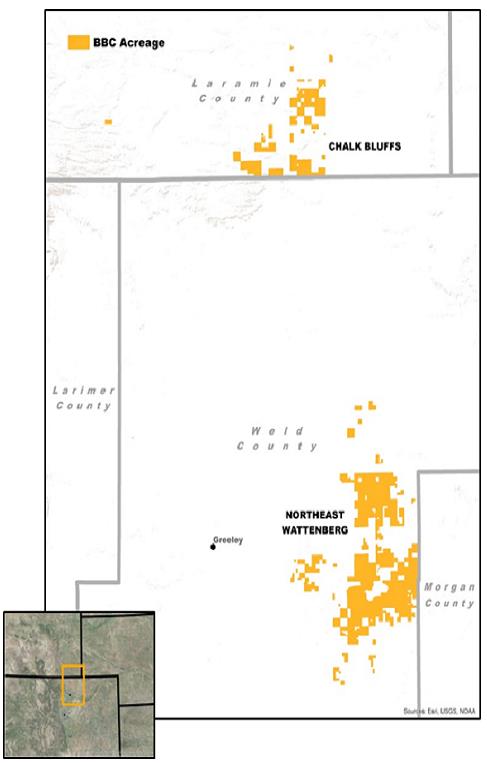

Bill Barrett Corporation (ticker: BBG) has built a core position in the Northeast Wattenberg field in Colorado’s Denver-Julesberg (DJ) Basin, where it holds 71,900 net acres. The company also has producing acreage within the Uinta Basin in Utah, numbering approximately 24,000 acres.

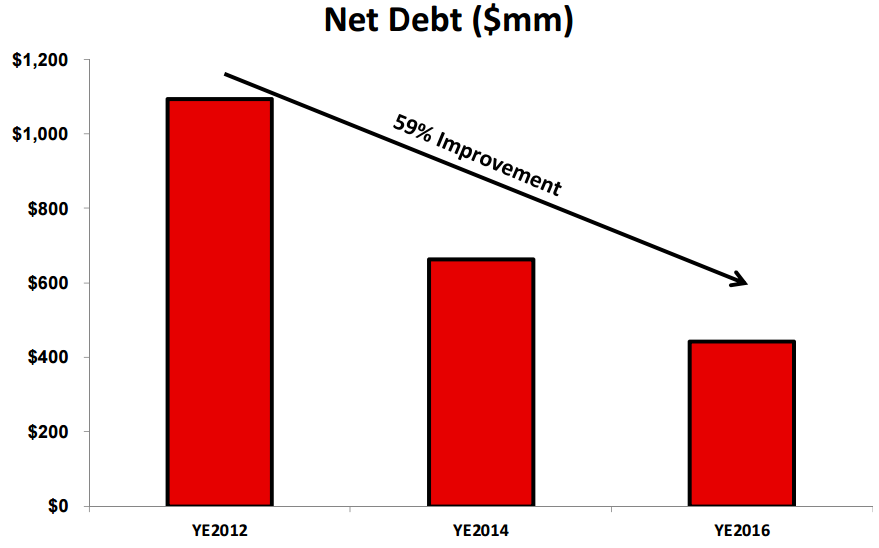

Debt load 1/3 of what it once was

Bill Barrett Corporation has steadily reduced net debt levels to about $400 million in 2016, all the way down from $1.1 billion in 2012.

