The Jerry Jones effect: the Comstock-Covey Park acquisition

Securities analysts had views about today’s announced acquisition of privately held Covey Park Energy by Comstock Resources (stock ticker: CRK) for $2.2 billion.

Size matters

(From: EnerCom Inc. Managing Director Aaron Vandeford)

This deal checks a few important boxes for the market. Post-merger, Comstock will hold approximately 374,000 net acres, 5.4 Tcf of SEC proved reserves, and 7.6 Tcf of SPE proved reserves. Importantly, pro forma production will exceed a mental market hurtle of 1 Bcf/d allowing a broader set of investors to get comfort on the size of operations and begin to award a ‘premium’ P/CFPS multiple.

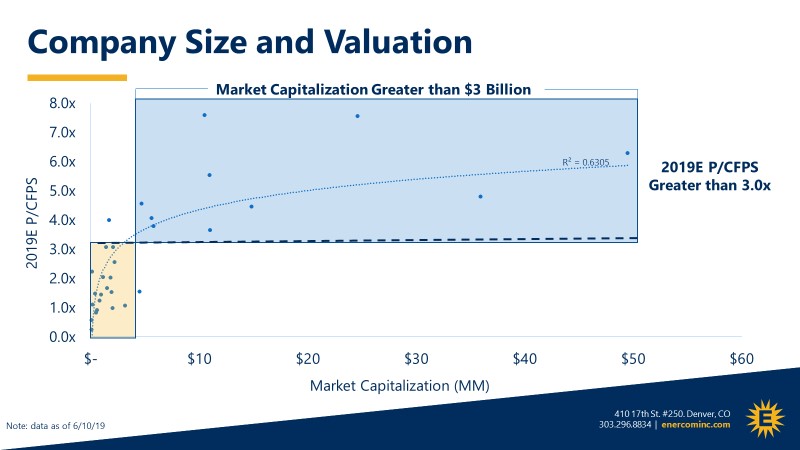

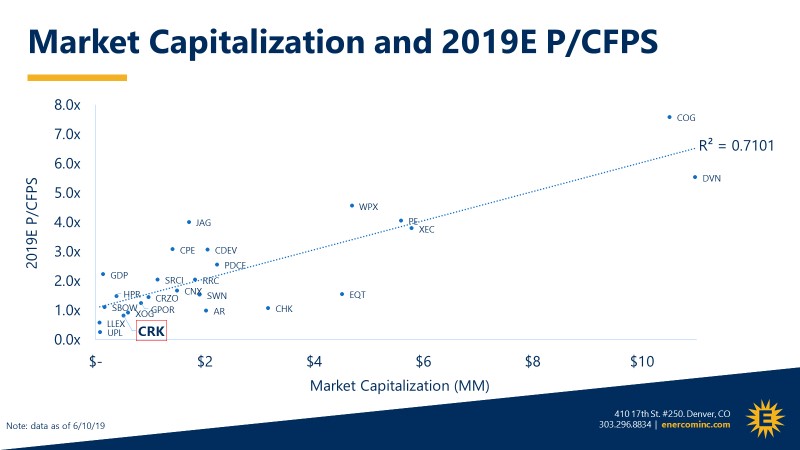

Figure 1 below highlights the current market relationship between valuation and market capitalization for a group of companies with a market cap less than $11 billion. With an R2 of approximately 71%, there is a clear market bias toward larger companies as investors remain focused on free cash flow generation. Figure 2 expands the universe of names to include companies larger than $11 billion and more clearly highlights that companies greater than $ 3 billion in market cap can achieve more premium valuations in the current market.

Figure 1: Company Size and Valuation – Source: EnerCom Analytics

Figure 2: Market Capitalization and 2019E P/CFPS – Source: EnerCom Analytics

With at total after market valuation in excess of $4 billion, we would expect CRK to participate in some multiple expansion.

From a purchase price prospective, the deal was done at a price that allows CRK to reduce its over all leverage. Given the $2.2 billion price, CRK will be purchasing Covey Park for less than the $2.4 billion SEC PV-10 value. On a flowing production metric, the $2.2 billion value comes in at $3,120 per flowing Mcfe/d value and is in line with an 11-company gas peer group from EnerCom’s data base at $3,059 per Mcfe/d.

As a leverage reducing transaction, the market should reward the company with additional multiple expansion as long as the company executes on its plans to move toward the 2.0x level and drill within cash flows.

