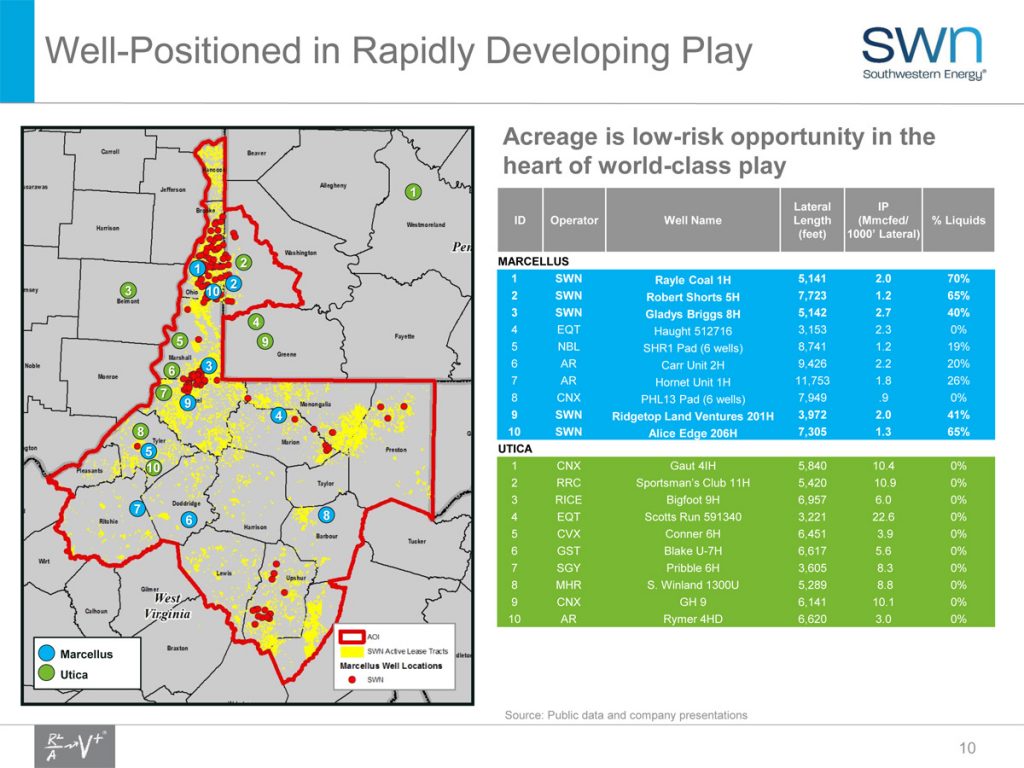

Antero Resources (ticker: AR) has signed an agreement with Southwestern Energy (ticker: SWN) to acquire approximately 55,000 net acres in the core of the Marcellus shale, the company announced on June 9, 2016. Approximately 75% of the 55,000 net acres contains dry Utica rights.

The acquisition includes undeveloped properties located primarily in Wetzel, Tyler and Doddridge Counties in West Virginia and approximately 14 MMcfe/d of net production. The transaction is expected to close in the third quarter of 2016, subject to customary closing conditions, with an effective date of January 1, 2016.

Transaction Highlights

- Includes 33,000 net acres of core Marcellus leasehold in Wetzel County, WV, establishing a new platform for development and consolidation with stacked pay potential for the dry Utica

- Adds 12,000 infill net acres of core Marcellus leasehold in Tyler County, WV, where Antero already holds significant acreage

- Enhances dry gas optionality with 12,000 net acres of core Marcellus leasehold, adding or enhancing 225 core Marcellus dry gas locations

- Adds 4.1 Tcfe of unaudited Marcellus 3P reserves and 1.8 Tcf of dry Utica resource potential

- Substantially all of the 55,000 net acres will be dedicated to Antero Midstream for gas gathering, compression, processing, and water services

- In conjunction with the transaction, Antero is increasing its 2017 production growth target to a range of 20% to 25%

- All incremental production is expected to be sold at currently favorably priced markets through Antero’s firm transportation portfolio

- An additional 13,000 net acres, including 1 Tcfe of unaudited Marcellus 3P reserves, 400 Bcf of dry Utica resource potential and 3 MMcfe/d of net production, are subject to the exercise by a third party working interest owner of its tag along option

