Texas dunes, HCLP provide answers

Texas is the motherlode when it comes to decade after decade of oil and gas production in the U.S., and the Permian basin is widely considered to hold some of the best rock in the country for oil production from shale formations. In addition, the industry’s Permian operators are learning how to best optimize their completion designs to get more production out of every Permian well.

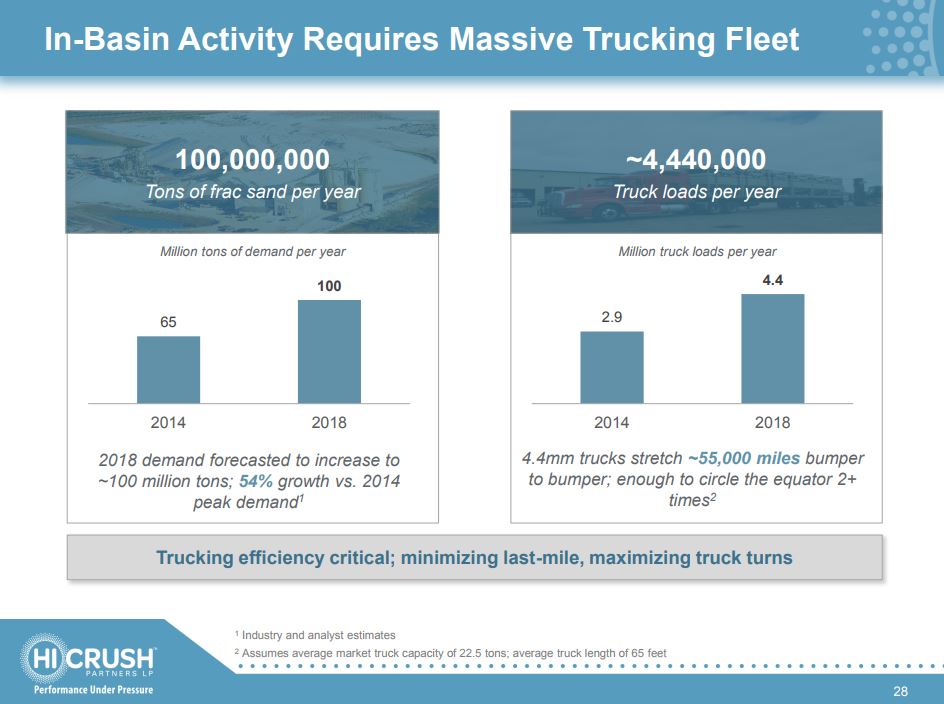

The improving EURs have followed a trend of operators drilling longer latterals and using more frac sand in higher-intensity completions. Analysts now project 55 to 60 million tons per annum of sand capacity for 2018 in the Permian basin.

