Current sale involves half of interests, can be expanded to all

Denver-based private E&P Armstrong Energy is selling its interest in its Alaskan properties, where it made a massive discovery earlier this year—the largest conventional onshore discovery in 30 years.

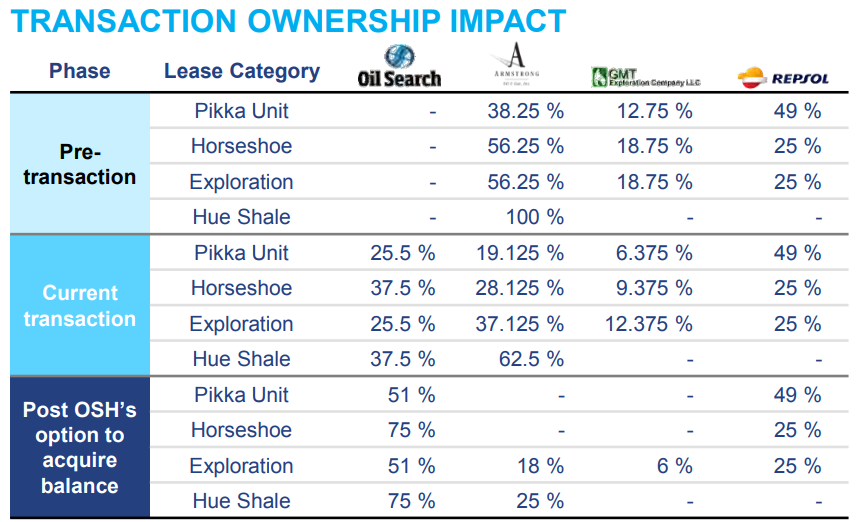

Oil Search (ticker: OSH), from Papua New Guinea, will pay $400 million for minority interests in the Pikka and Horseshoe units, along with the adjacent exploration acreage. Armstrong and private GMT Exploration will each divest half of their respective interests in the fields. Repsol is not party to these transactions, and will continue to hold its minority shares. OSH has the option to double its holdings for another $450 million, which would give it a majority interest in all the available leases.

Pikka will produce 100 MBOPD

Pikka is one of the most significant projects under development in Alaska, with first phase production of about 100 MBOPD expected. Recent filings from Armstrong indicate one well with side track and test drilled this winter, further outlining the field.

Oil Search has big plans for Pikka, and released an overview of Phase 1 of development. The single appraisal well this winter will be joined by three to six more next winter. Development is expected to take place between 2020 and 2023, and would involve extensive activity. Oil Search estimates it will drill 60 producing wells and an additional 60 injectors from three drill centers. 40 miles of pipelines and 25 miles of roads will be constructed, along with a central processing facility. The company hopes to recover a total of 500 MMBBL from Phase 1, for development costs of $4 billion.

Sale includes massive discovery made in March

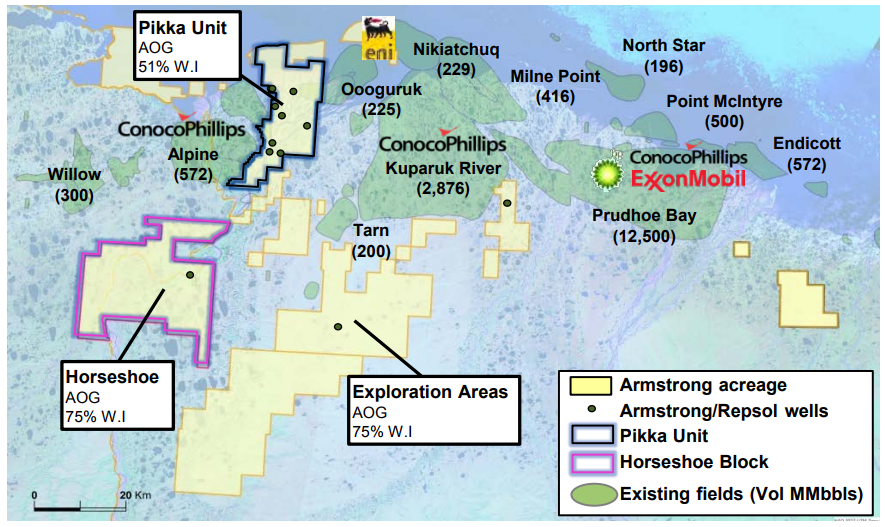

The Horseshoe unit is located directly south of Pikka, and is the location of Armstrong’s headline-catching discovery earlier this year. The company drilled a well more than 20 miles south of the existing Pikka discoveries and hit oil in the same interval. According to Repsol, the discovery has an estimated 1.2 billion barrels of oil recoverable and is the largest U.S. onshore conventional hydrocarbons discovery in the last 30 years.

Magic touch: Armstrong has found major fields before

This is not the first time Armstrong has found and sold a major Alaskan field. The company discovered the Oooguruk field in 2003, then farmed in Pioneer and sold the rest of its interest to ENI in 2005. In 2004 Armstrong discovered the Nikaitchuq field, which it also sold to ENI in 2005. These two fields have produced a combined 320 MMBBL.

Speaking about the transaction, Armstrong Energy CEO Bill Armstrong told Oil & Gas 360®, “Oil Search is the perfect partner for Repsol and Alaska. Their track record in PNG has been second to none.”

Oil Search managing director Peter Botten commented extensively on the transactions, saying, “For some time, Oil Search has been seeking to acquire oil interests to complement our PNG gas assets, to create a more balanced portfolio that is less exposed to one single commodity and one country. The key challenge has been to achieve this without diluting the Company’s world class, high returning PNG assets. Utilizing our existing relationships, this Alaska North Slope opportunity has been proactively pursued and an agreement structured to the benefit of all parties. The interests acquired provide a unique opportunity for Oil Search to participate in a world class, high returning, proven oil province that can add material value to the company. The option to acquire additional equity allows us to increase our interest once appraisal drilling has taken place, as well as the potential to sell-down to a strategic third party to create further value.

“The Nanushuk field in the Alaska North Slope is a giant oil discovery and has been acquired at an attractive point in the commodity cycle, at a very competitive price of approximately US$3.1 per barrel of discovered resource. This purchase price reduces to US$1.3 per barrel if Repsol’s gross resource estimates are used. In addition, the transaction delivers significant exploration upside, providing the company with the potential to develop, over time, a business of a similar scale to our PNG operations.

“Our joint venture partners in these assets comprise Repsol, with whom we have a strong working relationship in PNG, and Armstrong, which has a proven 15-year track record of finding major oil accumulations in Alaska. As highlighted, Oil Search will assume the operator role in June 2018. We are in the process of establishing a separate US-based entity to manage these assets. We will be partnering with Armstrong, which has significant operating expertise in Alaska, and with Halliburton, in a cooperative arrangement similar to that which worked so successfully when Oil Search took over operatorship of the oil fields in PNG in 2003, to help us build North Slope operating capabilities and ensure a smooth transition. Oil Search looks forward to being able to apply its extensive experience of operating safely and cost effectively in challenging environments, as well as leverage its skills working with indigenous people, to these assets.”