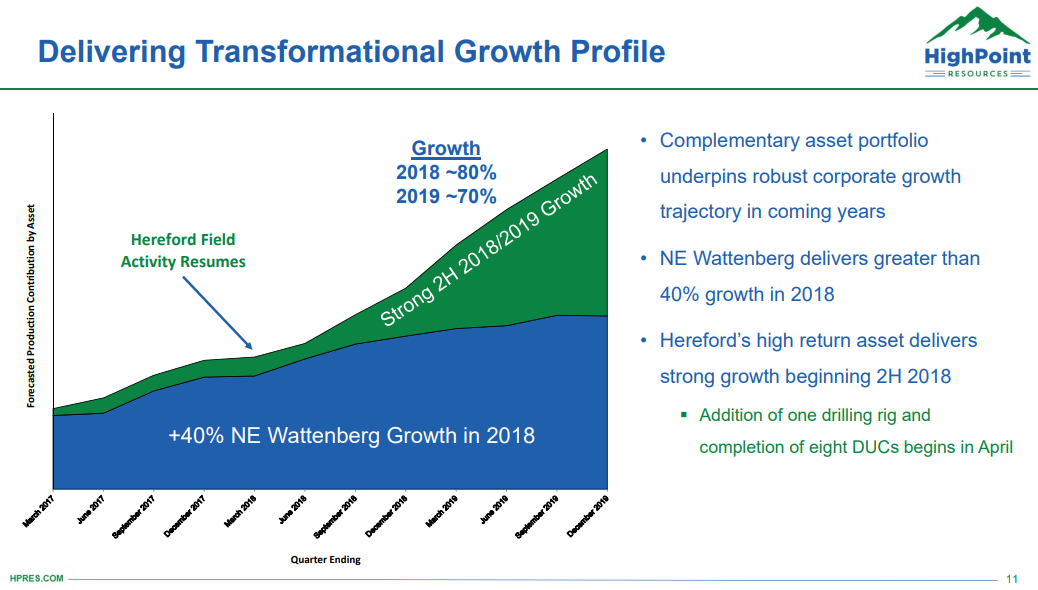

$525 million will create 80% production growth for 2018, and another $600 million for 2019

HighPoint Resources (ticker: HPR), the newly-formed merger of Bill Barrett and Fifth Creek Energy, announced its 2018 guidance today, positioning itself as one of the most important players in the DJ Basin. HighPoint plans to spend about $525 million in 2018, spending that will be funded through cash on hand and cash from operations.

This spending will produce a step-change in production, as the company plans to produce around 30.8 MBOEPD in the coming year. This represents growth of about 80% from the company’s DJ Basin properties, and 40% growth from the legacy Northeast Wattenberg acreage.

Operations will target Hereford field

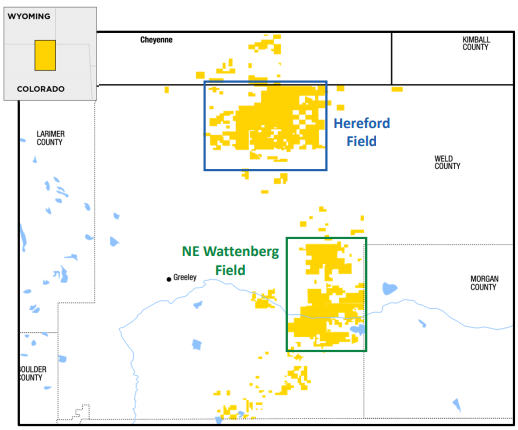

HighPoint will focus on integrating its Hereford field, which is located on the border of Colorado and Wyoming. The company plans to begin drilling in April with a focus on drilling long lateral wells. HighPoint did not do any drilling or completion operations during Q1, but three of the most recent Hereford wells achieved average 30-day IP rates of 1,016 BOEPD. One completion crew will begin operating in April and will work on eight previously drilled, but not completed, XRL wells.

HighPoint plans to spud about 125 XRL wells in 2018, using a three-rig program for the majority of the year. Two rigs will be operating in the NE Wattenberg field, while one will drill the Hereford acreage

Operating cash flow beyond operations in 2H 2019

HighPoint also provided an outlook for 2019, showing the company’s longer-term plans. HighPoint expects to run a three-rig drilling program in 2019, drilling 150 new wells. The company will focus on the Hereford field in 2019, reversing the current proportion by running two rigs in the Hereford and one in NE Wattenberg.

HighPoint expects to spend about $600 million in 2019, and produce an average of 52 MBOEPD. This would mean yearly production growth of 70%. Assuming $55/bbl WTI and $3/Mcf gas, the company expects operating cash flow will exceed capital expenditures in the second half of 2019. Based on the same pricing assumptions HighPoint expects its year-end leverage ratio to improve to below 1.5 times at year-end 2019.

HighPoint CEO and President Scot Woodall commented, “We are focused on integrating Hereford this year and excited about the transformational impact this asset will have on our corporate growth trajectory, capital efficiency metrics and inventory quality. The three most recent wells brought online in December achieved average initial thirty-day production rates of over 1,000 Boe/d (86% oil) and are consistent with previous well performance.

“We expect to resume drilling and completion activity at Hereford in April that will drive significant volume growth in the back half of the year and into 2019. In NE Wattenberg, we are pleased to announce that our optimized completion program in 2017 resulted in twelve-month cumulative oil production 47% higher than the 2015 program. This low-cost, high-quality asset provides significant cash flow to support the development of the Hereford asset.

“The enhancement to our inventory depth and quality, combined with our demonstrated technical execution will allow us to deliver robust production growth in 2018 and 2019, while becoming free cash flow positive in the second half of 2019. Lastly, the anticipated step change in production, cash flow and EBITDAX generation materially improves leverage metrics and provides an optimal capital structure to drive substantial returns to shareholders in the coming years.”