The United States energy market has big decisions ahead of it: Do we export oil? How do we safely transport crude oil across our country? Should we build the Keystone pipeline? And perhaps more captivating is what the industry/country should do with the tremendous amounts of natural gas we’ve untapped. The natural gas landscape continues to make headlines by means of the continuous industry revolution and, most notably, freakishly high spot prices in the midst of an Arctic-cold stretch in the United States.

And now, looming below the radar is the up-and-coming liquefied natural gas (LNG) export market that could emerge here in the United States. Southeast Asia countries, especially Japan and South Korea, are relying heavily on future imports to fuel its surging energy needs. The nuclear meltdown of Fukushima from a 2011 tsunami has had drastic consequences, with contamination levels being classified on the same scale as the Chernobyl disaster. Japan has since begun to reduce its reliance on nuclear facilities and more on natural gas. The only problem is many of the nations are hamstrung by an extremely limited hydrocarbon environment and are forced to look abroad to fulfill its needs. OAG360 notes that despite Japan’s increased reliance on foreign countries for natural gas and the United States’ growing natural gas reserve base, the EIA reports LNG exports to Japan actually decreased from 2012 to 2013.

LNG Market Rising

Japan is equipped for the long haul in the LNG markets and has contracts in place with super producers like Australia and Qatar, as well as independent U.S. natural gas companies like Cabot Oil & Gas (ticker: COG). COG recently announced a 20-year definitive gas sale and purchase agreement to sell LNG to Japan. The contract is set to begin in 2017 and will involve the sale of 350,000 MMBtu /d to SSUMY’s Dominion Cove Point LNG facility. The resources will come from COG’s operations in the Marcellus Shale, where the company achieved a new gross production record of 1.5 Bcf/d in late 2013.

Supermajor companies are switching gears in the midst of the United States shale boom and are redirecting attention to offshore LNG projects. Due to the size of the supermajors, prospects in the United States can be materially insufficient especially when their smaller competitors can acquire/sell acreage and nimbly move throughout plays.

Larger operators are taking their capital elsewhere. Chevron (ticker: CVX) said spending for its LNG ventures in the Asia Pacific will reach peak spending in 2014 and will account for roughly 34% of the company’s $39.8 billion budget ($13.25 billion). The region is expected to become CVX’s top production area by 2017, with the flow expected to reach an astounding 1 MMBOEPD. Shell (ticker: RDS.B) is following a similar path and is embarking on projects in the Asia-Pacific, Gulf of Mexico and offshore Brazil before 2016.

Japan and South Korea’s Future

Japan is already the world’s greatest LNG importer and is the third largest oil importer, according to the EIA. The country has lost $30 billion in transportation costs since the nuclear decommissioning began, due largely to its tremendous import costs. Japan accounted for 37% of global LNG imports in 2013.

The second largest importer of LNG is South Korea. The country imports virtually all of its energy and estimates say power demand will surge 60% by 2027. All 48 south Asia countries will collectively increase its thirst for energy demand by 67% from 2010 through 2035. South Korea, like Japan, is following suit on reducing its nuclear reliance. Reports have revealed its nuclear division is overrun with corruption and fabricated safety reports.

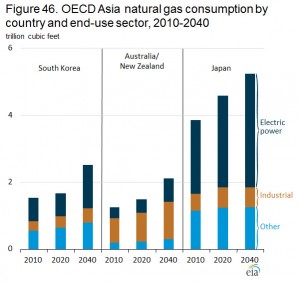

The EIA expects natural gas needs in both countries to increase by 1.0% to 1.7% until 2020. Japan’s needs will then slow to roughly 0.3% per year through 2040, while South Korea’s ramp up to 2.0% annually for the given time period. Other countries expected to stand out in the LNG market are China and India. China’s need is vastly outpacing its production and now account for 29% of the country’s energy consumption, while India is the world’s fourth greatest energy consumer and relies heavily on imports from Qatar.

What About Now?

So, contracts are in place for a huge future LNG market. However, many of those projects are a few years away from commencing and the glut in supply is forcing the stated nations to pay a premium for immediate LNG imports. In fact, LNG imports jumped by 36% following the Fukushima shutdown, according to a report from James Jensen, President of Jensen Associates, at the US Unconventional Hydrocarbon Renaissance & the Impact on Japan Conference on January 14, 2014. Prices in Japan reached an all-time high in 2012 as the country continued its effort to dial back on coal and nuclear power. The switch was no small feat, considering the two accounted for 54% of power generation in 2009. It comes as no surprise that 89% of LNG imports were consumed by the electric utility sector. LNG will continue to factor into future plans as coal and nuclear consumption has dropped to only 30% of Japan’s consumption.

The crisis in Ukraine has suddenly amplified the spotlight on the natural gas market, and the United States is viewing LNG exports as a tool to weaken Russia’s European energy dominance. The United States has made interesting moves as of late, including the unexpected sale of 5 MMBO from the strategic reserve. Government officials continue to clamor for President Obama to expedite the export process. In a recent interview with CNBC’s Closing Bell, Gary Evans, Chairman and Chief Executive Officer of Magnum Hunter Resources (ticker: MHR), said the export debate is a “no brainer,” especially considering LNG spot prices overseas are up to five times greater than in the United States.

The Ukraine situation is peculiar, considering the nation currently receives 60% of its natural gas from Russia. Both Ukraine and Russia are mutually dependent on another, meaning any embargoes from Russia are unlikely to occur in the near-term. Ukraine also does not have any LNG facilities, while the first one in the United States is scheduled to go online in 2015. Six more LNG facilities have been granted approval but their construction could be accelerated by speeding up the licensing process. Russia currently provides Europe with 30% of its energy, so the opportunity for the United States to make an impact in the market is substantial.

The EIA estimates the U.S. could export as much as 12 Bcfe/d (15% of production) as early as 2018 if licensing is expedited. President Obama has not made a formal decision on the export debate, but the industry can only hope it is addressed in a quicker fashion than the Keystone pipeline issue.

Even in the unlikely event that emotions subside in the Ukraine-Russia standoff, ramping up exports may be beneficial for a United States industry that has shut in natural gas projects due to the low prices. Maria van der Hoeven, executive director of the International Energy Agency, believes exports are a must. Says van der Hoeven: “Some may see this as a choice between keeping American oil within US borders for reasons of economic security and allowing the US to generate billions of dollars in new export revenues. But market realities suggest a far simpler decision ahead: either US crude is shipped abroad or it stays in the ground.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. A member of EnerCom has a long-only position in Shell.