Blackbird position in the Montney remains economical, even at today’s prices

Blackbird Energy (ticker: BBI, BlackBirdEnergyInc.com) presented at EnerCom’s The Oil & Service Conference™ yesterday at 2:30 p.m. PST. Blackbird Energy is an emerging Canadian exploration and production company focused on the highly prospective liquids-rich Montney natural gas resource in Alberta. Blackbird is focused on the development of its Elmworth Montney project where it has 100% working interest in 81 sections of highly prospective Montney resource. The company announced that its 2-20-70-7W6 Monteny well beat its gas and BOE type curves by 109% and 80%, respectively, in January.

Even at today’s oil prices, Blackbird’s wells remain economical, company president, chairman and CEO Garth Braun told the audience in San Francisco. Blackbird’s 2-20 well achieved 1,768 BOEPD on a restricted flow, with 94 barrels per MMcf of production, and it’s that condensate that BBI is targeting, Braun said.

Many assume Blackbird is looking at the gas coming out of the wells, but Braun said the condensate is the real prize.

“Condensate trades on par with WTI,” Braun said. “Even at an 8%-10% premium, at times.” This is excellent news for a Canadian producer, with Canadian benchmark WCS typically trading at a substantial discount to its U.S. counterpart. Blackbird sees additional gains when selling the condensate into the U.S. as well, because of the weakness of the Canadian dollar against the U.S. dollar, Braun said.

Demand for condensate is also high in Canada, which consumes about 400-450 MBOPD, and only produces about 150-200 MBOPD domestically, Blackbird’s CEO said. The condensate is mixed with heavy oil sands crude so that it can flow through pipelines, making it essential to oil sands producers.

”The Alberta government give us major credits for focusing on the condensate,” Braun said.

Moving from delineation to production

Blackbird was able to buy into the Montney at a low price compared to its neighbors. The company assembled a position of 75 sections inside the play for just $6.9 million. NuVista Energy (ticker: NVA) bought 12 sections four miles west of BBI’s position for $35 million.

Other acquisitions in the area are seeing price tags in the hundreds of millions of dollars as well.

The activity on the acreage surrounding Blackbird has gone a long way in de-risking the play. The play has gone from around 30 wells to 164 in just a few short years, and now that Blackbird believes it has a strong understanding of the play, it is shifting its focus towards growth.

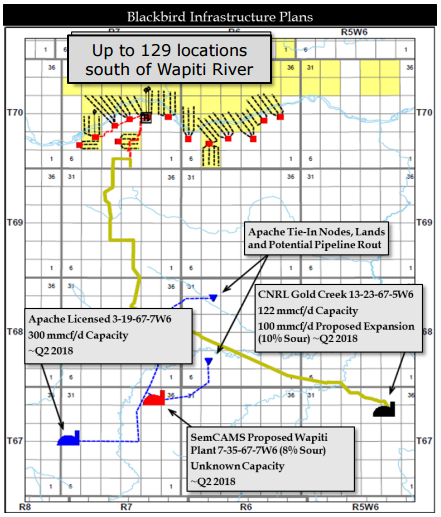

The company announced earlier this week that both the size and value of its reserves increased by 313% and 120%, respectively. Blackbird is still in the very early stages of building reserves though, said Braun, and the next step for the company will focus more on development of infrastructure, which will allow Blackbird to move from delineation to cash flow.

The company recently acquired 5 MMcf/d of firm full path service to the Gold Creek metering station south of its position. Braun said it would have been possible to put more production in the pipeline, but he didn’t want to put undue stress on the company.

“I don’t want to chase my production with drilling because that will put excess pressure on my company,” said Braun. “Let me put it this way though: on both the sour gas capacity and the takeaway, both are scalable to a substantially larger amount.”

Blackbird plans to build out its own infrastructure to leave it in a strong position in this still-developing play. Braun said initially the infrastructure would be able to handle 5 MMcf/d, but would be scalable to as much as 30 MMcf/d, eventually.

Blackbird plans to build out its own infrastructure to leave it in a strong position in this still-developing play. Braun said initially the infrastructure would be able to handle 5 MMcf/d, but would be scalable to as much as 30 MMcf/d, eventually.

“If prices remained compressed, we can continue to grow organically with this infrastructure, just with our cash flow,” Braun said.

Looking at the low price environment as an opportunity

As the company begins its push toward the cash flow stage, Blackbird is viewing the current price environment opportunistically, said the company’s CEO.

“We saw this economic pull-back as an opportunity to attach ourselves to low-cost, high-quality services, both in the drilling completion, and in the infrastructure,” he said.

Blackbird has also focused on innovation as a source of cost reduction. The company was the first to drill a mono-bore well in the play, which saved BBI $500,000. It has also pushed down the number of days spent drilling to 24 from 49, and Braun and his team believe the next one can be done in as little as 19 days.

The company also carries zero debt, giving it a financial edge as other producers look towards spring redetermination with some level of dread.

“We’re contra-cycle,” said Braun. “There’s a window right now, and you need to take advantage of that window.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.