[contextly_sidebar id=”2SQGFtRa5koM2prgqKI9W9w0MmMB3Z4i”]

Haynesville gets some long awaited and much needed consolidation

(From SunTrust Robinson Humphrey)

The Haynesville is the home of the super-private (see note), but the Comstock (CRK, Not Rated) acquisition of Covey Park could be kicking off a public consolidation phase. Metrics assuming $2.0k/mcfepd would equate to $669k/location or $3.8k/ac. The $2.2b transaction is for less than YE18 PV10, & while this is run ~15% ahead of current strip it still points to a hard metric for consolidation. Other major private operators in the basin are Vine, Rockcliff, Indigo, although the majority have integrated midstream ops which could make any deals less fertile than imagined.

This is a slightly higher price than the QEP Resources (QEP, Hold, Dingmann) transaction of $2.8k/ac, but in our opinion it is likely a better average acre and less developed. The Osaka transaction, which was worse acreage, went for $2.3k/ac after the production adjustment. We see the CRK transaction favorably from this view point.

At $669k per location the CRK transaction still points to stout economics for one of the best gas basins in the country; the key will be how quickly CRK can accelerate. While the 2020 FCF of $75-100mm will provide a yield of ~10%, the company’s ’20 runrate implies a whopping 24 years’ of running room. While this provides surety on future plans, it also severely impacts A&D economics. Think of the PV of that last well drilled, it was acquired for $669k so PV’d back from the year 2043, it is hard for it to cover the initial costs.

We believe this puts the ball in Goodrich Petroleum’s court. GDP (Buy) is the granddaddy of the basin and we believe it has the management to scale up in a fruitful manner. GDP remains a top gas pick for its low multiple (2.0x ’20 EV/EBITDA vs the group’s 3.5x), high growth (prod. +43% y/y vs +12%), and FCF yield (+5% vs +4%). Please see our map on the next page for acreage overlaps.

Key takeaways

From Johnson Rice

Comstock announced the agreement to purchase Covey Park for total cash and stock consideration of $2.2 billion, significantly increasing its scale and creating the basin leader in the Haynesville shale with almost 295,000 net acres in the Haynesville/Bossier.

The transaction marks a significant step in CRK’s path to consolidating the Haynesville shale following last year’s investment by Jerry Jones, who is investing another $475 million in CRK in this transaction, increasing his total investment to-date to $1.1 billion.

The combined entity is well positioned to meet CRK’s goal of sustainable free cash flow generation and reduced leverage over the long-term, and the initial planned combined capital program will be internally funded out of cash flows while achieving a leverage ratio of 2.0x by the end of 2021 (down from 2.9x at year-end 2019).

Both Jerry Jones and Denham Capital (Covey Park’s PE backer) have agreed to make significant equity investments in common stock at a price of $6.00/share, representing a 35% premium to Friday’s closing price, with Jerry Jones and Denham owning a combined 91% of the pro-forma shares outstanding. With leading margins due to the combination of its geographic location and lowest in-basin gathering/transportation costs, the combined entity should further benefit from the increased capital efficiencies associated with a larger drilling program and an estimated $25 million of G&A savings. CRK’s initial capital program is anticipated to generate $75-$100 million of FCF in 2020, assuming a $55/$2.60 price deck. We believe the creation of a large-scale Haynesville producer will be viewed favorably and positions CRK for further consolidation in the basin.

Key Points

Combined asset base: On a pro-forma basis, CRK will have a total acreage position of ~374,000 net acres, of which ~293,000 net acres are in the Haynesville/Bossier play (up from 87,000 net Haynesville/Bossier acres on a CRK stand-alone basis), with Covey Park’s acreage position significantly complementary to CRK’s footprint. Production for the combined entity will be 1.1 Bcfe/d, up 165% from CRK’s 1Q stand-alone run-rate of 422 mmcfe/d. At the same time, the combined drilling inventory of ~2,000 drilling locations includes almost 1,300 locations capable of having 5,000’+ laterals, which will drive significant capital efficiencies going forward. Please see the following page for a map of the combined assets as well as a table highlighting Comstock pro forma the acquisition.

Deal financing terms: CRK is paying total consideration of $2.2 billion for Covey Park, comprised of $700 million in cash, $173 million of common stock (28.8 million shares at an agreed price of $6.00/sh), $210 million in 10% perpetual convertible preferred stock and the assumption of ~$1.1 billion of debt ($675 million of notes and ~$440 million of revolver debt). At the same time, Jerry Jones is investing an additional $475 million in CRK, comprised of $300 million of equity at an agreed price of $6.00/share and $175 million of 10% perpetual convertible preferred stock. The preferred stock has a conversion price of $4.00 per share and can be converted after being outstanding for 12 months or redeemed by the company at face value plus the value of accrued dividends.

[contextly_sidebar id=”2cZsPYwZZ6Na4rWiCB14gAoTMMGKDJ65″]