Oil prices on Thursday rallied more than 20% following reports of a possible deal to cut production by an enormous 10 million barrels per day, but one analyst is still predicting that Brent crude will sink to $10 a barrel.

The benchmark Brent crude was trading up 9.92% trading at $32.91 on Friday afternoon in Asia, while West Texas Intermediate gained up 4.82% at $26.54.

“There is little chance of any OPEC+ deal that’s going to save the crude oil market from the attack of the COVID-19,” he told CNBC’s “Capital Connection” on Friday. “I think any talk of big cuts is probably too little, too late.”

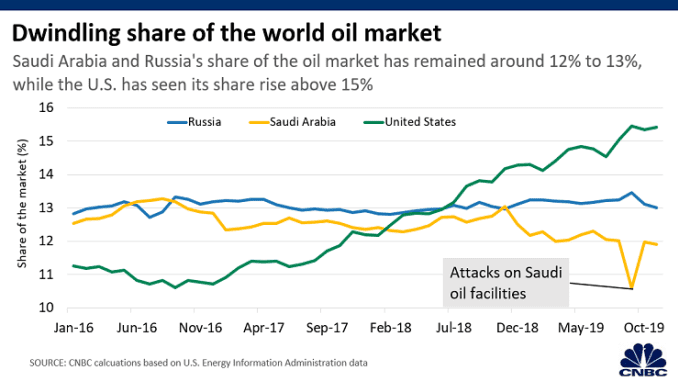

Oil futures have fallen more than 50% since the beginning of the year amid a Saudi-Russia price war and demand destruction because of the coronavirus pandemic.

U.S. President Donald Trump attempted to play “moderator” between Saudi Arabia and Russia, and said on Thursday that he was expecting a cut of 10 million bpd to 15 million bpd. Riyadh called for an emergency meeting of OPEC and its allies, which was supported by Iraq, according to Reuters reports.

Still, Shum said, given that both sides produce around 10 million bpd to 11 million bpd, he considers it “highly unlikely that Saudi Arabia will agree to a unilateral massive cut or even a bilateral cut with Russia.”

Riyadh could, however, as the G-20 chair for the year, try to put together a coordinated cut that includes other oil-producing countries such as Canada.

“We need every producer to come in to agree to a cut and have the cuts enforced,” Shum said. “That is a tall order in the limited time we have before the world runs out of crude oil storage.”

Analysts have predicted the ceiling will be reached in May or June. That’s when market forces will compel producers to lower output, he said.

With “no real signs” that Saudi Arabia and Russia have agreed to put aside their differences, it’s going to be “tough,” he added. “I imagine it will be a brutal, unadulterated market fight and the weak producers will have to shut in their production, in particular in the U.S. shale oil sector.”

[contextly_sidebar id=”nObgKKYcK2xzO9F8wgemsCcikjq86bCU”]