Eight pipelines included in BP Midstream Partners

BP (ticker: BP) announced today the filing of a registration statement with the SEC for an IPO of some of its U.S. midstream assets.

BP announced in July it was considering the formation of an MLP to support the company’s strategy to grow its midstream business. The proposed company will be called BP Midstream Partners, and will trade on the NYSE under the ticker: BPMP. Current plans call for an IPO in Q4 2017.

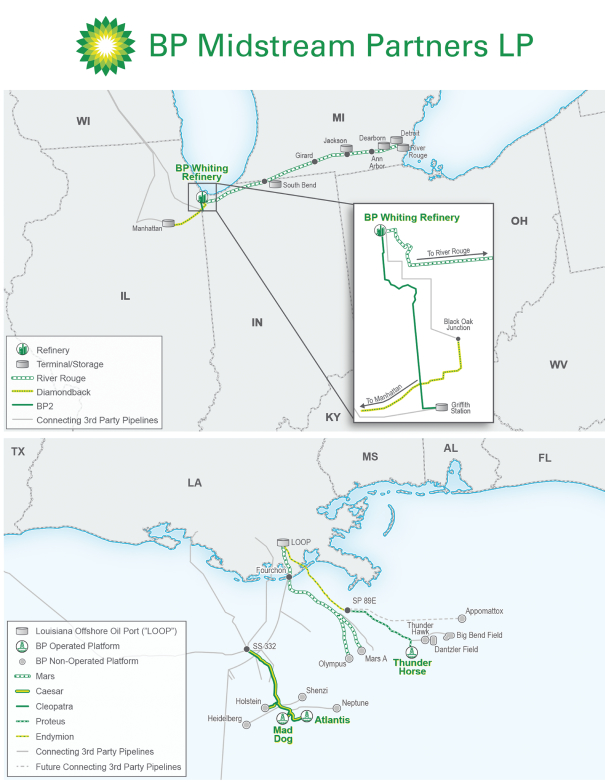

850 miles of pipe carrying 2.9 MMBOPD

BPMP owns one onshore crude pipeline, one onshore refined products pipeline, one onshore diluent pipeline and interest in five offshore pipelines. All onshore pipelines center around BP’s Whiting refinery, the largest refinery in the Midwest. Located in Whiting, Indiana, at the border of Illinois and the shore of Lake Michigan, this refinery recently underwent a significant modernization program. The BP2, BPMP’s crude pipeline, carries oil from major interstate lines to the refinery. BPMP’s River Rouge delivers refined products from the Whiting refinery to the Detroit markets. The Diamondback line transports diluents to a major third-party pipeline, with ultimate delivery to the Canadian oil sands.

The offshore pipelines are all located in the Gulf Coast, south of Louisiana. The Mars, Caesar, Proteus, Endymion and Cleopatra all transport crude oil and natural gas from platforms. Some, like the Mars and Endymion, bring oil directly to the Louisiana Offshore Oil Port, while others connect to third-party pipelines.

In total, these pipelines represent over 850 miles of pipeline, with a capacity of roughly 2.9 MMBOPD. According to Reuters, BP expects to receive about $100 million from this sale.

According to Reuters, the idea for spinning off midstream assets originally came up five years ago. The oil price downturn, however, forced BP to put these plans on hold. Several other major companies have since spun off pipeline assets, including refiners like Valero (ticker: VLO), Tesoro (ticker: ANDV) and Marathon (ticker: MPC). Shell (ticker: RDS) raised nearly $1 billion when it carried out an IPO of its midstream assets, in the largest MLP IPO to date.