Debt-free Blackbird Energy chalks up production record, scores new long-term gas processing agreements, secures ownership option for processing capacity in the Montney

In an operational update put out by the company Wednesday, Blackbird Energy (ticker: BBI) highlighted several announcements including a new company record for production and a new gas processing agreement in Alberta’s Montney play.

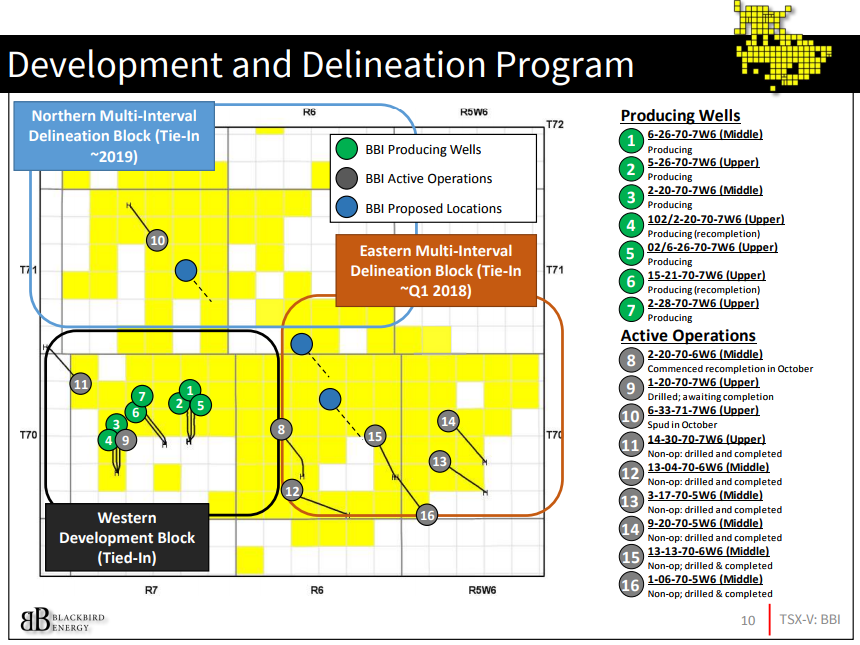

For the period of October 1 to October 21, 2017, Blackbird produced estimated average sales volumes of approximately 1,808 BOEPD (52% liquids), a new corporate production record and a 108% increase from third quarter average production of 868 BOEPD (49% liquids). The company shut-in production on October 21 due to unplanned third-party facility maintenance. Once production is back online, based on current processing agreements Blackbird expects that its inventory of wells will allow the Company to sustain consistent production of approximately 1,600 to 2,000 BOEPD and evaluate the productivity of both the Upper and Middle Montney to further establish type curves and plan for future development.