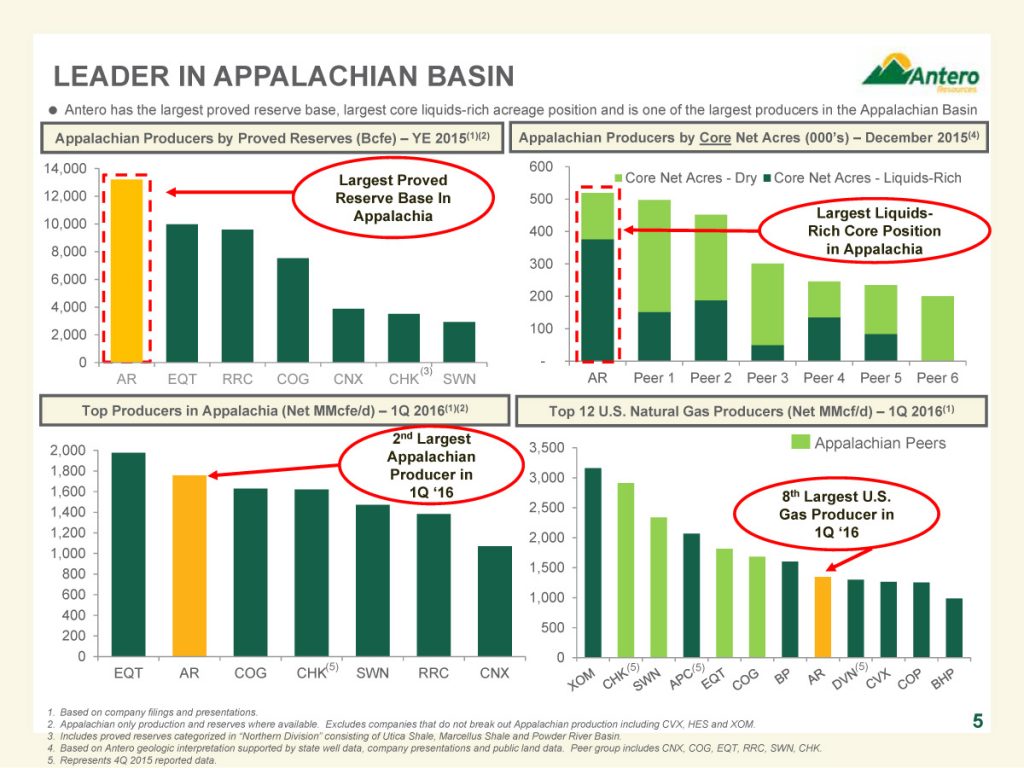

Commenting on the acquisition, Paul Rady, Antero chairman and CEO, said: “This strategic acreage acquisition in the southwestern core of the Marcellus Shale play further enhances our leading position as a pure-play Appalachian operator. The transaction creates a new platform for development and consolidation in Wetzel County, with attractive rich and dry gas Marcellus locations, as well as stacked pay potential for the dry Utica.

“Additionally, this acquired acreage is able to access our firm transportation portfolio and thus move incremental production to currently favorable markets. Similar to the successful strategy that we deployed in Tyler County, we expect to further consolidate acreage in Wetzel County and build out the necessary midstream infrastructure to move our gas to market, creating significant value for both Antero Resources and Antero Midstream.”

Financial Arrangements

Immediately following the announcement of the acquisition Antero announced that it has commenced an underwritten public offering of 26,750,000 shares of common stock. In addition, the Company anticipates granting the underwriters a 30-day option to purchase up to an additional 4,012,500 shares of common stock. The underwriters intend to offer the shares from time to time for sale in one or more transactions on the New York Stock Exchange, in the over-the-counter market, through negotiated transactions or otherwise at market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices.

Antero plans to use the net proceeds from the stock offering, including the proceeds from any exercise of the underwriters’ option to purchase additional shares of common stock, to fund the recently announced acquisition of properties from a third party and for general corporate purposes including funding future development.

Southwestern Energy said it plans to use the cash proceeds from the transaction to reduce the principal balance of the company’s $750 million term loan due in November 2018.

Core Marcellus a Popular A&D Target

Today’s move by Antero mirrors a similar announcement by EQT Corporation (ticker: EQT) last month, in which EQT said it would acquire 62,500 net acres and 50 MMcfe/day of production from Statoil’s core Marcellus stake for $407 million. The acreage EQT acquired was in Wetzel, Tyler, and Harrison Counties, West Virginia. EQT said that acquisition included drilling rights on 53,000 acres that are undeveloped and prospective for the deep Utica. Twenty-four Marcellus producing wells came along with EQT’s acquisition.

Antero says it has drilled and completed 452 horizontal Marcellus Shale wells, all of which are on line. The company is operating 6 drilling rigs in West Virginia. Antero says its production in the Marcellus Shale has averaged 1,232 MMcfe per day in the first quarter of 2016. The net daily production figure includes approximately 46,900 Bbls per day of NGLs and oil.