Borrowing Base Redeterminations Kicking into Full Swing

Cyclicality in the oil and gas industry is a given. Across the board in today’s commodity price environment, the E&Ps and the OilService companies that provide them with drilling and completion services have worked hard to right-size costs.

Management teams will expand and contract their companies’ drilling activity not necessarily by their doing, but as warranted by the commodity markets. Companies with the ability to manage through troughs that also have ample capital to meet current and future investment and expenditures–for example, drilling, personnel costs, rent and interest–are rewarded by the market with above average forward valuations.

The average Price to Cash Flow per Share ratios of the 301 companies in EnerCom’s database of regularly tracked companies: U.S. E&P, 4.0 times; Canadian E&P, 4.7 times; OilService: 10.3 times; Midstream and non-E&P MLPs: 9.5 times.

Oasis Petroleum (ticker: OAS) announced the redetermination of its borrowing base last week in the amount of $1,525 million. The Oasis news release devoted only 51 words to the new borrowing base, but it devoted ten times the real estate to announce three concurrent solicitations to holders of three issues (7.25%, 6.5% and 6.875%) of the company’s senior notes. The company is asking the bondholders to allow it to amend the notes.

According to the company’s news release, the proposed amendments would allow Oasis “to incur senior indebtedness under its senior secured revolving credit facility in an amount at any time outstanding greater than or equal to the amount of its borrowing base under that facility.”

For their cooperation, Oasis is offering its bondholders $10 for each $1,000 of principal amount. There are $1.2 billion outstanding in the three series of senior notes. A fully successful effort would obligate the company to pay the bondholders a total of $12 million in consent fees, which is about the cost of drilling and completing one Bakken/Three Forks well. The solicitation is scheduled to end on October 16.

Companies Looking for Financial Flexibility: Bankers Discuss Consent Solicitations

Oil & Gas 360® spoke with Raymond James Managing Director, E&P Research, Andrew Coleman and DNB Bank Senior Vice President Byron Cooley for their insight into consent solicitations.

“The high yield market is closed and the equity market is closed for all but the companies with the strongest balance sheets,” Coleman told Oil & Gas 360®. “A lot of bonds issued in the past 18 months in particular have covenants that say ‘I’m not going to allow you to draw all your credit facility because I’ve given you [unsecured] money’; and so what Oasis is doing—and you’re going to see a lot of guys doing this—is going after consent from bondholders—‘if I give you this payment will you change this covenant for me?’

DNB’s Byron Cooley said in general terms [not specifically referring to Oasis] that for short periods of time, companies will sometimes ask for an over-advance from the banks managing their secured credit facility. “For six months a company might want to borrow some amount that takes them over the borrowing base.” White said that if the company’s unsecured bond covenants prohibit the company from doing that, then the consent solicitations come into play.

Raymond James’ Coleman put it like this: “Everybody is looking at their bag of tricks. They’re talking to their investment bankers and their equity guys and whoever else they have, trying to come up with ‘What’s the lowest cost way to improve financial flexibility?’ I’ve seen a lot of covenants get knocked off and debt-to-EBITDA covenants have gone away for the most part.”

Just Part of the Gumbo

“It’s part of the mosaic, part of the gumbo that everybody’s putting together to navigate this environment.”

Raymond James Equity Research, in a research note dated October 12, 2015 said, “Perhaps unlike any redetermination process since the 2008/2009 financial crisis, this fall’s redetermination process is fraught with uncertainty as the vast majority of our small/mid E&P companies under coverage are largely cut off from equity and high yield capital markets and, therefore, are looking at their senior debt facilities as their primary source of capital/liquidity.

“Depending on the outcome of this process, we could see the fall redetermination potentially kick off a wave of mergers, property deals, and even some corporate restructuring,” Raymond James’ analysts said.

