The shifting landscape of global energy

2014 marked the beginning of a new era in the oil and gas industry, said Bob Dudley, Group Chief Executive for BP’s (ticker: BP) 2015 Statistical Review of World Energy. Price volatility is nothing new to the industry, said Dudley, but “[prices] may well come to be viewed as symptomatic of a broader shifting in some of the tectonic plates that make up the energy landscape.”

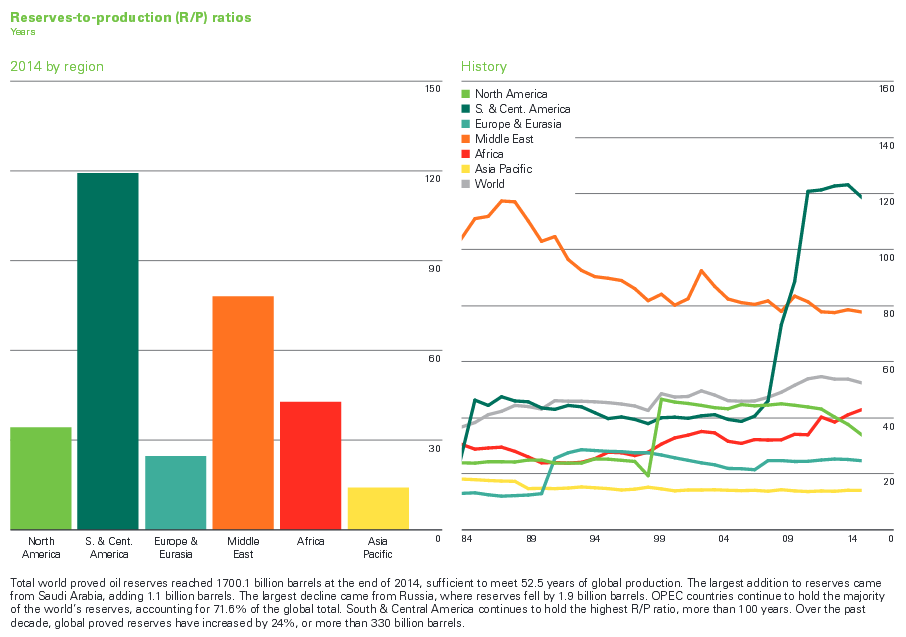

On the supply side, the United States became the first country to ever increase its average annual production by at least 1 million barrels of oil per day (MMBOPD) for three consecutive years, surpassing Saudi crude oil production and taking the top spot for oil and gas production from Russia. But while supply surged, demand became catatonic. Global primary energy consumption increased by just 0.9% in 2014, its slowest rate of growth since the late 1990s, other than immediately after the financial crisis, says BP.

Oil is King

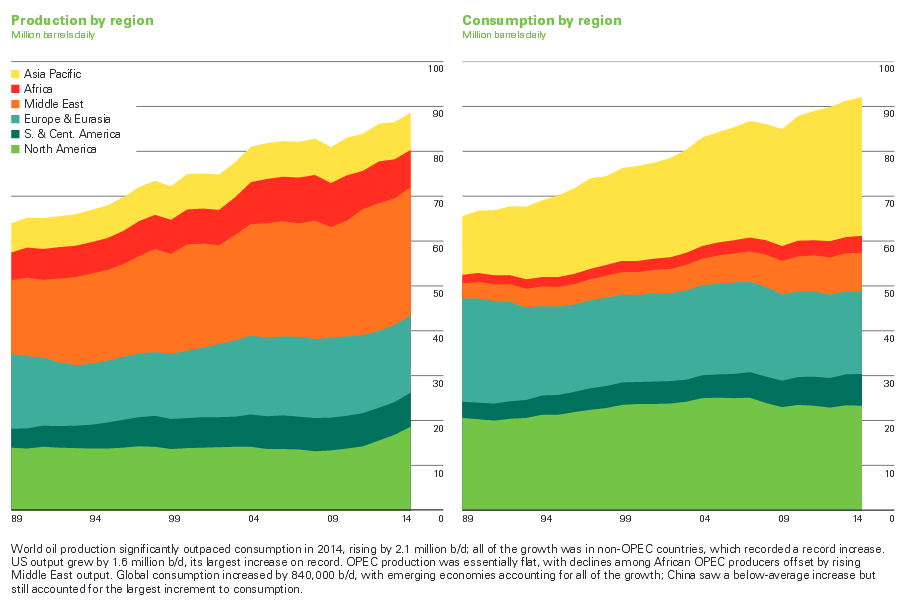

Oil remained the world’s primary fuel source, holding 32.6% of the market, but lost market share to other forms of energy for the 15th straight year, said the reports. Emerging economies accounted for all of the net growth in energy consumption, as they have over the past decade, but growth in China slowed to its lowest point since 1998, even as the country continued its 14 yearlong streak of showing the largest incremental growth in primary energy consumption in the world.

Global consumption grew by 0.8 MMBOPD, or 0.8%, below recent historical averages and significantly weaker than the 1.4 MMBOPD increase seen in 2013. OECD consumption declined by 1.2%, with Japan recording the largest decline globally, with demand falling by 220 MBOPD, the lowest level since 1971.

Global oil production grew at more than twice the rate of global demand, largely due to the production from the U.S. The report notes that OPEC production was flat, with the group’s share of global production falling to 41%, its lowest since 2003.

Brent averaged $98.95 per barrel in 2014, $9.71 less than a year before, and the first time since 2010 that the European benchmark has averaged less than $100 per barrel. The WTI-Brent spread narrowed to $5.66 per barrel on average despite continued U.S. production growth.