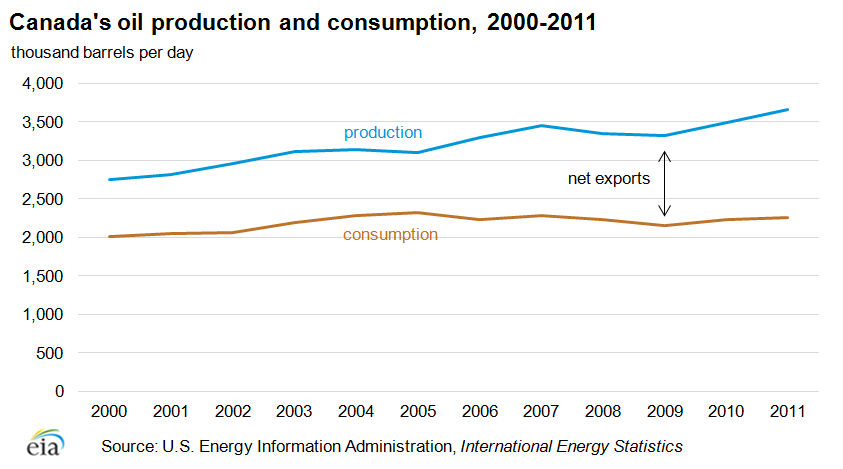

Several countries, including the United States, Australia and Qatar, are already pumping up LNG investments to tackle the growing international opportunities. Canada has not broadened its horizons to that level, possibly since the nation is exporting 100% of its hydrocarbons just south to the US. Despite its current shale boom, the United States still imported 9.8 MMBOPD in 2013. Canada accounted for 32% of the imports while OPEC, by comparison, accounted for 38%.

But Canada exports nothing overseas, and British Columbia in particular is pressing for LNG investment. In the second-ever LNG in B.C. Conference in Vancouver, British Columbia, government officials and representatives for major international E&Ps discussed future potential in the region. Geographically, B.C. is in an ideal position to supply Southeast Asia’s rising demand and Canada is currently the world’s fourth largest producer of dry gas. Global LNG demand is expected to double by 2025 – creating a shortfall of 150 million tons of fuel. Analysts believe roughly 100 million tons will still be available for replacement despite increased output from traditional LNG giants.

Canada’s first LNG venture has been approved but construction has not begun. The Kitimat LNG project located about 400 miles north of Vancouver and will be operated through a joint venture between Chevron and Apache Corporation (ticker: APA).

Canada May be Late to the Party

However, one of Canada’s greatest problems in the LNG field may be its chief importing partner: the United States.

At the conference, Edward Kelly, Vice President of Natural Gas at IHS CERA, said: “The U.S. projects are starting on second base. They’ve got the harbor, they’ve got the tanks there, they have natural gas infrastructure in place, [and] they’re offering a clear model for North American gas price exposure.”

Additionally, a very particular issue is arising with E&Ps: the cost.

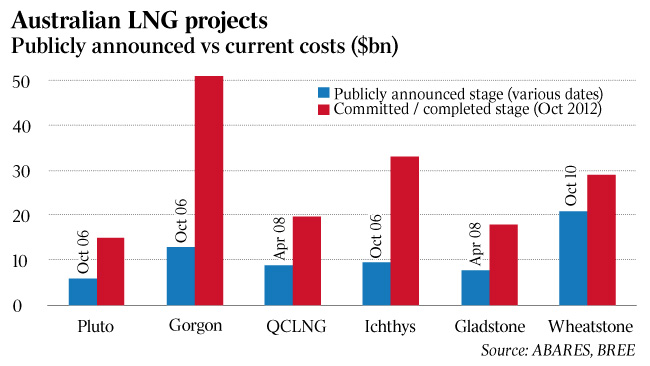

Current LNG infrastructure in Canada is minimal. Three LNG terminals, including midstream buildout, would cost anywhere from $190 billion to $280 billion, according to Ernst & Young. Apache is already looking for ways to reduce its stake in the Kitimat, saying the project needs to be “right-sized.” According to a report by KPMG, 10 out of 12 worldwide LNG projects (most in Australia) are either behind schedule or exceeded its preliminary budget by as much as 50%. Taxes may also be a significant hurdle. British Columbia government plans on imposing taxes of up to 7% of net profits.

Potential is there, but is it worth it?

Investing companies should be wary, says Tan Sri Dato’ Shamsul Azhar Abbas, Chief Executive Officer of Malaysia-based Petronas. “This is a once-in-a-lifetime opportunity for B.C.,” he said. “We must be careful to not squander it away by banking on unrealistic expectations and misconceptions.”

Marvin Odum, President of Shell Oil Company, said financial competitiveness is a chief element of his company’s future in the B.C. LNG market. He said: “ “We have very little concern about the secondary, but getting the clarity around the fiscal elements of these projects so we can continue with the engineering and move forward is critically important. We recognize that LNG plants in British Columbia really do compete with LNG plants all over the world. There are a lot of opportunities to build but B.C. definitely has the potential to come out on top.”

Potential in the industry is one thing, but delivering is another.

Coincidentally, the conference occurred just days after China reached a 30-year, $400 billion agreement to buy natural gas from Russia. China will likely remain in the market for the resource despite of the Russia deal – the EIA reports China consumed 5.2 Tcf of gas in 2012, and imported 1.5 Tcf (29%). The country’s natural gas need is expected to balloon to 17 Tcf by 2040 at an annual average growth rate of 4%. Russia’s exports are set to begin by 2018 and the amounts are significant. Its first shipments will be 38 billion cubic meters (1.3 Tcf, nearly matching China’s 2012 import level) but can expand to as much as 130 billion cubic meters (4.6 Tcf). In addition, Russia holds a major geographical advantage similar to Canada’s relationship with the US. Russia holds existing pipelines, can adjust output and fluctuate on prices to combat competitors. LNG shipments, on the other hand, are more expensive and leave its producers with much less flexibility.

Christy Clark, the Premier of British Columbia, has established LNG plants as a staple of her recent campaign and promotes the situation as a way to pay off government debt and create jobs. In her message as the keynote speaker at the LNG in B.C. Conference, Clark said the China-Russia pact does not change the outlook for Canadian LNG. “We’ve certainly seen the way that Russia likes to do business these days, and we certainly know that the Chinese want a dependability of supply. We can supply that,” she said.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. A member of EnerCom has a long only position in Shell.