In the past two days ExxonMobil Corporation (ticker: XOM), Chevron Corporation (ticker: CVX), and ConocoPhillips (ticker: COP) all reported second quarter earnings and gave operational updates.

ExxonMobil

ExxonMobil earned $3.4 billion in Q2, which brought the company’s earnings for the year-to-date to $7.4 billion. This represents a 97% improvement from the same quarter of 2016—in which Exxon earned $1.7 billion. The $3.4 billion in earnings is approximately $660 million less than the previous quarter of 2017, which Vice President of Investor Relations and Secretary Jeffrey Woodbury attributed to “weaker results in the upstream in chemical segments.”

The company reported average production volumes of approximately 3.9 MMBOEPD per day, which was a 1% decrease from Q2, 2016. Exxon spent $3.9 billion in capital and exploration, which reflected a decrease of 24% from a year ago.

In operational updates, Exxon is proceeding with the first phase of its Liza field development in offshore Guyana where it expects oil production will begin by 2020. Production will be through a floating production, storage, and offloading vessel—or FPSO—and is expected to reach approximately 120,000 BOPD.

In addition to a July discovery of oil bearing sandstone in the Payara development, Exxon found more and 197 feet of oil bearing sandstone in the Liza-4 well, which may allow for a second phase of development.

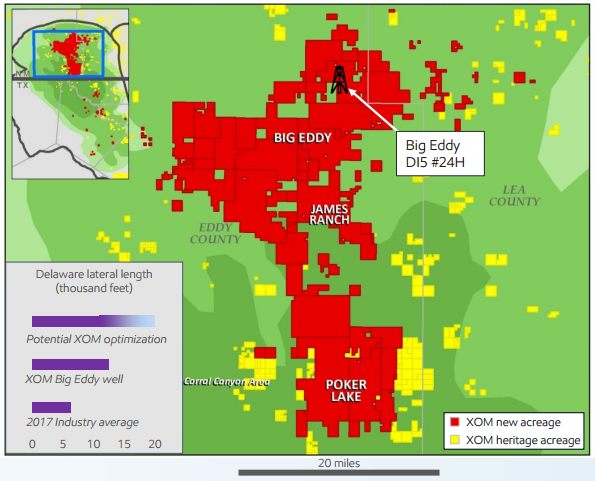

16 rigs in the northern Delaware

In its northern Delaware basin acreage—which numbers approximately 1.8 million acres—Exxon had 16 operated rigs active with over 165 MBOEPD of production in Q2.

Exxon’s year-to-date Capex was $8.1 billion—a decrease of 21% from 2016—and its capital guidance remained unchanged after the Q2 update at approximately $22 billion for the year. The company’s cash flow from operations and sales totaled $16 billion, $8.5 billion of which was free-cash flow.

Exxon Q2 conference call Q&A

Q: Starting with Liza just because it sounds like there’s been some developments there. So as the recoverable resource reserve gets bigger and bigger, are there any other factors in place with the development that might be changing? Is this project getting more complicated or less complicated as you’re building economies of scale? And just curious about your thoughts around development impacts of the resource increasing and ongoing discoveries.

Jeffrey Woodbury, VP of investor relations: Well, the short answer is we really like what we’ve got, Sam, and we’ve got significant scope to continue to increase the resource. As you can see, we’ve grown the acreage substantially to I think about 14million gross acres now with the additional pickup of Surinam.

Yes, I mean, clearly you can see the model that we’ve employed here is that we’re trying to get production or revenue stream on pretty quick through this leased FPSO approach. Five years from discovery to startup is industry leading. At the same time will continue to maintain the ongoing exploration and appraisal program that is, as you’ve seen in our recent communication, has continued to build the resource base, positioning us for subsequent phases of development.

And you can see the analog we’ve got here with what we did in Angola block 15, where we got out there early with at least FPSO to get a revenue stream on, we maintained our exploration program. We built mass, it allows us to get into much more of a manufacturing process. We designed one template and then we go ahead and build that template throughout the development of the resource and that allows us ultimately to make this value proposition I talked about with Doug previously, drive that unit development cost down and maximize the results. So as I indicated my prepared comments, very excited about where we are. A lot of activity going on, a lot of scope. This is exactly what we want to be doing right now.

ConocoPhillips

ConocoPhillips reported a loss of $3.4 billion for Q2 2017. The company expects approximately $16 billion in dispositions before the end of 2017 from its properties in the San Juan, Barnett, and Panhandle.

The company reduced its debt by $3 billion in the second quarter, and expects to further decrease debt by $2.4 in the third quarter—with the intent of dropping debt to below $20 billion by year end.

COP produced an average of 1.425 MMBOEPD during Q2—which is 121 MBOEPD less than the same quarter of 2016. The production was above the company’s anticipated production guidance. The company’s continental U.S. operations increased to 226 MBOEPD in Q2 from 221 MBOEPD in Q1.

This was influenced by the operation of 12 rigs in the Eagle Ford, Bakken, and Permian assets. It spent $1 billion in capital expenditures during Q2 and lowered its 2017 guidance to $4.8 billion.

In looking forward, ConocoPhillips expects that it will average between 1.17 and 1.21 MMBOEPD of production during Q3—excluding production from its Libya assets. The decrease from its Q2 production is reflective of production loss from its planned dispositions.