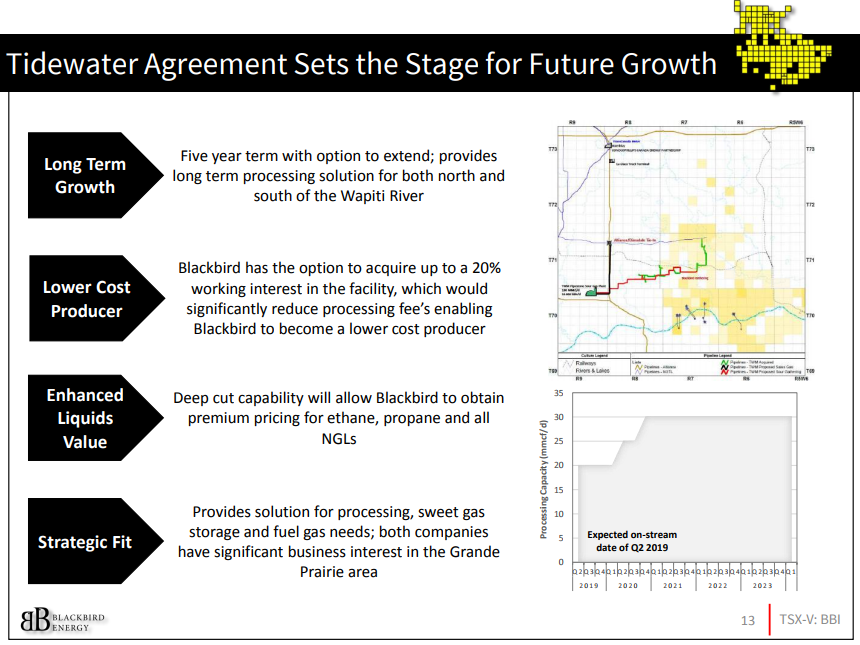

A telling communication was Blackbird’s announcement of an agreement with Tidewater Midstream Infrastructure for firm processing of raw gas from the BBI’s condensate-rich Pipestone/Elmworth Montney play in the greater Grande Prairie area of Alberta. The companies have agreed to an initial term of five years with firm capacity of 20 MMcf/d expected to commence in second quarter of 2019, increasing to 25 MMcf/d 12 months after plant start-up and to 30 MMcf/d 18 months after plant start-up.

Blackbird will have an option to acquire a working interest of up to 20% in Tidewater’s proposed deep cut sour gas processing facility located near Wembley, Alberta, which is expected to significantly reduce processing fees and establish Blackbird as a lower cost producer, the company said in its press release.

“We have line-of-sight on profitability” – Blackbird CEO Garth Braun

“This is huge,” Blackbird President, Chairman and CEO Garth Braun told Oil & Gas 360®. Prior to the announcement, Blackbird owned and operated its own Pipestone/Elmworth gas processing facility, but the company was actively negotiating with several parties to extend and expand processing capacity in the region.

“We are able to buy into this project which is absolutely critical for us,” explained Braun. “We will co-own future infrastructure which will help to further reduce processing fees.”

The facility will also offer a host of features that make the deal appealing for Blackbird, including deep cut sour gas processing and sweet gas storage. The deep cut processing will help Blackbird realize increased revenue from its ethane and propane production to the tune of $0.65 to $0.75 per Mcf, Braun said, and the 100 Bcf of sweet storage will mitigate production losses due to pipeline curtailments.

“In a marketplace where gas was a byproduct some were simply trying not to lose money on, we’re seeing some increased revenue from ours,” said Braun. “Now that we’re starting to see some stability in prices, we have line-of-site on profitability.”

Responsible growth

“Often companies struggle to go from 2,000 BOEPD to 10,000 BOEPD,” Braun told Oil & Gas 360®, “but we have no debt, and the Tidewater deal allows us to grow with the facility. We’re not overstretching our balance sheet going from 20 to 30 MMcf per day.”

“Often companies struggle to go from 2,000 BOEPD to 10,000 BOEPD,” Braun told Oil & Gas 360®, “but we have no debt, and the Tidewater deal allows us to grow with the facility. We’re not overstretching our balance sheet going from 20 to 30 MMcf per day.”

Historically, investors have rewarded growth from oil and gas companies, a trend that has continued even throughout the downturn as we discussed in our January Energy Industry Data & Trends. More recently, however, companies are beginning to let off the gas pedal and think more carefully about how they grow.

EnerCom Analytics found that at a debt-to-market cap of 1.5x or greater, reducing leverage tends to be the most effective use of free cash-flow in terms of increasing price-to-cash-flow metrics. Even though markets remain focused on growth, they have become increasingly sensitive to debt and the long-term financial health of companies.

Blackbird: the right deals can achieve growth without levering up the company

Blackbird seems to have taken this to heart by finding deals that allow the company to continue growing at a significant rate without levering up the company.

A buy-side professional who spoke with EnerCom noted that Canadian markets were quicker to place an expectation on companies that they should keep debt in check if they wanted to receive premium multiples than markets in the U.S. have been. The trend is clearly extending to the United States, however, with major U.S. players such as Cabot Oil & Gas (ticker: COG) saying they will not pursue growth if it becomes “value destructive.”

“Where we end up in the production guidance range will ultimately be dependent on in-basin pricing during the fourth quarter,” said Cabot CEO Dan Dinges. “Cabot has recent been electing to curtail a small portion of its production when pricing is value destructive. While production is a byproduct of our capital allocation to high-return projects, we are not chasing topline production growth for the sake of it and have absolutely no problem holding back volumes if the prices do not warrant moving additional gas at certain times,” Dinges said in the Q3 call.

Given the uplift in pricing from Tidewater’s deep cut processing and Blackbird’s ownership in the plant, it seems unlikely the company would encounter “value destructive” production, but the company’s financial position and Tidewater’s sweet gas storage both offer the company flexibility that has become increasingly desirable in North American markets.