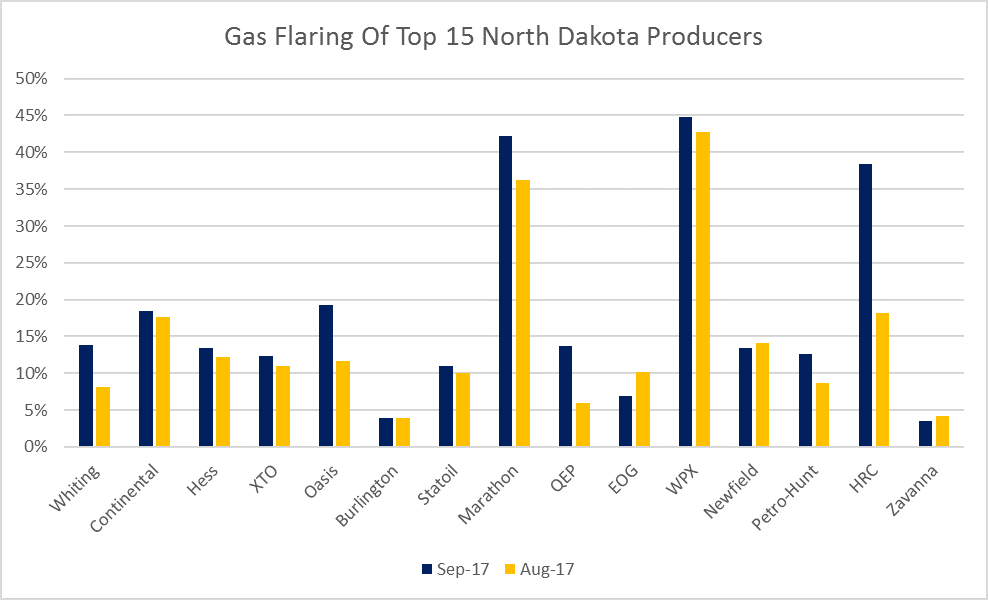

17% of North Dakota’s Bakken gas was flared in September: that’s half of basin’s original flaring rates

Flaring only 8% in August, Whiting Petroleum’s flared gas is among the lowest as a per cent of its overall gas production

Gas output in the Bakken is growing and has set new records in four of the last six months, according to the North Dakota Industrial Commission.

While gas production is not the primary focus of operators in North Dakota, it is an important consideration. In previous years in the Bakken, particularly when development was just starting, there was only limited gas gathering infrastructure. Operators with no place to put gas flared it at rates far higher than in other basins. According to NDIC, more than 35% of the state’s gas production was flared before gathering infrastructure was built.

In 2014, NDIC set gas capture goals intended to reduce flaring to 10% by 2020. This effort seems to have been successful, and the industry has almost always reached its targets for gas capture.

In the most recent month with data, September, though, flaring reached 17%, compared to the current target of 15%. This was due to several force majeure events, specifically, unanticipated maintenance, a pipeline shutdown and road restrictions.

Whiting, Burlington, Zavanna flare least

In total, North Dakota producers flared nearly 8.8 Bcf of gas in September, compared to 7.5 Bcf in August. The largest producer of gas in the Bakken is Whiting Petroleum (ticker: WLL), which produced 6.7 Bcf in September. As the largest producer of gas, Whiting also flares one of the largest volumes of gas, 0.9 Bcf in September. However, Whiting actually flares at lower proportions than most producers. Whiting flared 13.8% of its gas in September but only 8.1% in August.

Whiting flared one of the lowest proportions of gas among large producers in August, surpassed by only by Burlington, QEP and Zavanna. Several companies, on the other hand, are flaring significantly above targets. Marathon Petroleum and WPX, for example, flared above 35% of produced gas in both August and September.

Reaching 100% gas capture is very difficult, and requires the right infrastructure in place and significant coordination between midstream providers and gas producers.

Smaller companies are much more likely to flare either all or no produced gas.

The largest company that flared none of their gas was Remuda Energy Development, which produced about 20 MMcf in September. Extremely small companies, which produced less than 5 MMcf of gas in September, are actually more likely to flare either none of their gas or all of their produced gas, rather than some percentage in between. The North Dakota Industrial Commission lists 44 companies that produced less than 5 MMcf of gas in September. Only 27% of these flared some proportion of their gas.