Bank Credit Facilities

“Bottom line: we think fall borrowing base redeterminations will likely be more punitive this fall, leading to a 15-20% reduction in overall U.S. E&P bank credit facilities.” Raymond James’ analysts predicted deeper cuts coming in the spring due to falling PUD values, hedge book deterioration, government agency involvement and lower oil price decks in the hands of commercial banks. “Taking all of this into account, we would expect borrowing bases to be down, on average, closer to 20-25%.”

Although the concern about balance sheets, borrowing terms and covenants, and the forward curve of the commodity market are real, E&P borrowing bases are largely hanging in there because:

- Operators have reduced drilling costs, operating costs and increased drilling efficiencies/per well reserve size;

- Operators and banks started working together a year ago to address “what if” scenarios should OPEC decide to drop the hammer and increase production without regard for return on investment; and

- Banks managed their own balance sheets and cash reserve needs so that they would not be the burden to their banking customers who were the ultimate debt holders.

Below are recent headlines announcing updates to borrowing bases, issued by a few selected E&P companies:

EV Energy Partners (ticker: EVEP) Announces Amendment to Senior Secured Credit Facility and Borrowing Base Increase to $625 Million

Callon Petroleum (ticker: CPE) Boosts Borrowing Base by 20%, Targeting Self-Funding by 2016

PDC Energy (ticker: PDCE) Extends Maturity of its Revolving Credit Facility to 2020 with Re-Affirmed Borrowing Base of $700 Million

Bill Barrett Corporation (ticker: BBG) Announces Reaffirmation of $375 Million Borrowing Base, the Sale of Non-Core Uinta Basin Properties for Cash Proceeds of $27 Million, and Lower 2015 Capital Expenditure Guidance

Oasis Petroleum Inc. (ticker: OAS) Announces The Redetermination of Its Borrowing Base and The Commencement of Consent Solicitations

Unit Corp. (ticker: UNT) Raises 2015 Production Growth Estimate to 6%-8%, Borrowing Base at $550 Million

SM Energy (ticker: SM) Completes Semi-Annual Redetermination of Credit Facility: $2 Billion

Resolute Energy Corporation (ticker: REN) Announces Closing of Powder River Basin Sale and Redetermination of Its Borrowing Base at $165 Million

Ample Undrawn Liquidity

Antero Resources (ticker: AR) met with energy bankers in Denver on October 8, 2015. The thrust of the meeting was the company is seeking a modest expansion in the borrowing base but does not have a need to draw anything beyond its current position.

The company disclosed its financial position in its July 29, 2015, Q2 news release, saying it had ample undrawn liquidity: “As of June 30, 2015, the Company’s consolidated net debt was $4.36 billion, of which $1.1 billion were borrowings outstanding under the Company’s $4.0 billion senior secured revolving credit facility, and no borrowings under the $1.0 billion senior secured credit facility for Antero Midstream. Including the $475 million in letters of credit outstanding, the Company had $3.5 billion in available liquidity on a consolidated basis as of June 30, 2015.”

Antero’s 2015 P/CFPS on October 2, 2015, was 6.1 times.

Fall Redeterminations: Industry Survey Predictions

Oil and gas and financial industry respondents to Haynes and Boone’s recent borrowing base survey said they expected that 79% of the oil and gas companies would see a decrease in their borrowing base during the fall redetermination period by an average amount of 39%.

