Company will Operate in Only 2 Basins: DJ and Uinta; Deal Eliminates 57% of BBG’s Net Debt

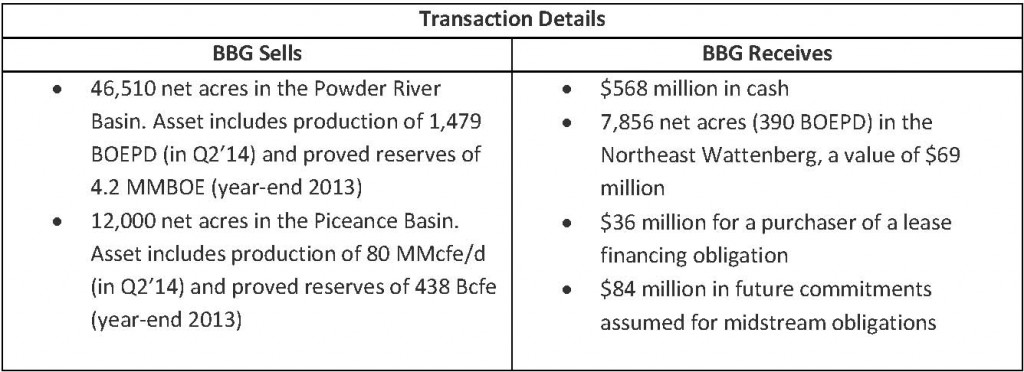

Bill Barrett Corporation (ticker: BBG), an exploration and production company focused on the Rocky Mountain region, has shifted its asset position in a deal totaling $757 million. On September 16, 2014, the company announced the sale of the majority of its acreage in the Powder River Basin, along with the remainder of its Piceance Basin acreage, for cash and acreage in the Northeast Wattenberg.

The divested assets provided 33% of BBG’s field level cash flow in the most recent quarter. The transaction is expected to close by the end of Q3’14.

In the news release, the company said it is “diligently” working to sell its remaining stake in the Powder River Basin, which includes 17,649 net acres and 170 BOEPD based on Q2’14 results. The Piceance Basin assets are being purchased by Vanguard Natural Resources – the same company involved in BBG’s first sale of its Piceance/Powder River Basin acreage in November 2012. Then, the transaction involved proceeds of $335 million in exchange for an 18% working interest in the Gibson-Gulch Piceance assets, and 254,000 net acres (50 MMcfe/d, 239 Bcfe of reserves) in the Wind River Basin and Powder River Basin.

Narrowing the Playing Field

Bill Barrett Corp.’s recent sale achieved two company goals: It simplified the portfolio while becoming a more oil-weighted producer. “We’ve fully repositioned Bill Barrett Corporation as a growth-oriented, focused oil development company,” said Scot Woodall, President and Chief Executive Officer of Bill Barrett, in a conference call following the release. “This is a significant repositioning from where the company was three years or four years ago when, we were a 90%-plus natural gas company, active in exploration and production in a majority of areas, including more than 10 different areas that we were spending capital in at that time.”

Pro forma for the transaction, BBG will operate in just two areas: Utah’s Uinta Basin and D-J Basin. The commodity mix by year-end 2014 is expected to be 70% – well above the 39% oil mix prior to the sale. Woodall projected the oil mix to be 80% in the Uinta and roughly 62% in the D-J.

