2017 highlights

- Equity financing – closed an upsized and over-subscribed marketed public offering for total gross proceeds of $84.8 million on March 14, 2017

- Reserves – reported Pipestone/Elmworth Montney proved plus probable (2P) reserves of $395 million

- Revenue – $6.2 million during the year ended July 31, 2017, with $48.8 million of working capital surplus

Q4 and 2017 production: While on production during the quarter, Blackbird produced 5.5 Mmcf/d of natural gas, 594 bbls/d of condensate, and 88 bbls/d of NGLs for total production of 1,589 BOEPD. While on production during the year, Blackbird produced 5.2 Mmcf/d of natural gas, 665 bbls/d of condensate, and 78 bbls/d of NGLs for total production of 1,609 BOEPD.

Gas processing: In November, Blackbird Energy Inc. executed an agreement for firm processing of raw gas produced from the company’s condensate rich Pipestone/Elmworth Montney play. The agreement has an initial term of five years with firm capacity of 20.0 Mmcf/d and is expected to commence in Q2 2019, increasing to 25.0 Mmcf/d twelve months after plant start-up and to 30.0 Mmcf/d eighteen months after plant start-up. Blackbird said that the agreement was signed with Tidewater Midstream and Infrastructure Ltd.

“The Tidewater gas processing facility will have the benefits of deep cut capability which will allow Blackbird to realize premium pricing for NGLs as well as a solution for gas storage and fuel gas needs,” said Blackbird.

Operations

Blackbird invested $78.3 million during the year ended July 31, 2017, drilling 10 gross (6.2 net) wells, completing 7 gross (4.0 net) wells, recompleting 1 gross (1.0 net) well, bringing 4 gross (4.0 net) wells on production and constructing/commissioning its Pipestone/Elmworth facility.

The company drilled a combination of wells which further developed its western acreage located south of the Wapiti River, while delineating its eastern acreage south of the Wapiti River. Results from Blackbird’s eastern lands have encouraged management to proceed with surveying for its eastern gathering system, to facilitate tie-in of pads in this area. The company anticipates construction of the eastern gathering system to commence and be completed during the second half of fiscal 2018.

Blackbird recently drilled and cased the 6-33-71-7W6 (surface location) Upper Montney well, the company’s first well located to the north of the Wapiti River. Through continued drilling optimization, Blackbird further reduced its drilling days on the 6-33-71-7W6, making it the fastest well in the company’s history to date. Blackbird expects to complete the well in December, 2017.

Blackbird said, “This is a significant well for Blackbird and will delineate the northern extent of Blackbird’s land while also retaining 14 sections of Montney rights.”

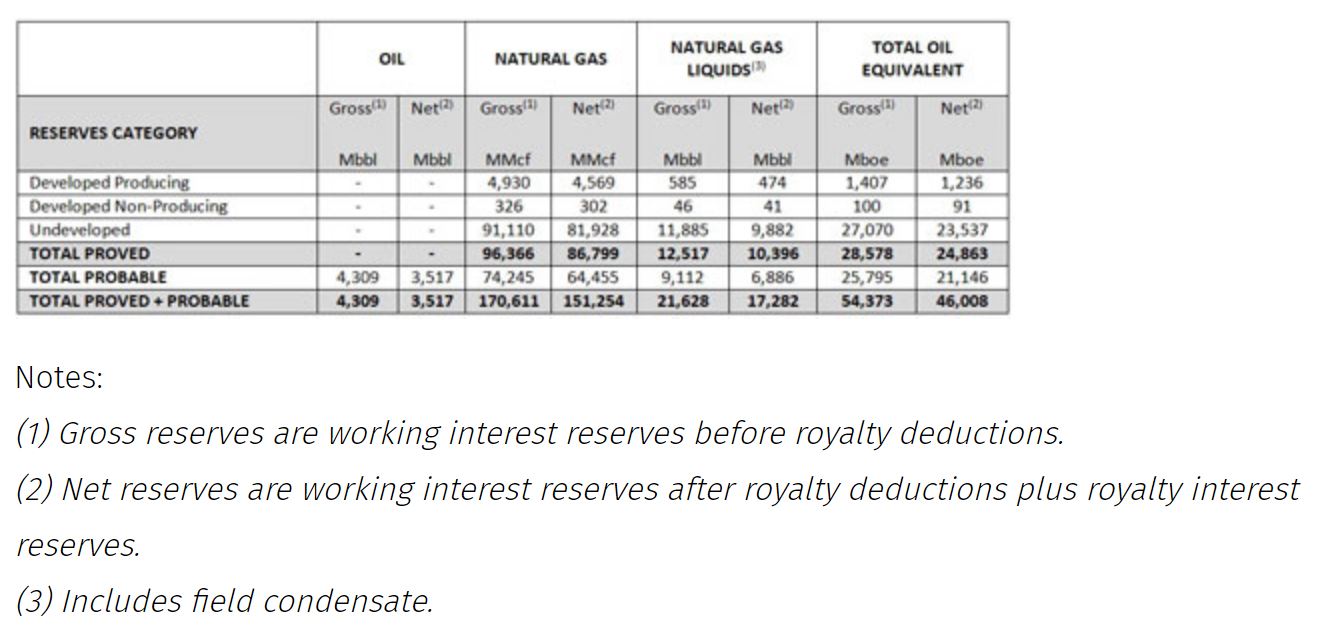

Summary of corporate reserve data

Blackbird’s independent reserve evaluator, McDaniel & Associates Consultants Ltd., completed their independent reserve evaluations effective July 31, 2017. The company’s total gross proved reserves (1P) were 28,578 Mboe at July 31, 2017. Total gross 2P reserves were 54,373 Mboe.

2017 financial and operational figures