Bellatrix updates hedging contracts

Calgary’s Bellatrix Exploration Ltd. (stock ticker:BXE) has reported its plans to acquire complementary assets within its core Ferrier area of west central Alberta.

The company plans to acquire the assets from POSCO Daewoo E&P Canada Corporation for total consideration of approximately $9.5 million. Bellatrix also updated its commodity risk management contracts.

Acquisition consolidates working interest ownership, when complete will add 1,250 BOEPD

The acquisition includes approximately 1,250 BOEPD (65% natural gas, 35% liquids) of low decline (<15%) current production and represents the consolidation of working interest ownership in existing producing wells and formation rights. The acquisition consolidates 100% of partner assets in the area.

Bellatrix reported that the acquisition includes production volumes from 61 gross (19.6 net) producing wells and acreage originally acquired by Daewoo International Corporation and Devonian Natural Resources Private Equity Fund in 2013, and subsequently jointly developed with Bellatrix.

Total consideration of approximately $9.5 million includes $1.75 million in cash and 6.75 million shares of Bellatrix. The transaction has an effective date of September 1, 2018.

The acquired volumes are expected to be processed through Bellatrix owned and controlled infrastructure and facilities, and as a result, the acquisition is expected to have no incremental impact on general and administrative expenses.

Details of the transaction include:

| Total consideration | $9.5 million |

| Estimated current production | 1,250 boe/d (65% natural gas, 35% liquids) |

| Estimated base decline rate | <15% |

| Estimated 2019 net operating income1 | $3.5 million |

Estimated acquisition metrics include:

| Estimated current production | $7,600/boe/d | |

| Estimated 2019 net operating income multiple | <3.0x |

Note (1): Estimated 2019 net operating income based on prices of $1.66/GJ AECO and US$62.88/bbl WTI.

[contextly_sidebar id=”x1qsDJtJuxVHqej09tnMifqQF9NZL3gf”]

The asset acquisition will contribute approximately one month of volumes (based on an estimated closing date on or before November 30, 2018) to Bellatrix’s annual results or the equivalent of approximately 100 boe/d, therefore Bellatrix is not amending its 2018 full year production guidance range.

Updated commodity price risk management protection and market diversification contracts

Bellatrix’s entered into a series of market diversification contracts approximately one year ago that provide a distinct advantage and benefit from recent North American natural gas price improvement.

Bellatrix’s market diversification sales into the Dawn, Chicago and Malin markets represent approximately 55% of Bellatrix’s natural gas volumes (based on the mid-point of 2018 average production guidance). Bellatrix said the three markets have demonstrated price improvement in concert with strengthening Henry Hub prices.

Bellatrix has proactively fixed the prices on a portion of these markets to reduce the impact of commodity price volatility on our business. As at November 26, 2018 Bellatrix has locked in fixed prices in December 2018 (approximately 30% of natural gas volumes based on current annual 2018 production guidance at a Canadian equivalent price of approximately $4.33/Mcf) and the first quarter of 2019 (approximately 20% of natural gas volumes at a Canadian equivalent price of approximately $4.20/Mcf) as follows:

| Month(s) | Market | Quantity | US$/MMBtu Price | Net Cdn$/Mcf Price(1) |

| Dec 2018 | NYMEX/Dawn/Chicago Avg. | 50,000 MMBtu | US$4.59/MMBtu | $4.33/Mcf |

| Jan – Feb 2019 | NYMEX/Dawn Avg. | 30,000 MMBtu | US$4.64/MMBtu | $4.40/Mcf |

| Mar 2019 | Malin/Dawn Avg. | 30,000 MMBtu | US$4.19/MMBtu | $3.78/Mcf |

Note (1): Net Canadian equivalent price is calculated as the US$ fixed price, less contracted differential, adjusted to Canadian dollars at an assumed exchange rate of $1.30 USD/CAD.

Bellatrix ‘s market diversification contracts include a total of 75,000 MMBtu/day of market exposure as follows:

| Product | Market | Start Date | End Date | Volume |

| Natural gas | Chicago | February 1, 2018 | October 31, 2020 | 15,000 MMBtu/d |

| Natural gas | Chicago | November 1, 2018 | October 31, 2020 | 15,000 MMBtu/d |

| Natural gas | Dawn | February 1, 2018 | October 31, 2020 | 15,000 MMBtu/d |

| Natural gas | Dawn | November 1, 2018 | October 31, 2020 | 15,000 MMBtu/d |

| Natural gas | Malin | February 1, 2018 | October 31, 2020 | 15,000 MMBtu/d |

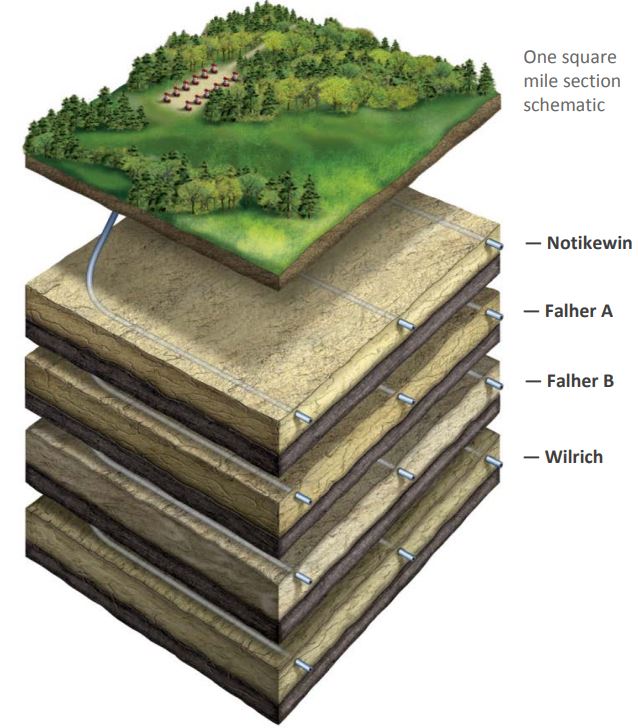

Bellatrix is principally focused on development of the Spirit River liquids-rich natural gas play in Alberta.

View the Bellatrix Exploration company profile page and analytics tearsheet here.