ConocoPhillips Q2 conference call Q&A

Q: So ConocoPhillips and the super majors too have increased their investment in U.S. shale over the last several years as understanding of the subsurface has grown. But in contrast there are a lot of public and private E&P companies that seem to be determined to drill many of their best prospects even at low commodity prices which seems kind of curious given the NPV profile of these wells.

Alan Hirshberg, EVP production, drilling and projects: Yes, we think that you can drill too fast in these unconventional plays, and we like to make sure that we’ve progressed sufficiently in our technical understanding and down the learning curve before we go into full manufacturing mode and really drill things up. And we think we get ultimately better – much better recoveries and avoid causing damage to an area that you can’t go back and fix very easily once you’ve changed the subsurface pressures. And so we think that has stood us in good stead and allows us to maximize the value that we get from our acreage.

Second, with regard to where we are in the learning curve, I so far, despite the reports sometimes of early demise, I haven’t seen any slowdown in the pace of improvement in our unconventional. So it still feels to me like we’re in the relatively early innings. Maybe we’ve advanced getting toward the half-time, but to mix metaphors between different sports, but I haven’t seen any slowdown. I’ve seen the tools that we’ve used to continue to make progress have shifted over time. But the kind of pace of progress has stayed pretty consistent. I haven’t seen a slowdown. So we’ve still got –I still think we have a long ways to go.

Chevron

Chevron reported earnings of $1.5 billion for the second quarter of 2017—an about-face from its Q2 2016 loss of $1.5 billion. The company’s Chairman and CEO, John Watson, noted that Chevron’s oil and gas production was up 10% in the second quarter from a year ago and that its operating expenses were down 10% and capital spending was down 25% in the first six months of 2017, as compared to the first six months of 2016.

Chevron produced 2.78 MMBOEPD during Q2, up from its 2.53 MMBOEPD production from Q2, 2016. It attributed the increase in company-wide production to increases from major capital projects, base business, and its shale/tight formation properties, as well as a reduction in downtime for maintenance.

Chevron’s U.S. based upstream operations sustained a loss of $102 million in Q2, 2017—down significantly from its $1.11 billion loss in Q2, 2016. The company’s international upstream operations earned approximately $955 million during Q2, compared to its Q2, 2016 loss of $1.35 billion.

Chevron capital and exploratory expenditures totaled $8.9 billion in the first six months of 2017—down from $12 billion in the first six months of 2016. The majority of the expenditures—89%–were dedicated to its upstream business during 2017.

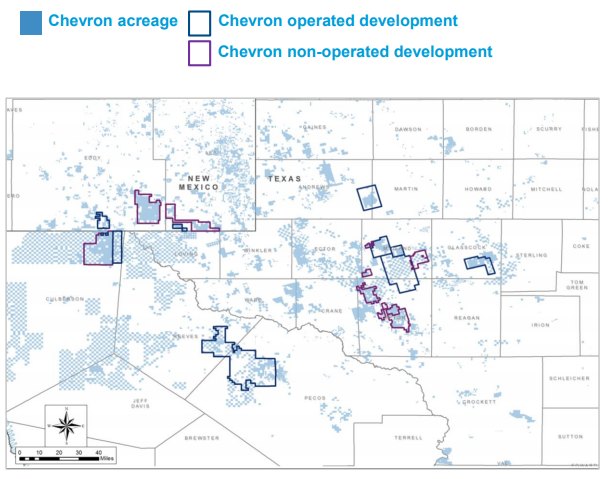

In its Midland and Permian basin assets the company has approximately two million acres and produced approximately 178,000 BOEPD at the end of the second quarter. As of Q2, it was operating 13 drilling rigs, with another seven net rigs operating in joint venture operations. Chevron intends to add more rigs to its Permian assets every eight to ten weeks, with the goal of having a total of 20 rigs active at the end of 2018.

Chevron Q2 conference call Q&A

Q: [Talk about] the Permian running well ahead of your guidance.

James Johnson, EVP Upstream: We’re seeing very good performance out of the Permian. Our drive on capital efficiency and good execution is really paying off for us. We also have seen good performance from our new basis of design. It’s early yet but the results are encouraging. As we look at our overall portfolio and as we finish the period of heavy capital spend that we’ve been on, we have a pretty youthful portfolio that allows us a lot of opportunity to continue to build now on the infrastructure that’s been installed. And to capitalize on the Permian as a very large resource base for us. Our current plan that we’ve given you has the rigs running up to 20 company operated rigs by the end of next year.

One thing I really like about the Permian is we’re monitoring financial performance and financial returns virtually on a real-time basis. And as we continue to see performance out of Permian we have the option to continue to expand that rig fleet. Or to hold the rig fleet depending on the performance that we’re seeing. So we have seen a continued set of surprises to the upward over the years as we’ve shown you what the Permian can do for us and I would expect to see continued performance as we move forward. What’s first and foremost, out of all this is that the Permian is one of our primary assets and it will attract the capital that’s necessary. We are not holding back capital to the Permian and I don’t think we’ll need to. As these big capital programs roll off, the amount of discretionary capital allocation that we have has been increasing pretty significantly and that’s going to continue over the next several years. So I’m very encouraged.