Repsol Sells Portion of Interest, Dials Back Development Plans

Armstrong Oil & Gas, a private exploration and production company headquartered in Denver, Colorado, is backing up its optimism for hydrocarbon production in Alaska.

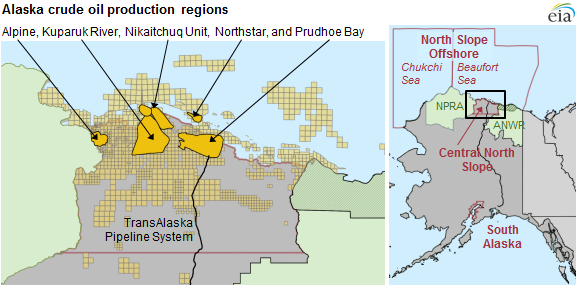

On October 13, 2015, the company increased its stake in the Colville River Delta region on Alaska’s North Slope for total consideration of more than $800 million. A combination of cash, operational control, drilling commitments and contractual adjustments for monetary considerations were all implied in the transaction. The seller, Repsol (ticker: REPYY), is reducing its interest in the region.

On October 13, 2015, the company increased its stake in the Colville River Delta region on Alaska’s North Slope for total consideration of more than $800 million. A combination of cash, operational control, drilling commitments and contractual adjustments for monetary considerations were all implied in the transaction. The seller, Repsol (ticker: REPYY), is reducing its interest in the region.

The agreement is somewhat complicated, as different interests are broken down according to the developed and undeveloped areas. Armstrong will acquire an additional 15% of interest (increasing its stake to 45%) in the Colville development area, where the majority of exploration and appraisals have already occurred. The company also holds an option to further increase its stake by 6%, making it the majority interest holder and operator.

Armstrong also increases its share to 75% from 45% in the jointly owned exploratory area, which spans more than 750,000 acres.

Colville River Delta Primer

The Colville River Delta began regular production in 2000 and has lured investment from majors like ConocoPhillips (ticker: COP). On a side note, ConocoPhillips says the only way to deliver equipment to its Colville operations is via ice roads in the winter.

