Update: Blackbird acquires additional acreage in the Montney

Blackbird Energy Inc. announced that it has entered into a binding agreement with Knowledge Energy Inc. for the acquisition of two gross sections (two net) of Montney rights for total consideration of 1,923,077 Blackbird common shares. These lands are contiguous with Blackbird’s existing lands and will, upon closing, increase Blackbird’s Montney rights at Elmworth/Pipestone to 116 gross sections (100.9 net).

Assuming the same $0.55 per common share value from Blackbird’s earlier offering, the value of the shares is approximately $1.1 million.

Blackbird Energy is sitting on 137 years of inventory with upside potential

Calgary-based Blackbird Energy (ticker: BBI) closed its public offering for 112.5 million common shares for $0.55, 29.6 million shares issued on a “CEE flow-through” basis at $0.64 per share and 6.8 million shares issued on a “CDE flow-through” basis at $0.59 per share, for aggregate gross proceeds of $84.8 million, according to the company.

“Blackbird has been the only major oil and gas financing in Canada in 2017 so far,” Blackbird CEO Garth Braun said to Oil & Gas 360. “The capital being brought to us because of the asset,” he expanded, referring to the company’s Pipestone Montney assets.

Pipestone

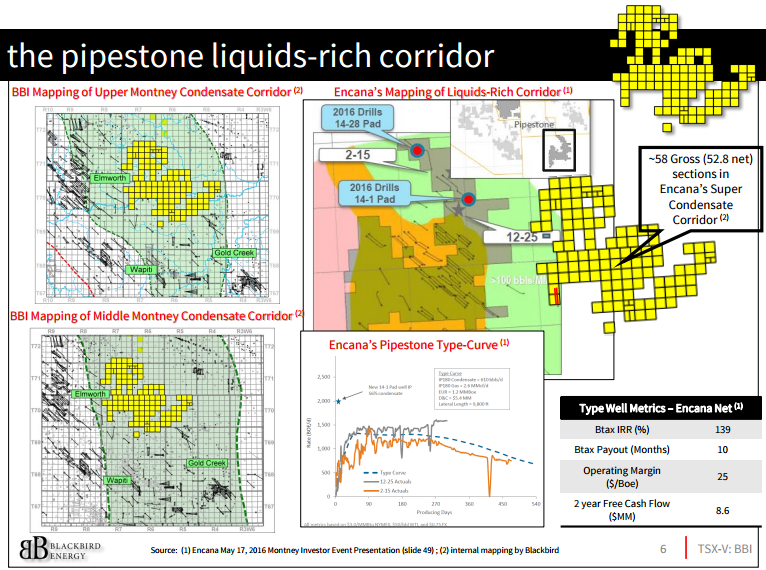

The company currently holds 98.9 net contiguous acres in the Montney inside what has been defined as the liquids-rich corridor by Encana Corp. (ticker: ECA), which holds acreage nearby as well. The play has four potential pay zones throughout, two of which Blackbird has delineated.

Blackbird plans to use the proceeds from the offering to drill and complete approximately 12 Elmworth / Pipestone Montney wells and to incur related tie-in, equipping and pipeline gathering system costs, as well as for general corporate purposes.

“We’ve put together this land package and brought infrastructure to the play for a little more than $32 million,” said Braun. “These assets used to be stranded, but not anymore. Condensate is the only competitive oil and gas resource in Canada, and we’ve got it.”

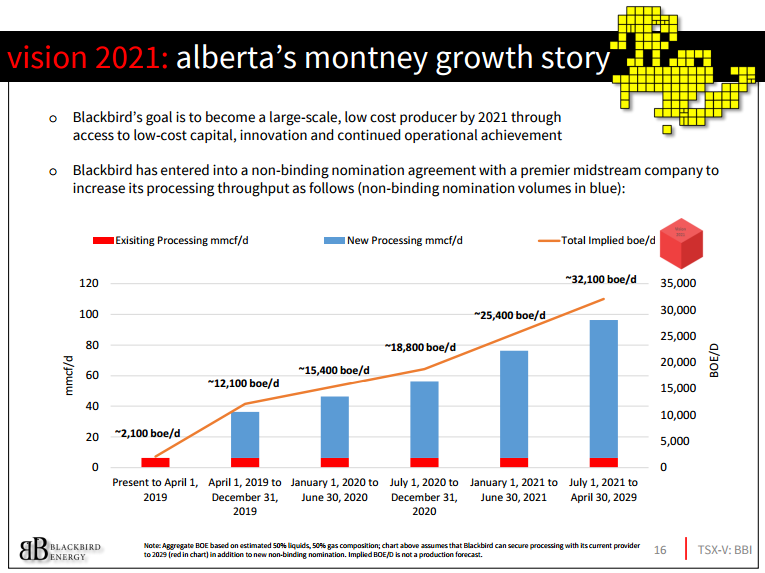

Capital will be the catalyst for 32 MBOEPD of production by 2021

The public offering will provide the catalyst Blackbird needs to produce approximately 32 MBOEPD by 2021. Along with the announcement of the public financing, Blackbird released a new investor presentation showing the company’s goals over the next five years. In it, BBI said it entered into a non-binding nomination agreement with a midstream company to increase its processing throughput to just over 32 MBOEPD by 2021.

“We’ve crushed D&C costs, we’ve implemented innovations with Stage Completions, and now we have the capital to work toward this goal,” said Braun. “We believe the resource is there, now we’re working on takeaway and processing capacity to get us there.”

For 2017, the company plans to drill eight development wells to build its production base. Blackbird also plans to drill four exploration wells to prove multiple intervals on Blackbird’s eastern acreage and north of the Wapiti River and build out infrastructure further moving forward, according to the presentation.

EnerCom Analytics shows Blackbird could have over 100 years of inventory with room for upside

In order to help give a sense of scope to the potential resource available on Blackbird’s acreage today, EnerCom used EURs from Encana’s presentation to estimate recoverable resources in place on BBI’s acreage. Assuming four successful wells per section on Blackbird’s current acreage, EnerCom Analytics believes the company would only have to drill a small portion of its overall inventory to reach its 32 MBOEPD goal, and could hold production there for more than 100 years.

One of Blackbird’s Pipestone neighbors, Encana Corporation (ticker: ECA), is active in the same area. Based on Encana’s estimates for ultimate recoveries in the “very rich gas condensate” portion of the Montney where Blackbird’s acreage sits, each well in the area could have an EUR of approximately 2,010 MBOE. Assuming four wells per section, and two intervals delineated already, Blackbird’s acreage could potentially support 800 derisked drilling locations.

If each of those wells does realize an EUR of 2,010 MBOE, those 800 locations would produce roughly 1.6 billion barrels of oil equivalent over their entire production life. Producing from those locations at 32 MBOEPD, the company has enough inventory in place to last it approximately 137 years.

There is even further upside to this number as well given that the industry is further delineating other pay zones inside the play. If all four zones prove to be economic, Blackbird’s inventory and resource could effectively double, assuming no other changes to our models.

Blackbird presents at EnerCom Dallas

Blackbird Energy recently presented as part of EnerCom Dallas to a room of investors and other members of the oil and gas industry. The audio from the company’s presentation, along with the slide deck, can be viewed here.