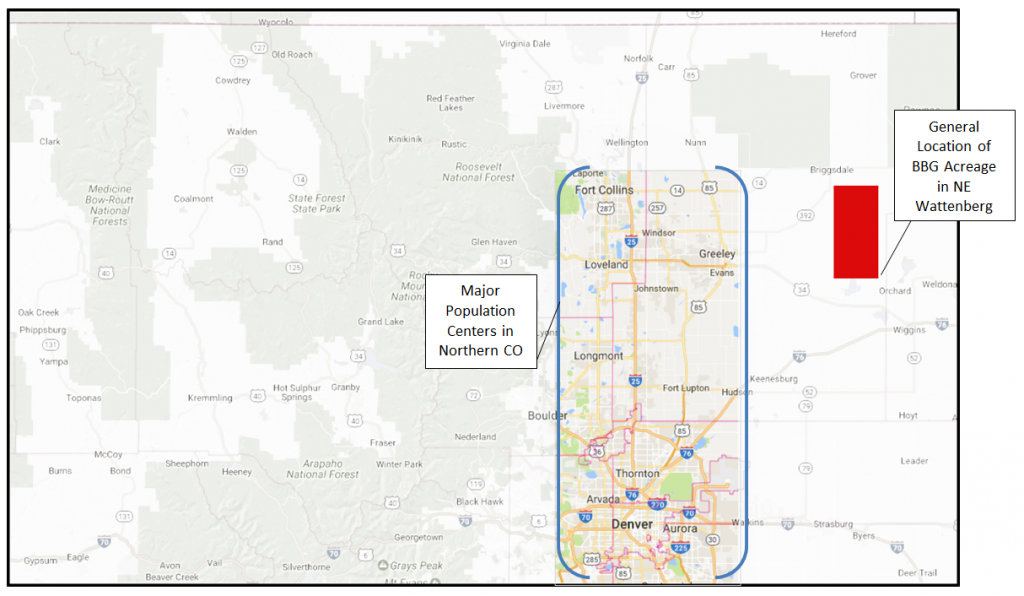

Rural Wattenberg locations

Unlike other Wattenberg operators who are developing their oil and gas assets located within minimal distance from new homes and communities that have been built during Colorado’s recent residential construction boom, BBG is fortunate to have its assets in mainly rural northeastern Colorado, away from the growing population areas that are literally bumping up against other Wattenberg oil and gas operations.

The rural location of Barrett’s Wattenberg assets has allowed for less contentious development opportunities.

Extended reach laterals: NE Wattenberg SOP

Bill Barrett Corp.’s Wattenberg assets are situated in a setting with few occupied structures, making the area a natural candidate for extended reach lateral wells.

Of Bill Barrett’s total acreage, the company said 68,000 net acres are ideal for extended reach lateral (XRL) development—allowing for maximum contact of Niobrara stacked pay. BBG said the majority of its XRL development can be developed using 1,280 acre spacing.

BBG acquired 13,800 additional net acres in March, 2017 for $13.3 million. The acreage holds approximately 80 XRL locations under operation and 20 more potential XRL locations. The new acreage has potential to access the Niobrara B and C, and Codell horizons, the company said.

By drilling Wattenberg XRL’s, Barrett has achieved a 173% increase in daily footage drilled to 3,661 ft./day in 2017, up from 1,343 ft./day in 2014. The company has also managed to chop drilling days per well in half, by cutting its average drill time for a Wattenberg well to 7.5 days in 2017, from 18.3 days in 2014.

One-two punch: XRLs plus completions tailored for each zone

Bill Barrett’s optimization of its DJ assets has not been solely focused on the creating XRL presence in the area, but also making use of enhanced completions tailored to each producing zone.

In its 2017 completions goals, Barrett intends to increase proppant usage to 1,500 lbs. per lateral foot from its previous 1,000 lbs. per lateral foot. Barrett also intends to reduce its frac-stage spacing from 175 ft. to 100 ft., taking completions from 55 to 95 stages.

