We are starting to layer in projects … to move our various products to the markets: Christmann

Pipeline bottlenecks have begun to plague producers in the U.S.’s top producing oil basin. For one thing the price they can get for a barrel of oil in West Texas is falling, compared to the price paid in Cushing, Oklahoma.

Analysts believe the Midland-Cushing price differential is not likely to close any time soon, as long as Permian production continues to rise and the basin’s limited takeaway capacity exists, putting higher pressure on prices.

Helping at least somewhat is the Midland-to-Sealy line, which has now entered service. This is the only major pipeline project scheduled for 2018. Enterprise Products Partners L.P. (ticker: EPD) built the 416-mile Midland-to-Sealy pipeline with an expanded capacity of 540,000 barrels per day. The pipeline is capable of transporting batched grades of crude oil and condensate.

The EPIC pipeline starts operations in early 2019, and several other lines are scheduled for the end of the year. Until then, however, producers are faced with much more expensive methods for getting oil out of the basin. Bloomberg estimates rail transport would cost $6-$8 per barrel, while trucking would cost several times more. If the differential continues to widen however, these options may become more economic.

Permian operator Apache Corporation (ticker: APA) reports that the Permian region is one of its core growth areas with over 2.8 million gross acres that have exposure to multiple plays primarily in the Midland Basin, the Central Basin Platform/Northwest Shelf and the Delaware Basin.

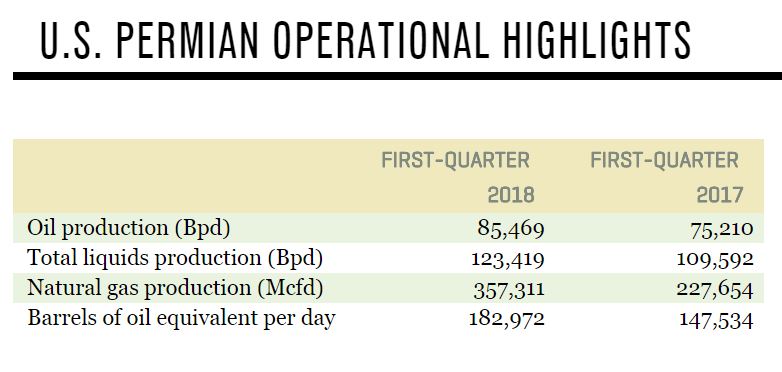

Apache reports estimated proved reserves of 681 MMBOE at year-end 2017 in the Permian, representing 58 percent of the company’s total worldwide reserves. Apache reported average Permian production in Q1 2018 of almost of 183 MBOEPD.

Apache Corp. CEO John Christmann was interviewed by Bloomberg Television last week about the effects of the Permian takeaway bottlenecks on the industry—relating to both oil and natural gas—and how Apache is coping with the takeaway constraints that appear to be at a point where Permian producers may tap the brakes. Excerpts from the interview follow.

Bloomberg: “Staying with oil, so there’s no differential that would make you have to shut in.”

Apache Corp. CEO and President John Christmann: In terms of shut in we are pretty confident we are going to be able to flow. We are happy with the prices; [but] you get to the point where trucking probably becomes an option for some.

Bloomberg: How wide do you think the differential will continue to stay? Is it a permanent differential or what point do you feel like the take away capacity will be resolved?

Apache Corp. CEO and President John Christmann: It’s going to come in chunks, you will see pipelines come on. At that point there is usually excess capacity and then [the pipes] get filled. This will continue, this won’t be a one-time thing as you expand the basin over the next several years. There will need to be more pipes incrementally built…. You’re not going to jump out there and [immediately] build all the capacity you might need for the next 5-10 years.

Bloomberg: How much capacity do you have total? And how much do you have to be able to increase?

Apache Corp. CEO and President John Christmann: If you have looked what we have done, over the next couple of years, we have met a lot of our needs.

- On the gas side we took out 500 million a day on Kinder Morgan’s Gulf Coast Express. We have an equity option to back in for fifteen percent of that pipeline that we would have to exercise at the end of the year.

- You Look at the Epic Pipeline—we have up to 75,000 barrels a day capacity.

- On the Enterprise line that we just announced last Thursday, Shin Oak, we have got 205,000 barrels of NGL capacity.

What you see is we are starting to layer in projects and making sure we can move our various products to the markets. Those hold us out to a time period and then we are confident that there will be some other projects that will need to come in the out years. But they do not need to be announced today.

Bloomberg: Do you ever envision a position where you would have to flare your natural gas because of takeaway capacity.

Apache Corp. CEO and President John Christmann: In a perfect world I don’t want to be flaring either because, not only are you emitting gasses, you are also burning revenue and you are having to pay royalty on those. So we have actually been shutting wells in and then waiting on our infrastructure and then opening those wells up as we build out that infrastructure.

Bloomberg: Are you in that place right now?

Apache Corp. CEO and President John Christmann: Yes, there are a few wells that we are cleaning up while you’re waiting because you don’t want to leave them immediately but after you have cleaned the wells up then we would shut those in. The good news is we are at a point today where we have fewer wells shut in.

Bloomberg: How many wells do you have now?

Apache Corp. CEO and President John Christmann: We have been working that number down quite a bit. It’s not as many as it was at the start of the year. We have been gradually bringing more wells on.

Bloomberg: Well, let’s start talking about your midstream assets. When are you going to monetize it?

Apache Corp. CEO and President John Christmann: We want to maintain control. We want to maintain a major equity piece of this. So we’ll have somebody that will come in for a minority equity piece, pick up future CapEx until the entity can be in a position where it can build itself out. I think we feel really good about that. We are doing a lot of due diligence on a lot of different parties and there is a lot of parties doing due diligence on us.

Bloomberg: How many different parties?

Apache Corp. CEO and President John Christmann: Can’t really comment but it’s more than I can count on a couple hands.