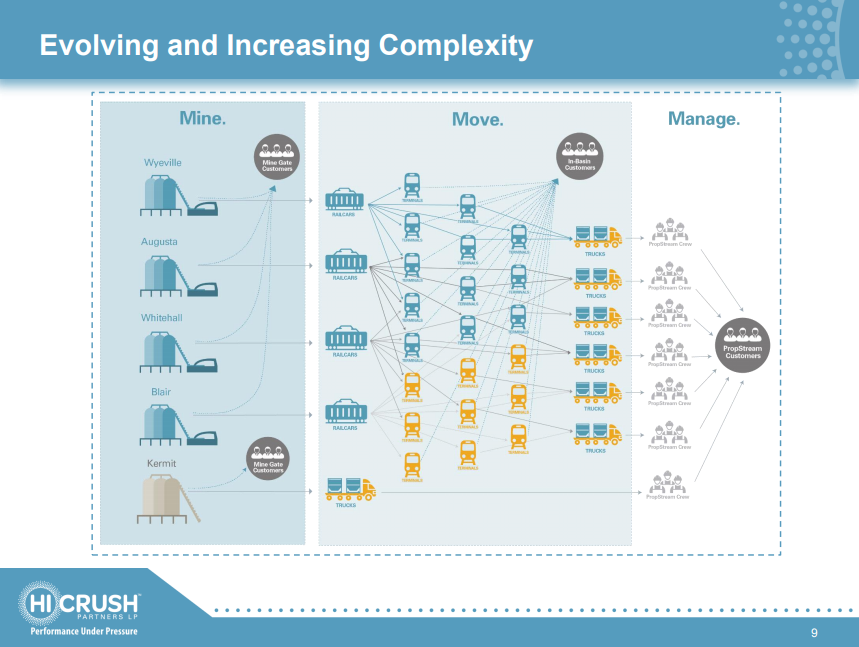

The logistics required to move today’s significantly larger quantities of sand from the Wisconsin mines to Texas and New Mexico have moved oilfield service companies to look at opening in-basin sand facilities to serve customers in the Permian basin.

Hi-Crush opens the first in-basin frac sand mine within 75 miles of 95% of Permian proppant consumption

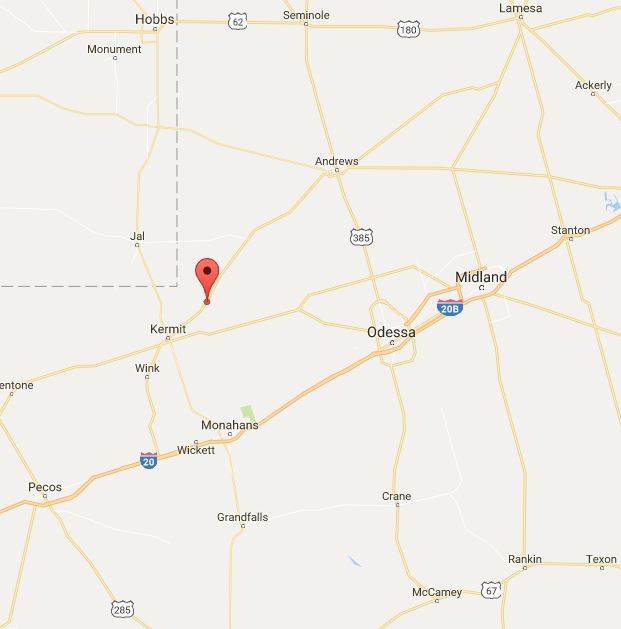

Hi-Crush Partners LP (ticker: HCLP) is the first oilfield service company to bring an in-basin frac sand mine online in the Permian basin, and the company believes its close proximity to the well sites will enhance operators’ well economics.

Hi-Crush hosted its grand opening media event last week. EnerCom Inc. provided media relations planning and coordination. Watch the CBS7 story live from the Kermit, Texas facility here.