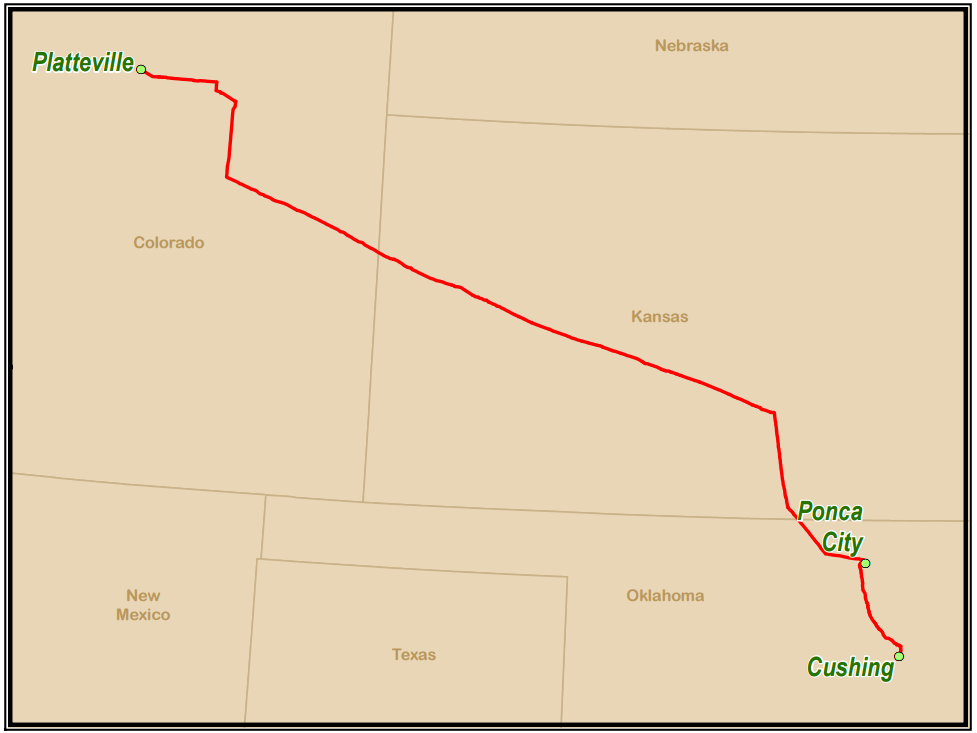

Another catalyst

A positive catalyst for BBG occurred in 2016 with the completion of the Saddlehorn/Grande Mesa oil pipeline, which increased takeaway capacity in the DJ Basin to approximately 650 MBPD. For BBG, the availability of this pipeline may generate a favorable price differential, adding between $3-4 to its oil margin in that region.

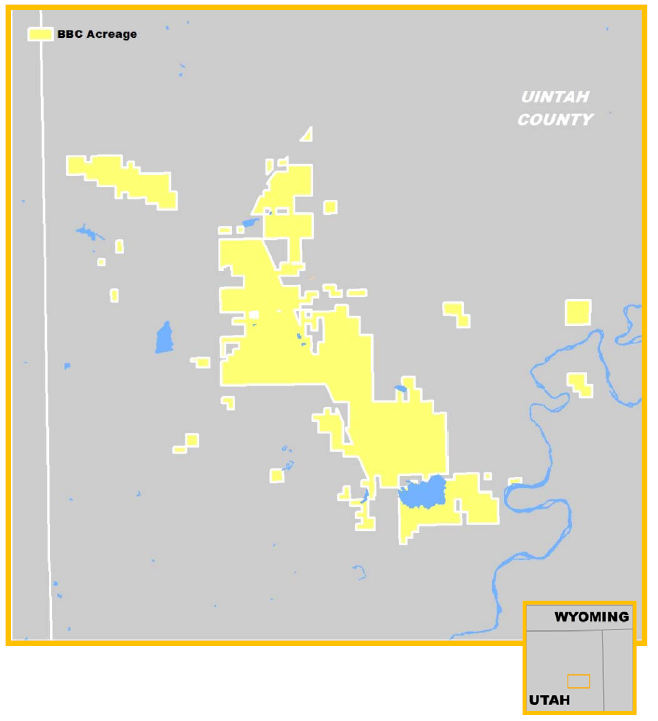

Uinta basin asset

Bill Barrett also holds approximately 24,000 net acres in the Uinta basin in Utah. In Q1, 2017 the Uinta assets produced approximately 1,700 BOEPD—looking into 2017—the company announced its plan to do recompletions on nine wells beginning in Q2, 2017.

BBG presenting at EnerCom

Bill Barrett Corporation will be a presenting company at the upcoming EnerCom conference in Denver, Colorado—The Oil & Gas Conference® 22.

The conference is EnerCom’s 22nd Denver-based oil and gas focused investor conference, bringing together publicly traded E&Ps and oilfield service and technology companies with institutional investors. The conference will be at the Denver Downtown Westin Hotel, August 13-17, 2017. To register for The Oil & Gas Conference® 22 please visit the conference website.