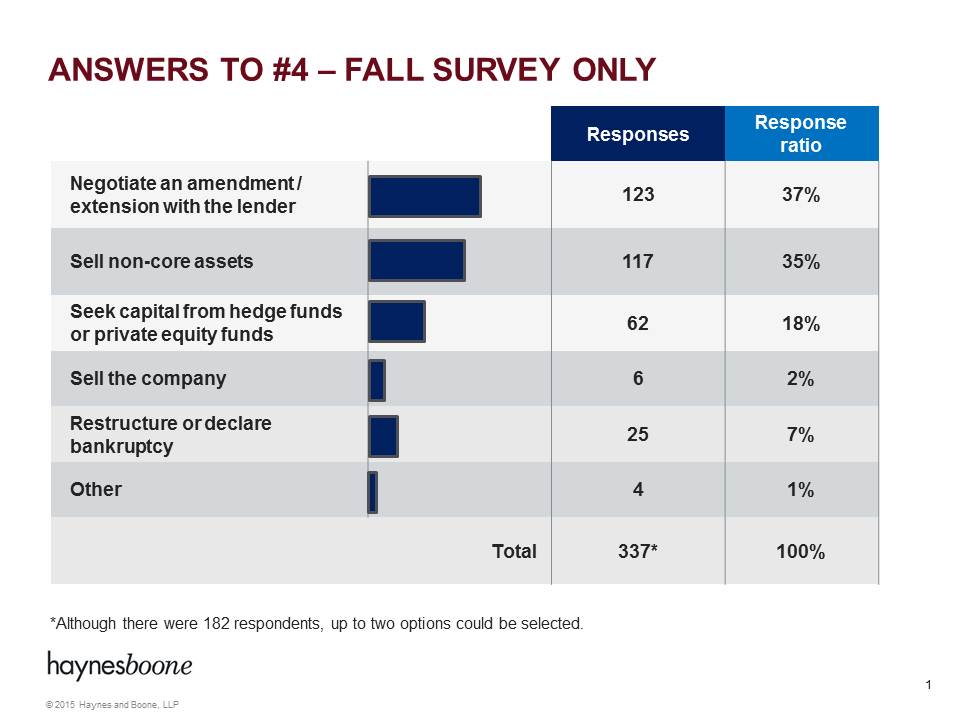

As far as a remedy, Haynes and Boone’s respondents’ beliefs were as follows: 37% said borrowers would negotiate an extension or amendment with the lender, 35% said borrowers would sell non-core assets, 18% said borrowers would seek capital from hedge funds or private equity funds.

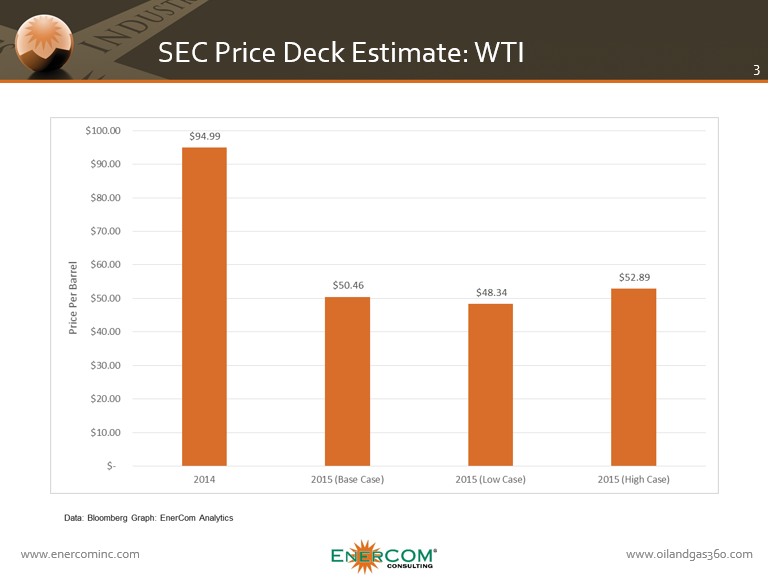

An E&P company’s borrowing power is based largely on the value of its reserves, its primary loan collateral. The SEC price deck, which companies use to book and value their reserves, is set by an average price of commodities the first day of every month of a calendar year. The SEC price deck set at year-end 2014 for the 2015 calendar year was $94.99 per barrel for crude oil, while companies were able to book gas reserves at $4.35 per MMBtu, even as both commodities’ prices dropped precipitously as 2015 ensued. Updated annual reserves determinations–based on a newly calculated SEC price deck–are just around the corner.