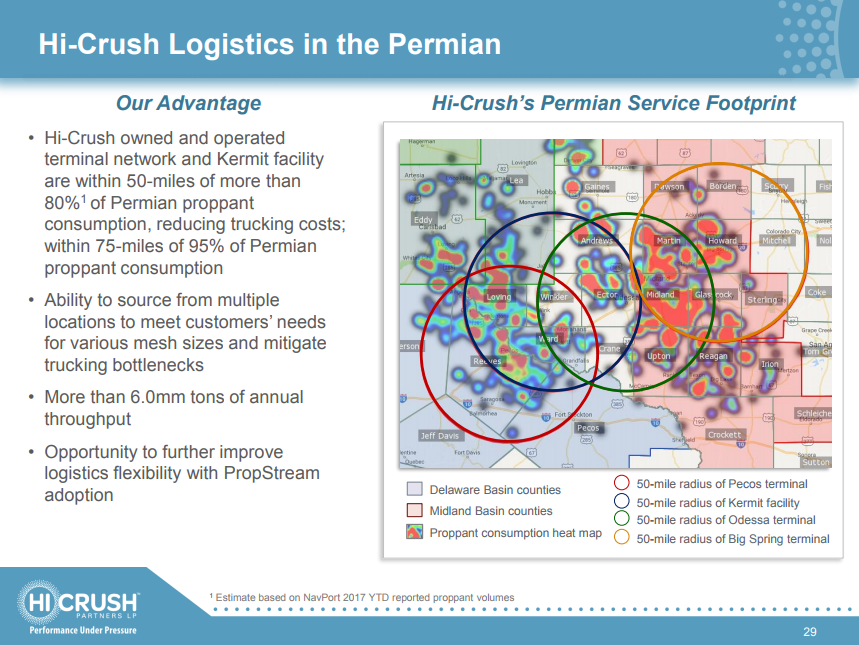

Hi-Crush’s Kermit frac sand facility is within 50 miles of more than 80% of Permian proppant consumption and within 75 miles of 95% of the basin’s proppant consumption, the company said in an investor presentation.

The Hi-Crush proppant facility will produce three million tons per annum of West Texas frac sand. Much of those three million tons can be trucked directly to operators’ wellsites from Kermit, taking steps out of the supply chain and reducing costs for operators.

Proppant sourced from Hi-Crush’s full-scale facility at Kermit, and its transload facilities at Pecos, Odessa and Big Spring, allows the company to service more than 95% of all proppant consumption within the optimal 75 mile distance.

The Kermit sand is sourced from active eolian sand dunes of the Quaternary period and has a high quartz content.

Sand from the new Hi-Crush Kermit facility has much reduced travel time to Permian basin wellheads

As completions continue to grow, four hundred to five hundred truckloads of sand may be required to complete a single well, and trucks coming from the Kermit sand mine can make three to four trips per day, compared to trucks coming from Central Texas that might be able to make only one or two trips a day.

Trucks hauling Hi-Crush’s proppant via its PropStream system are able to carry roughly 10% more sand per load, according to the company. The close proximity to operations and the 10% greater load-carrying capacity can have the effect of reducing the number of trucks and trips to the well site.

Drilling and completions most active in the Permian

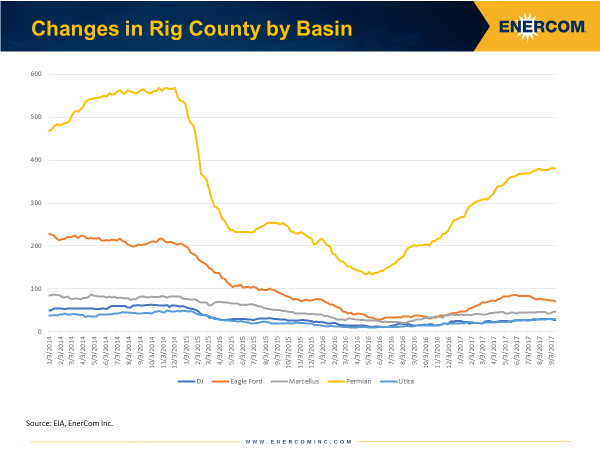

Throughout the commodities price downturn, the Permian has remained North America’s most active basin despite lower oil prices. The area remains the most active in terms of rig count as operators look to exploit the stacked-pay potential of the region. In the week ended September 15, 2017, the Permian reported 380 active rigs, 5.4 times as many rigs as the next most-active basin.

Other basins have seen an increase in activity since prices returned from lows in February 2016, but none has experienced the same kind of spike in absolute numbers as the Permian. In terms of percentage-change since January 2014, the Utica and Permian are both down approximately 20%, but the Utica’s absolute rig count is less than one-tenth of the Permian’s.

