Fort Worth-based Brazos Midstream Holdings, LLC and its financial sponsor, Old Ironsides Energy, have entered into a definitive agreement to sell its Delaware Basin subsidiary companies to North Haven Infrastructure Partners II (NHIP II) and related funds for approximately $1.75 billion in cash. Closing is expected in the second quarter of 2018.

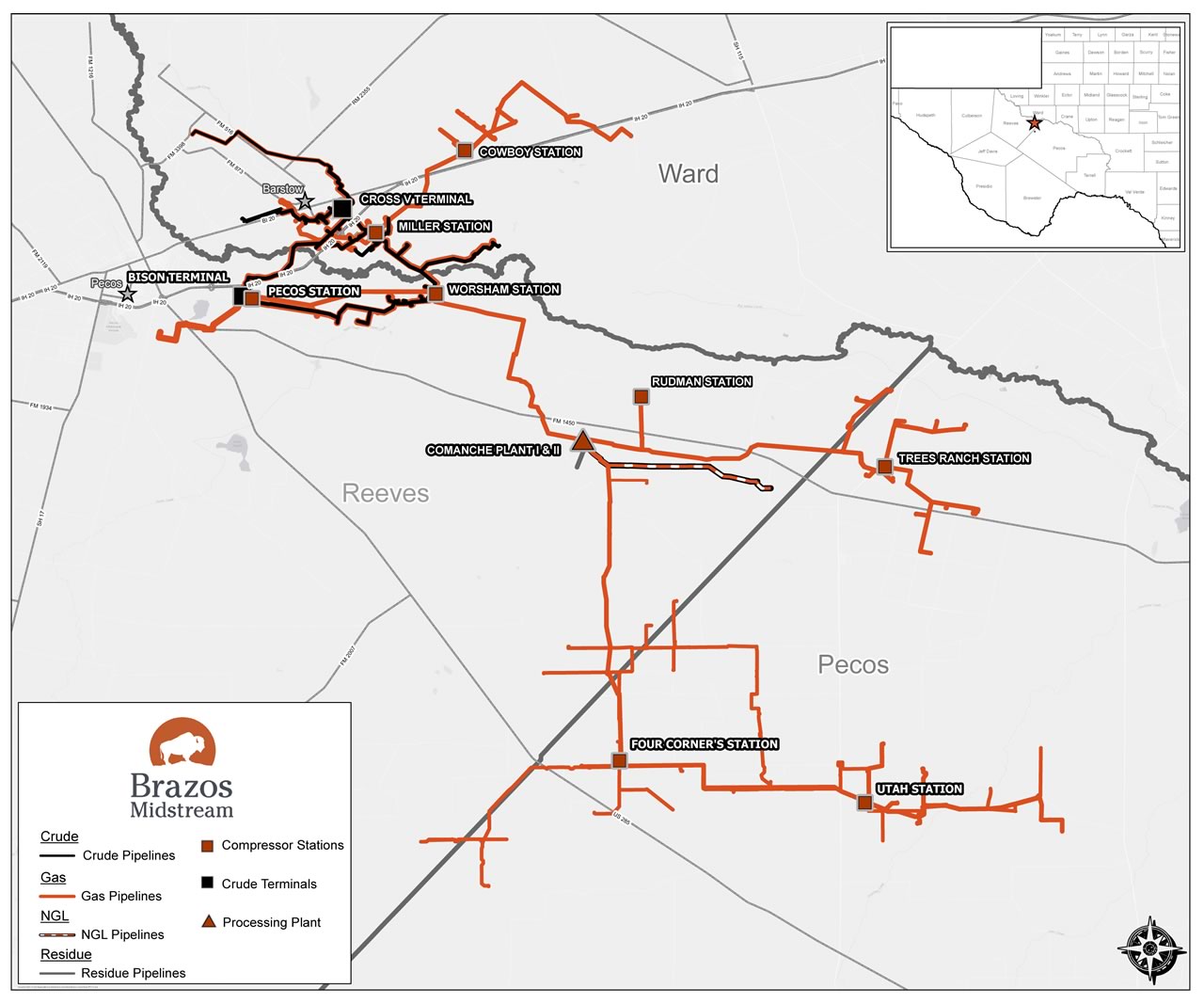

Brazos’s Delaware Basin assets are located in Reeves, Ward and Pecos counties and include approximately 350 miles of natural gas and crude oil gathering pipelines, a natural gas processing complex with 260 MMcf/d of processing capacity now operating with an additional 200 MMcf/d of capacity under construction and approximately 50,000 barrels of crude oil storage.

NHIP II is an investment fund managed by Morgan Stanley Infrastructure (MSI), and the transaction includes committed debt financing of $950 million ($900 million of term loan and $50 million of revolving credit facility).

After closing, Brazos will retain its name and operate as a portfolio company of NHIP II. The members of the Brazos management team will remain in their current roles. Brazos’s CEO is Brad Iles.