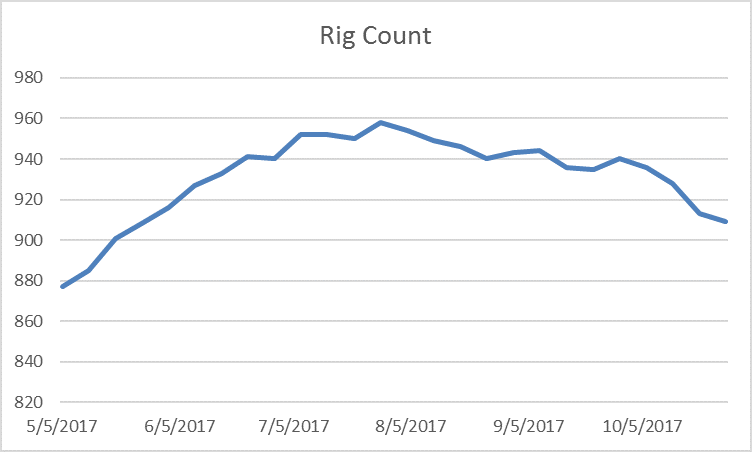

Four rigs go offline

Oil and gas industry signals were mixed this week, as the rig count and natural gas prices dropped, but oil prices rose.

U.S. drilling activity declined this week, with four land-based rigs shutting down. There are now 888 land-based rigs in the U.S., the lowest number in five months. Inland waters and offshore rigs counts were unchanged at one and 20, respectively.

Activity shifted away from gas, as five gas-targeting rigs shut down in the week. One oil-targeting rig became active, meaning oil now makes up 81% of all activity in the U.S. Activity also shifted towards vertical drilling, as four vertical rigs began activity this week. This growth corresponded with a significant drop in directional drilling, with six rigs shutting down. Two horizontal rigs also ceased activity this week.

Texas remains the heart of oil and gas operations, and five rigs started operations in the state over the week. Increases were only seen in two other states, Oklahoma and Wyoming, which each added one rig. Most major states saw activity decrease in the week. Three rigs shut down in Louisiana, while two shut down in North Dakota and West Virginia. One rig came offline in Alaska, Colorado, Kansas and Pennsylvania. The rig in Kansas began activity two weeks ago, and now that it has shut down Kansas again has no drilling activity.

Among the major basins tracked by Baker, the Cana Woodford saw the largest increase in rig count, with four additional rigs. One rig came online in the Barnett and Permian, while two shut down in the Granite Wash and Williston, and three came offline in the Marcellus.

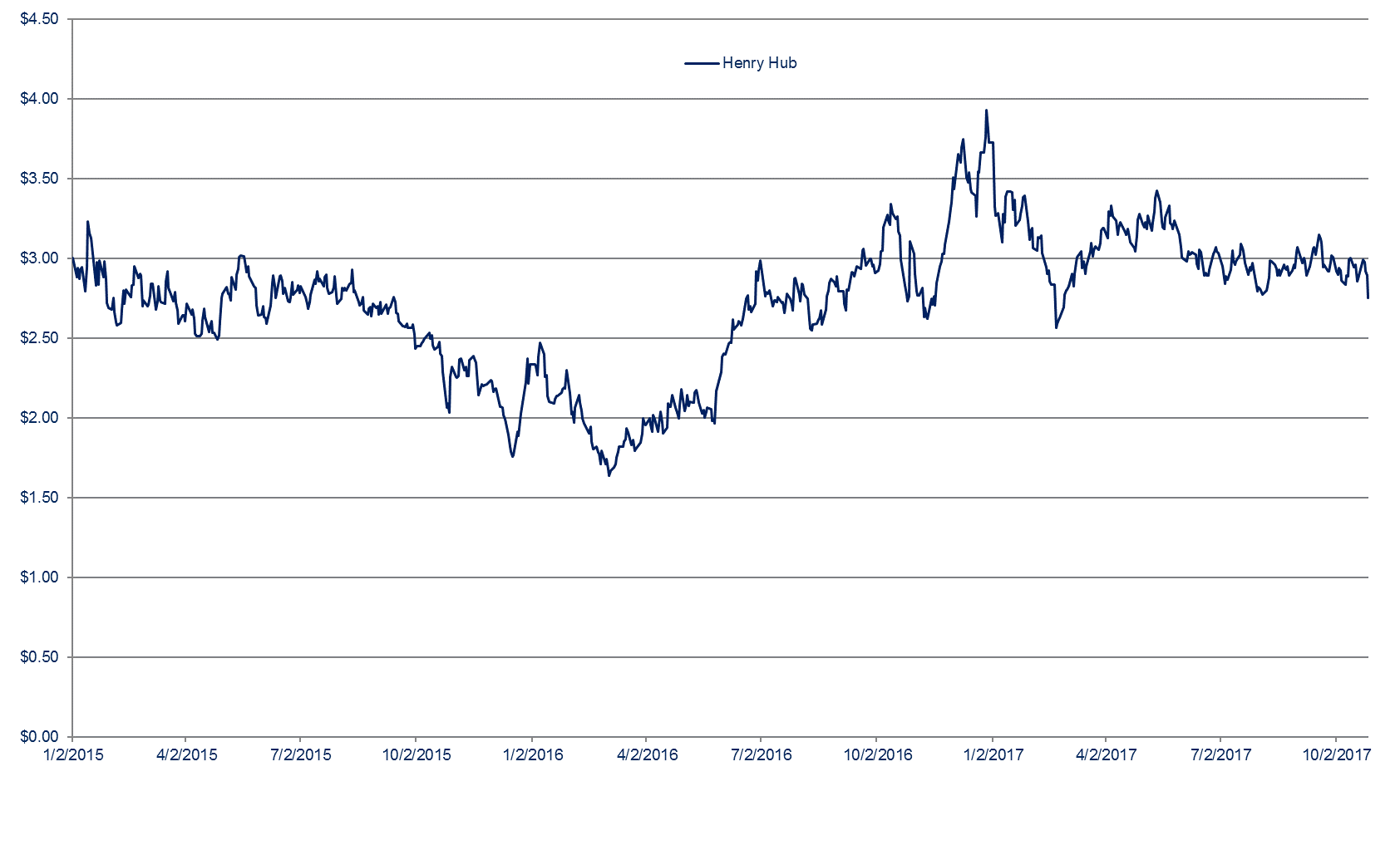

Brent hits 2-year record

Commodity prices were quite active today, with oil hitting major milestones. Brent rose by 2.02% to close the day at $60.54 per barrel, which is the highest closing price in more than two years. The last time Brent closed above $60 was early July 2015, when it closed the day at $62.07.

WTI rose by even more, adding 2.94% to end the day at $54.19 per barrel. While this is not as significant a milestone as $60 Brent, it is the highest WTI has closed since February this year.

Much of the gain in oil price is in response to a recent interview with the Crown Prince of Saudi Arabia, in which the monarch indicated Saudi Arabia would be open to extending the OPEC production cuts beyond the current March 2018 expiration.

Natural gas prices, on the other hand, dropped by nearly 3% on mild weather forecasts, closing the day at $2.964 per MMBTU.