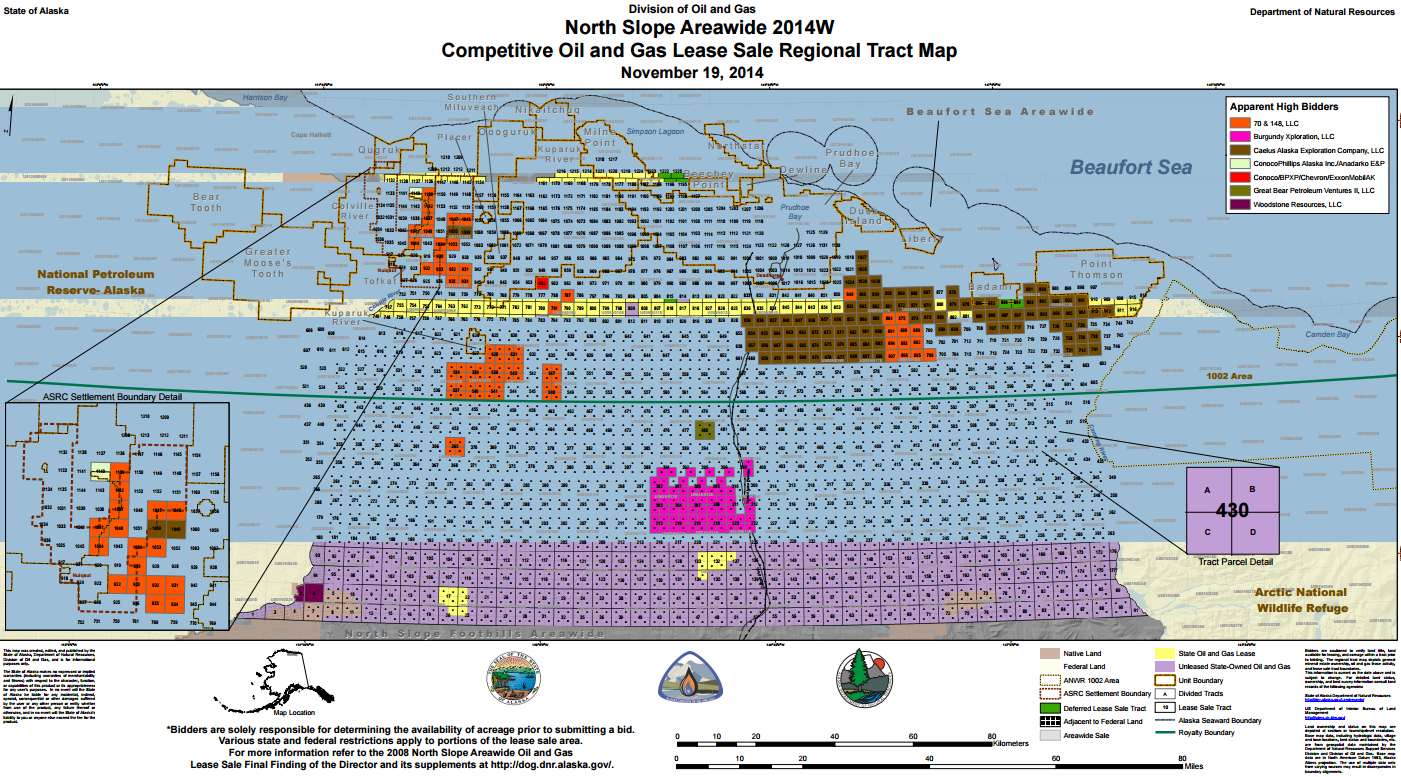

Armstrong Oil & Gas (entered as 70 & 148, LLC) drew media hype in November 2014 by outbidding majors like COP in a North Slope lease sale. In all, the group won 80 tracts and more than 138,000 acres for about $22.5 million. The sale ended up generating $54.5 million, marking the highest Alaskan oil and gas sale in more than two decades. Bill Barron, director of Alaska’s Division of Oil and Gas, said to a local newspaper that the interest was likely due to the region’s availability for the first time in several years.

Repsol’s drilling operations also encouraged investment, finding pay potential both onshore and offshore in the region. Armstrong had been working with Repsol as part of the development program. “They’ve got an inside knowledge of what’s there and why they’re excited, and I think you see the results,” Barron said.

Current field production estimates are believed to be roughly 120 MBOPD.

Armstrong Sees Opportunity Where Others Have Left Town

The industry bears are down on Alaska development possibly more than ever, following the much-publicized exit of Royal Dutch Shell (ticker: RDS.B) after the company found its exploration wells to be noncommercial in the current commodity environment. Several other majors like Chevron (ticker: CVX) and ExxonMobil (ticker: XOM) have suspended Arctic drilling in general due to cost measures.

But Bill Armstrong, President of Armstrong Oil & Gas, believes a different business structure is most beneficial among the frozen coast of Alaska. “Armstrong and Repsol’s North Slope project is representative of the new movement in Alaska where smaller independents work and operate in areas previously dominated by major oil companies,” he said in the news release. He points out a track record, Armstrong Oil & Gas first developed two other projects that are now operated by ENI (ticker: E) and Pioneer Natural Resources (ticker: PXD).

But Bill Armstrong, President of Armstrong Oil & Gas, believes a different business structure is most beneficial among the frozen coast of Alaska. “Armstrong and Repsol’s North Slope project is representative of the new movement in Alaska where smaller independents work and operate in areas previously dominated by major oil companies,” he said in the news release. He points out a track record, Armstrong Oil & Gas first developed two other projects that are now operated by ENI (ticker: E) and Pioneer Natural Resources (ticker: PXD).

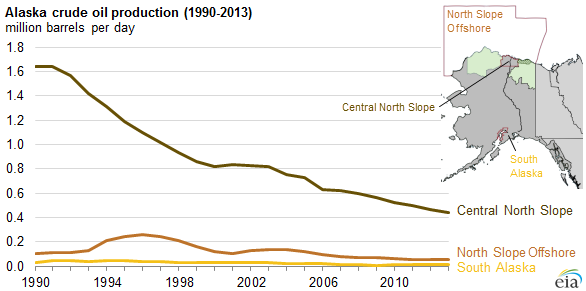

“With oil flowing through the Trans-Alaska pipeline at about 25% of capacity, Alaska is working hard to attract new oil and gas companies to the state,” he adds. When Oil & Gas 360® interviewed Alaska Governor Bill Walker earlier this year, the Governor expressed that changes needed to be made regarding permitting processes. Discussions on a new tax regime are gaining steam after royalty payouts reached an all-time high in September.

Armstrong Taking Charge

Armstrong Taking Charge

According to the release, Armstrong has participated in 16 wildcat and appraisal wells on the North Slope in the last four years. Every single well was successful, and a third-party engineering firm places total proven reserves at 497 MMBO in the region. Permitting work is ongoing for a three-pad development, but the drilling program has been deferred as Armstrong swaps from participant to operator of the partnership.

Repsol Update

Madrid-based Repsol (ticker: REPYY) is actively divesting non-core assets to ease its tightening margins from the commodity downturn. Its net profit fell by 44% on a year-over-year basis in its Q2’15 results and its fiscal net profit for 2015 is expected to drop by about 15% compared to 2014.

Repsol is an integrated company with both upstream and downstream operations, so increased margins in the refining department has offset some of the shortcomings on the E&P side. Refining margins in H1’15 were a company record, but the upstream division operated at a loss even though its production volumes in June 2015 were 86% higher than average 2014 production (660 MBOEPD compared to 355 MBOEPD) due to the closing of the $13 billion Talisman Energy acquisition.

The company surpassed a goal of more than $1 billion in divestments at the end of September, following the $748 million sale (652 million euros) of a piped gas business and a $372 million sale (325 million euros) of an investment in a private midstream company.