Bolstering the Wattenberg Position

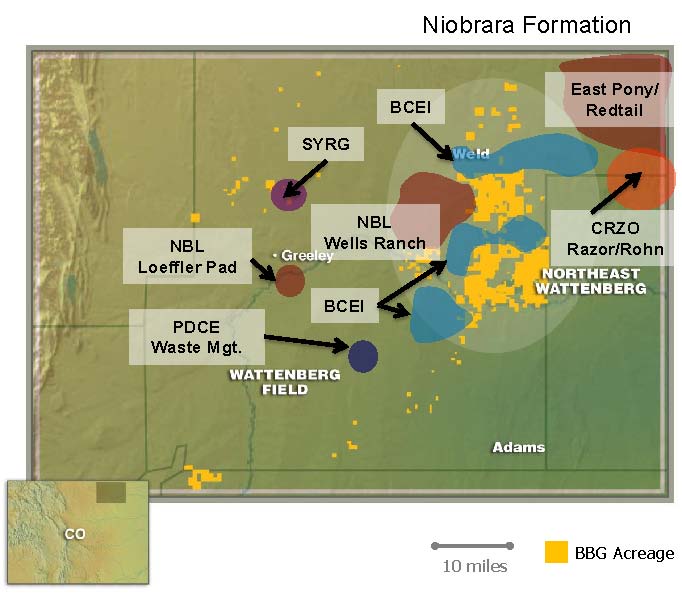

BBG has increased its Northeast Wattenberg footprint by 20% and reduced its activity elsewhere, allowing to the company to “have greater operating control and enables us to accelerate drilling and extract more value from this core area,” said Woodall.

In accordance with the announcement, BBG revised its 2014 production guidance to 9.6 MMBOE at its midpoint, a decrease of approximately 1.4 MMBOE. However, production based solely on oil is forecasted to increase by 26% year-over-year.

The company is also placing emphasis on its extended laterals program, which has drilled and cased 23 wells in the Northeast Wattenberg to date. The standard length is 4,000 feet. “Our goal was not to have the entire position delineated by year-end,” said Woodall. “The intent of the program is to continue to test the different technologies, such as extended-reach laterals, variations that we’re doing in the completion program, and provide real, repeatable results.”

Financial Impact

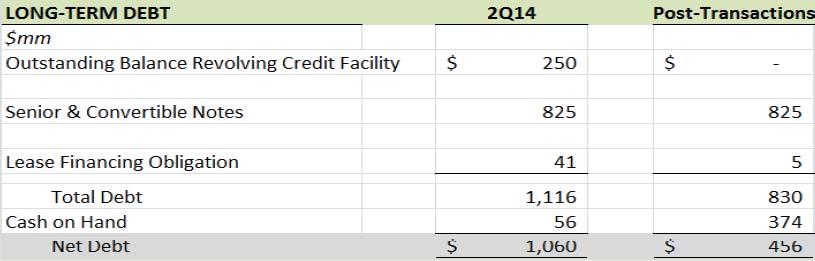

The large majority of proceeds will be used to pay down BBG’s debt. Its net debt, following the completion of the transaction, will drop to $450 million from $1,100 million. A long-term objective is to drop BBG’s net debt to EBITDAX ratio to 2.5x. The cash will handle the outstanding debt balance on the company’s revolving credit facility.

Currently, BBG has $625 million on its revolving credit facility. The company expects the number to drop to $350 million to $400 million pro forma the transaction, considering 40% of its facility is focused on proved results in the Gibson Gulch (Piceance). However, reserves are expected to climb under its accelerated drilling program in the remaining properties. BBG believes $575 million in liquidity will be available following the payoff of the existing credit facility.

Nearby Operations

BBG plans on running three of its five rigs in the Wattenberg in 2015, a year which “will be all about efficiency,” said Woodall. Bonanza Creek (ticker: BCEI) and Noble Energy (ticker: NBL) are operating adjacent to BBG. NBL has drilled 12 wells at its Wells Ranch asset and, like BBG and many other Wattenberg operators, is testing completion techniques. Official results have not been released, but NBL management said the pad exceeded expectations at the 30-day production mark.

BCEI is utilizing a 40-acre spacing program to exploit the Niobrara B and C benches. Each well on its first four-well pad tested above the 313 MBOE target type curve, and a five well pad is planning on being completed in the current quarter. Two 9,000 foot laterals in the same benches achieved an average 30-day production rate of 705 BOEPD. An additional 11 extended reach laterals will be drilled within the fiscal year.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.