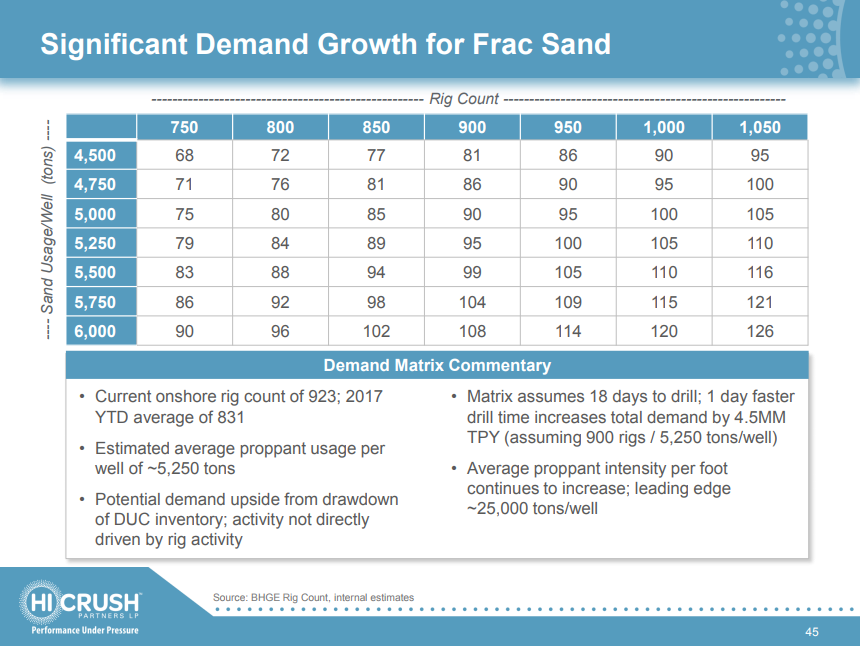

With that level of activity comes a similar increase in the need for frac sand.

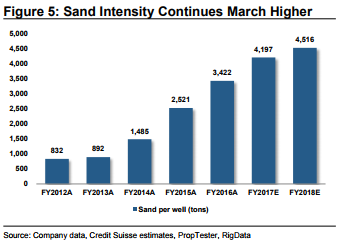

Analysts predict the average completion will use 4,516 tons of sand in 2018

In wells across the country, the amount of sand used for each frac job is steadily increasing. The full-year 2012 average for tons of sand per well was 832, per a research note from Credit Suisse. That number remained relatively unchanged in 2013, but began to climb quickly starting in 2014. For full-year 2018, Credit Suisse anticipates the average well will use 4,516 tons of sand during the completions process.

End-to-end management

Moving all the sand required for a completion is a mammoth task.

Rail has traditionally acted as the primary mode of transportation for sand, but companies such as Hi-Crush are beginning to pursue in-basin mines. The 3 million tons produced from the new Kermit facility can be put directly on trucks and taken straight to the wellsite, avoiding the cost of a cross-country trip by rail.

“We think of ourselves as a logistics company that moves sand,” Hi-Crush CFO Lura Fulton said. “And being in the most active basin in the country lets us match the pace of the Permian customer. We can meet the needs of Permian E&Ps in hours rather than days.”

The average contribution margin per ton of sand has increased 4.8 times from Q4 2016 to Q2 2017 as demand for sand tracks along with the growth of completion size.

Seven other companies have received permits to build sand mines in Texas, a Credit Suisse research note reported. The majority of permitted facilities are planned for Winkler County, where HCLP’s Kermit plant is currently up and running.

A projected 55 to 60 million tons per annum of sand capacity is being forecast for 2018 in the Permian and Hi-Crush and its Kermit mine should benefit as the first proppant supplier to deliver locally mined sand to Permian basin operators.

Hi-Crush said it expects its new Kermit facility to be at full run-rate by early October. Hi-Crush executives told CBS7 they estimate the plant will bring more than a $20 million impact to the local community.

Hi-Crush Partners’ presentation from the EnerCom conference in Denver is available to view here.

Download the Hi-Crush recent analyst day slide deck here.